Why the D2C era is about to begin in earnest

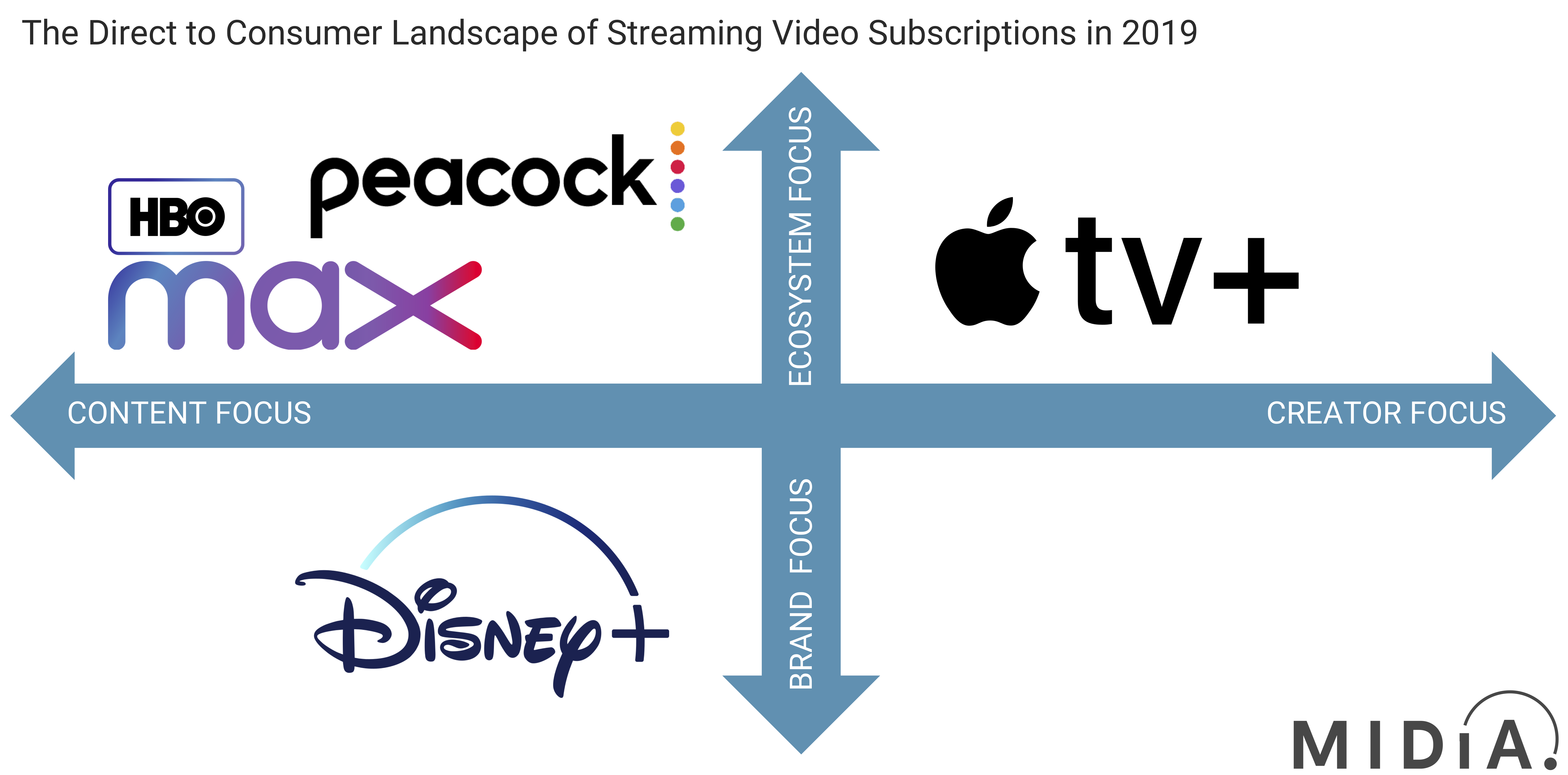

Next month Apple TV+ and Disney+ will launch, followed by Warner Media’s HBO Max in Q1 2020 and NBCUniversal’s Peacock in April – making the next six months pivotal in the evolution of direct-to-consumer (D2C) video adoption both in the US and beyond. Each of these services come with their own key unique selling points which could provide them with an edge in the highly competitive world of streaming video.

Four major new D2C entrants are set to reshape the US video market in late 2019 and early 2020:

- Disney – Launch Q4 2019: Disney’s nascent streaming service Disney+ will be a key part of Disney’s international brand equity play, and will come to define what D2C success means for the company. With Disney’s critically important Media Networks segment experiencing 0% year-on-year growth from the quarter ending March 2018 ($5.5 billion) to the quarter ending March 2019 ($5.5 billion), the strategic necessity of front-loading the D2C opportunity for investors is paramount. This was graphically underlined at Disney’s April 11thinvestor event where the main announcements all revolved around Disney’s ability to leverage its brand awareness and exclusive content to drive subscriber growth from zero on the Disney+ November 12thlaunch date to between 60 and 90 million paying subscribers by 2024. With Netflix taking eight years to reach 60 million subscribers in Q1 2015, Disney has clearly set itself a challenging performance metric to be judged against. In Disney’s favour, the streaming market is better established now. Against Disney, the streaming market is better established now. Success will be determined by the extent to which growing consumer demand and awareness trump audience satisfaction with existing propositions.

- Apple – Launch Q3 2019: Apple has made no secret of its desire to pivot into services, having peaked in smartphone shipments at the end of 2018. At a celebrity-studded “Showtime” event in March2019 at it is Californian HQ, Apple made a big splash – bringing forward industry heavyweights such as Steven Spielberg and Oprah Winfrey to opine on the creative freedom being afforded to their role as show makers in a service that does not have to be intrinsically revenue positive. Apple will benefit from the network effect of combining content into a wider ecosystem engagement strategy in a way that Amazon currently benefits from. Apple TV+ launches on November 1st 2019 priced at $4.99 per month, with a free 12 month trial subscription bundled in for all new Apple device purchases. Of the major D2C launches in 2019/2020, Apple’s is the wild card. Two important things to watch: 1) Services will not be Apple’s main revenue driver within any meaningful time frame (especially when App Store revenues are stripped out of the equation) so Apple really only needs services to pick up the slack until it finds its next hardware hit, and 2) Apple trades on being a high-margin business. Neither video nor music look to be anything other than loss makers. There is therefore inherently a cap on just how big Apple can let these revenue streams become, unless they become costs for hardware in a bundle proposition.

- Warner Media’s HBO Max – Launch Q1 2020:With the leading US telco successfully completing its acquisition of multiple leading US TV and film businesses in 2018, both media and tech players in the streaming video landscape now have a formidable full-stack competitor on their hands. The rebranded Warner Media content and distribution portfolio ecosystem offers wide integration opportunities for parent company AT&T, from both customer acquisition and retention perspectives as well as a synergetic ad-deployment aspect. For Warner Media, the key challenges facing its diversified media business as it rolls out HBO Max in Q1 2020 will be the potential brand impact of creating non-aligned brands (HBO, Warner Bros, Turner Networks) and the potential brand equity dilution of having all the assets on the same service. Alongside this are the unresolved tensions inherent in a major licensor seeking to avoid cannibalising revenues via D2C launch. This was illustrated by the Netflix Friends 2019 licensing renewal, which shows that Warner Media is sufficiently unsure of its own brand equity to continue to run third party semi-exclusive licensing deals with known streaming competitors such as Netflix. Warner Media’s D2C service is the only one of the three launching in 2019 which does not yet have the full backing of its senior decision makers and as such is likely to have largest go-to-market challenges.

- NBCUniversal’s Peacock – Launch Q2 2020:As a subsidiary of Comcast, NBCU has a competitive advantage in being able to leverage the distribution network effects of Comcast’s Cable Communications division, as well as NBC’s national and regional networks and its various pay-TV networks including CNBC, the Golf channel and the Olympic channel. Add to this the production heft of Universal Studios with its well-stocked library of proven feature films and prime-time TV, and Peacock needs to be taken seriously by other D2C competitors. The potential Achilles heel in the NBCU D2C strategy is akin to Warner Media – concern over cannibalising existing lucrative streams and lack of clarity on the strategic importance of Peacock. This has manifested in its two-pronged go-to-market strategy: it will be available as a TVE app for existing Comcast subscribers, and as a standalone paid subscription ad-supported video on demand (AVOD) service for other consumers. While Hulu has demonstrated that there is consumer appetite for paid AVOD services via its basic ad-supported subscription tier, bringing a new one to market in the wake of the ad-free Disney+ and Apple TV+ is a bold move.

This blog comprises excerpts from MIDiA’s report, Direct to Consumer | Video’s Big Bang Moment – which will be featured in Tim Mulligan’s upcoming presentation at MipCom. An updated version will be coming out soon, so stay tuned. In the meantime, subscribers can access the full report here; if you don’t have access but you’re interested to learn more, get in touch at info@midiaresearch.com.

The discussion around this post has not yet got started, be the first to add an opinion.