WMG is moving beyond superstars – and that is a good thing

Warner Music Group’s (WMG’s) Steve Cooper recently stated that the major is no longer financially dependent on superstars – which is, of course, quite a different thing from not being culturally dependent on them, but we’ll get to that. For a major’s CEO (exiting or not) to make such a claim is both bold and a reflection of the reality on the ground. In fact, it is a natural milestone in a trend MIDiA identified years ago: fragmented fandom. As streaming audiences and consumption fragment, so does the impact of superstars. As with any transition, the shift is not linear and there will continue to be more Olivia Rodrigos and Billie Eilishes, but they will be fewer and farther between, and crucially, they will be smaller than their pre-fragmentation peers.

Superstars getting smaller is music to the ears of independent labels and artists alike, but it is far from the death knell for big labels. Instead, it simply reflects the new environment in which they will operate. Indeed, Cooper said WMG is pursuing a “portfolio” strategy “across a bigger number of artists” to reduce financial “dependency on superstars”. This comes after BMG’s CEO, Hartwig Masuch, said of their latest results: “The extraordinary thing about our first half result is that we grew revenue 25% with virtually no hits”. Having no superstars does not mean having no hits, instead it means more, smaller hits.

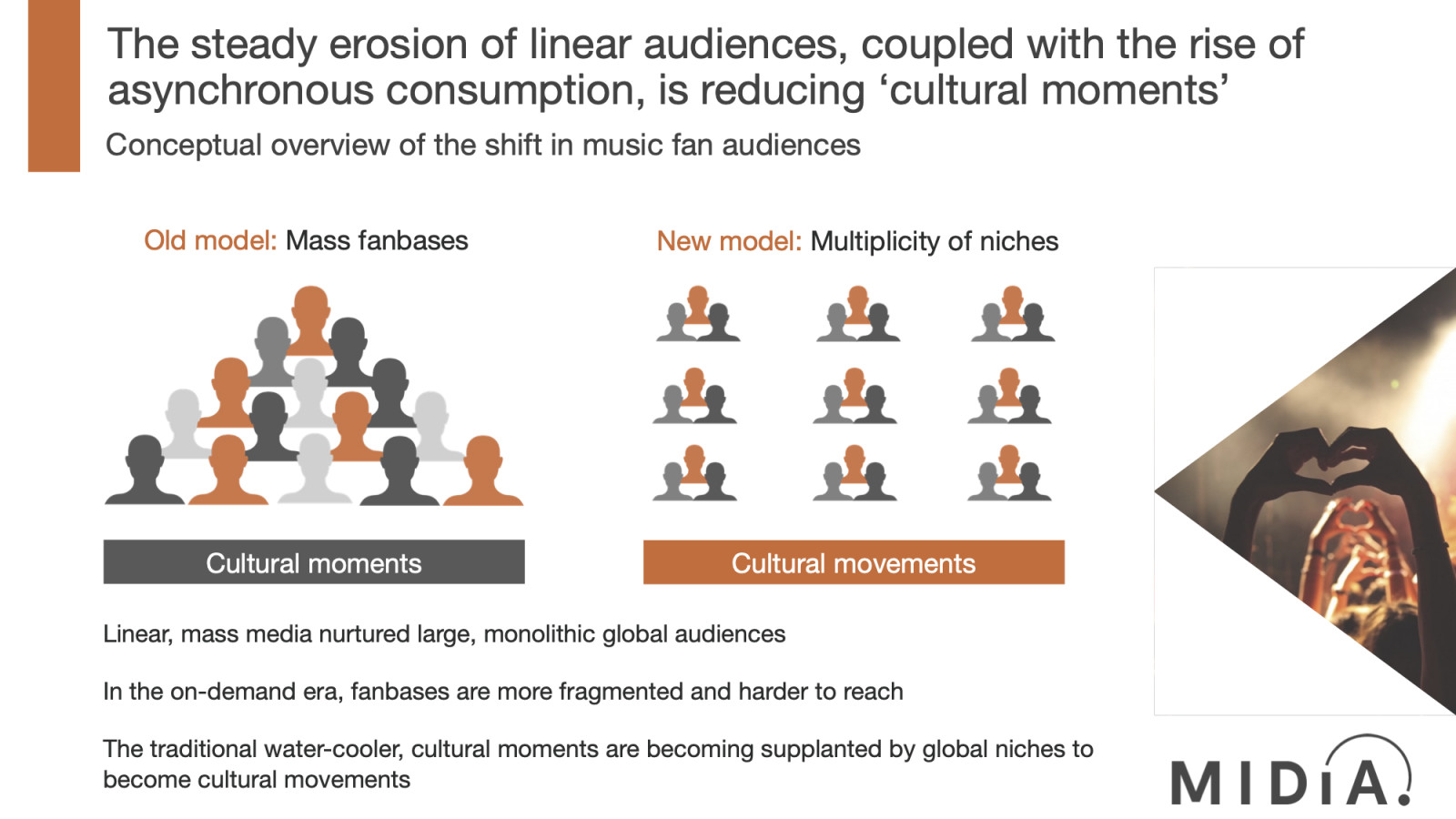

In 2019, MIDiA wrote that “Niche is the new mainstream”, that the water cooler moments of the linear era were being replaced by cultural moments. Audiences are in different places at different times, with algorithms delivering them different personalised content. Concepts, such as ‘song of the summer’, are becoming different for everyone. Each listener has their own song of the summer. In the era of fragmented fandom, water cooler moments across the masses, where everyone heard the song on the radio at the same time, are replaced by smaller groups of people finding pockets of likeminded fans across the world.

The consequence for artist marketing is a progressive shift from ‘carpet bombing’ mass media in order to build artist brand reach, to campaigns that, instead, reach real fans with laser-focused targeting. In the old model, a superstar artist was a household name, with mum and dad just as likely to know them as their kids. But what was the value of mum and dad knowing the artist if they were not the target audience? It might play to the artists’ egos, but it was an inefficient spend of marketing budget. Now, targeted marketing reaches the consumers who care. The result is smaller, but more passionate, fanbases. This is marketing to build fans rather than audiences. It is just a shame that western DSPs are built for passive audiences rather than fandoms. That will need to change. DSPs paradoxically triggered the fragmentation, but they do not provide the mechanisms for artists and labels to benefit. A cynic might argue that that is by design.

Indeed, the fragmentation of listening that streaming is pushing consumption towards the middle, away from the superstars, as Music Business Worldwide’s Luminate chart for streams of the US top-10 tracks shows.

Featured Report

India market focus A fandom and AI-forward online population

Online Indian consumers are expected to be early movers. They are high entertainment consumers, AI enthusiasts, and high spenders – especially on fandom. This report explores a population that is an early adopter, format-agnostic, mobile-first audience, with huge growth potential.

Find out more…For the superstars who are used to mega-fame from the pre-fragmentation days, a new release’s performance can look like diminishing success when measured by traditional metrics – just ask Beyonce. But, because fragmentation means it is truer fans that engage with the music, the cultural relevance of these smaller hits can actually be bigger – again just ask Beyonce.

There are, however, extra complications. As we are currently in a transition phase, pre-fragmentation hangovers are muddying the streaming waters. Pre-fragmentation hits stick around for longer on streaming because they had the pre-fragmentation brand reach. Since they benefited from the old-world mainstream media exposure, their hits cut through on streaming in a way that newer ones often struggle to. These pre-fragmentation hangovers have the effect of fragmenting new hits even further as they take up so much of streaming’s consumption. The result is that streaming is not so much a level playing field as a field of all levels.This transition phase will play out, and while it does, there is a world of opportunity for artists and labels that can harness the deeply held fandom that fragmentation creates.

The rise of scenes

The most exciting knock-on effect of fragmentation is the rise of scenes and micro scenes. In the old world, consumers had a limited range of things with which they could identify themselves, as everyone was watching the same TV, reading the same magazines, listening to the same radio, and shopping in the same shops. Now, consumers can build their own identity from an ever more diverse set of attributes, across fashion, music, TV / film, games, politics, etc.

As my colleague Tatiana Cirisano put it:“The result is that scenes are becoming more complex and splintered. Consider the seemingly endless range of subcultures on TikTok, from #cottagecore to #EGirl, or the Instagram account @starterpacksofnyc, which has garnered more than 64,500 followers by crystallising super-specific, yet eerily-familiar, personality types.”

This rise of scenes is what will shape the future of marketing, with scenes becoming the new territories, transcending borders and cultures. Superstars will get smaller, but they will get better at monetising their superfans (this is why Taylor Swift’s Universal Music Group deal includes a broader range of rights than just recordings, as her sales were only going to go in one direction). Superstars are not dead, they are changing, become smaller and less, well, super. It is an inevitable second-order consequence of streaming splintering listening and the smart labels will harness the trend rather than try to fight it.

The discussion around this post has not yet got started, be the first to add an opinion.