Paramount is on the right track but does it have enough time?

Photo: MIDiA Research

Yesterday, Paramount announced its full year 2023 financial results. The numbers were stark, with revenues down 2% to $29.7 billion and an operating loss of $451 million. The stock price declined at the end of the day by 1.69% - giving the company a market cap of $7.6 billion, less than 25% of full company earnings for 2023. The biggest drag on company earnings was the TV media segment which declined 12% over the period, largely a result of advertising revenues (historically the cornerstone of Paramount’s revenue generation) declining by 15%. Paramount’s earning’s release blamed this collapse on “continued softness in the global advertising market and a 5-percentage point impact from lower political advertising.” While political advertising revenues are likely to rebound in a US presidential year, the overall “softness” in advertising is a secular trend disproportionately impacting traditional TV advertising as consumers continue to move away from linear TV and disengage with reductive broadcast advertising.

Direct-to-consumer – the bright spot in the Paramount story

Amid the bad news, Paramount’s direct-to-consumer segment continued its acceleration towards profitability with revenues up 37% and costs reduced by 9%. Flagship subscription video on demand (SVOD) service Paramount+ added 4.1 million net subscribers in Q4 2023, bringing the total number of subscribers up to 67.5 million. As a result, Paramount+ global ARPU expanded 31% in 2023. In MIDiA Research’s forthcoming publication ‘Paramount+ Q4 2023 deep dive’, the consumer survey data shows that weekly active users (WAUs) in the US has grown by over 20% from Q4 2022, while in Brazil it has more than doubled over this period.

Alongside Paramount+’s impressive engagement growth rate, Paramount’s free ad-supported streaming TV (FAST) service, Pluto TV, has also experienced significant growth. Pluto TV’s move towards the mainstream is underlined by the high conversion rates between WAU and DAU behaviour, with over 50% of WAUs in the US consuming Pluto TV daily in Q4 2023.

Featured Report

Pixels to playlists Music preferences and behaviours of gamers

The global games industry is a $236.9 billion behemoth. It now rivals film, television, and music combined in terms of revenues and is a cultural driver. Yet, for music companies, labels, and platforms,...

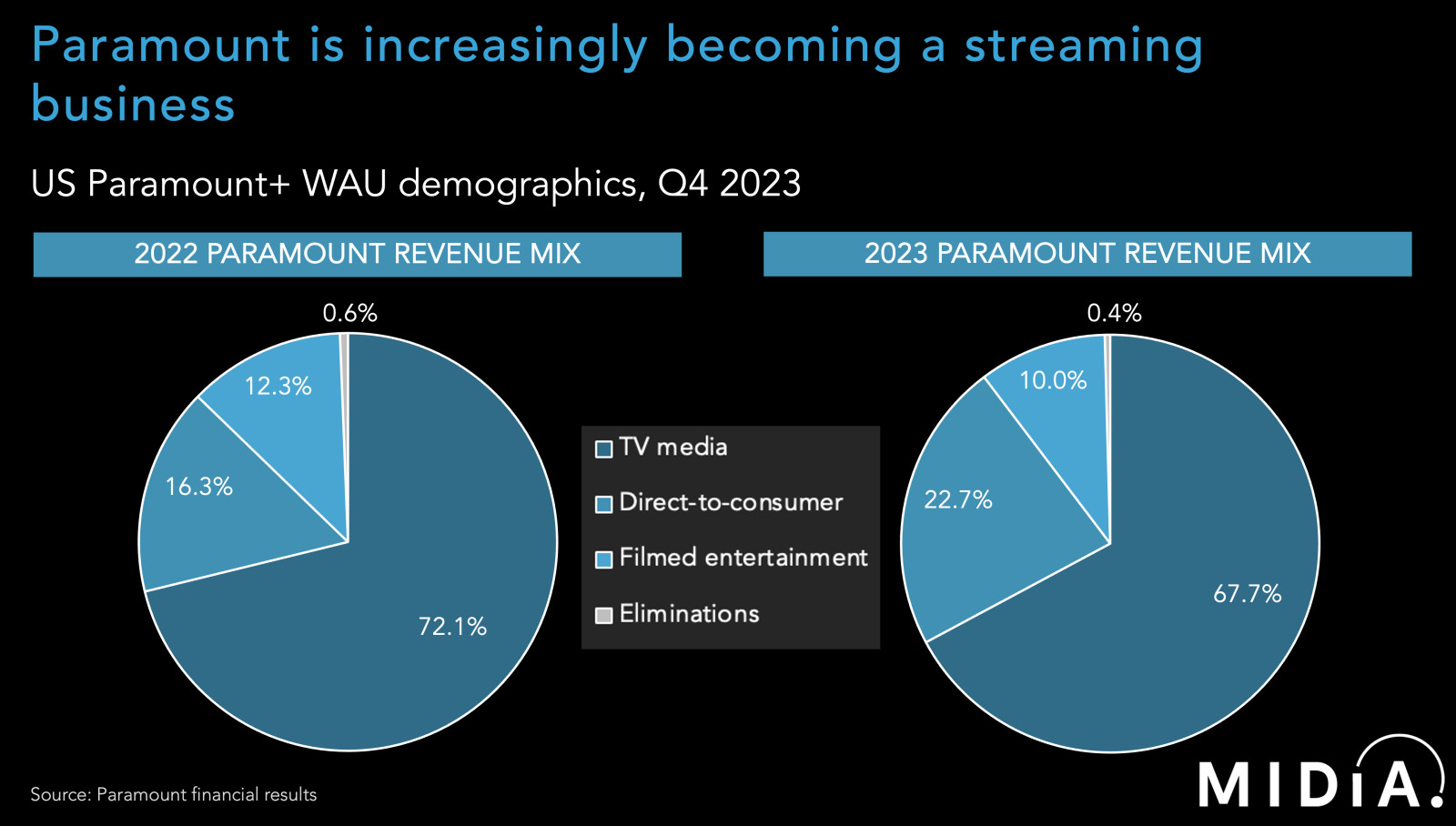

Find out more…As a result of increasing streaming engagement, Paramount has grown its direct-to-consumer revenues by 6.4 percentage points from 16.3% in 2022 to 22.7% in 2023.

Why streaming profitability in 2025 is crucial

The push towards streaming is clear for Paramount and underlined by the secular decline of the company’s traditional TV and film studio business. This is why Paramount has placed reaching Paramount+ domestic profitability in 2025 at the core of its mission statement to investors. Only by accelerating the shift towards streaming can Paramount regain control of its financial destiny and ultimately retain relevance in an increasingly fragmented entertainment landscape.

The discussion around this post has not yet got started, be the first to add an opinion.