Why investing in IRL entertainment is so important for Disney’s streaming future

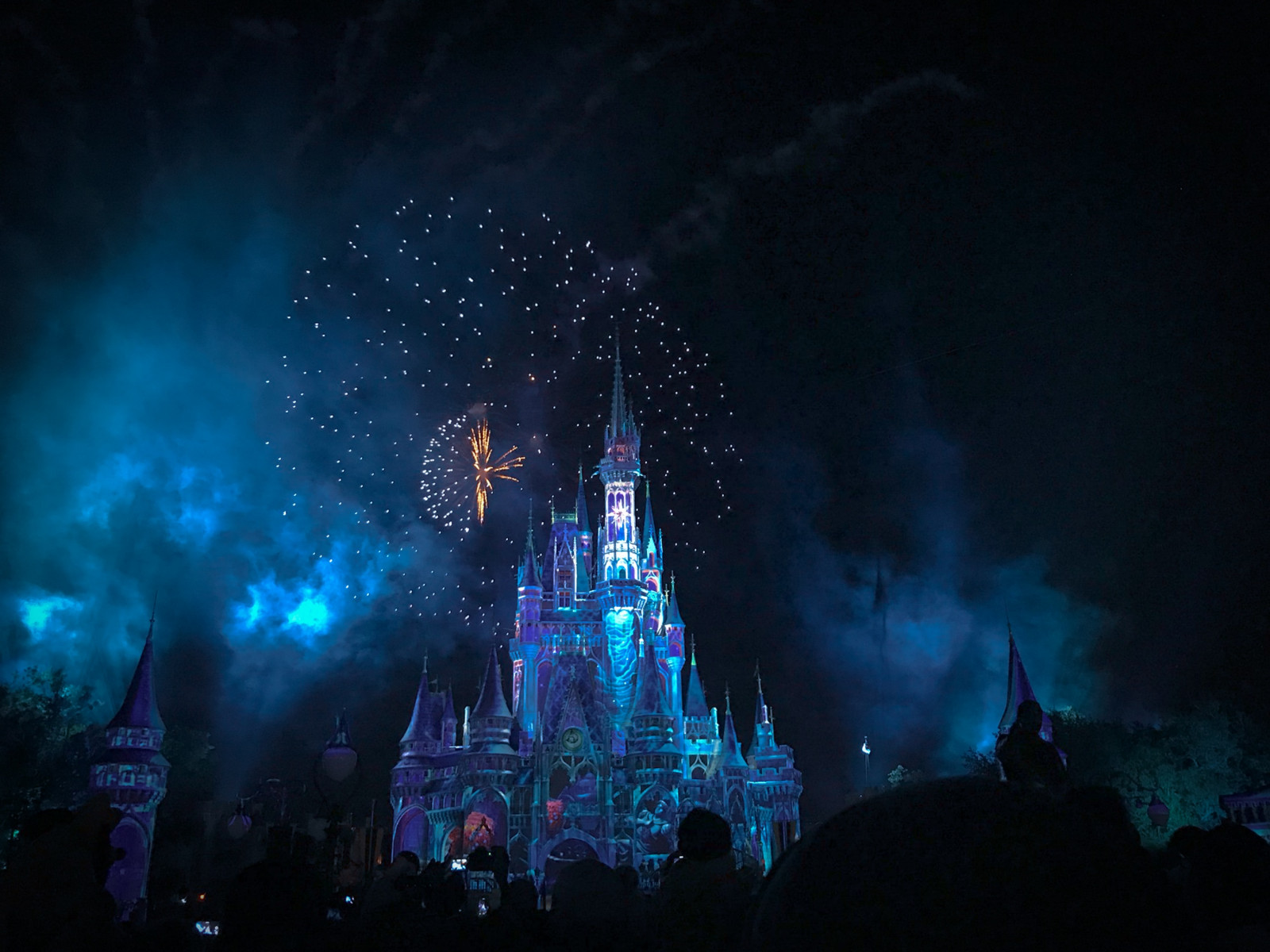

Photo: Jayme McColgan

It appears that investors are losing confidence in Disney as the transition from linear TV to streaming TV moves into its final chapter. Last week, Disney saw its stock price fall after announcing that it was doubling its capital expenditures investment in its parks, experiences, and products segment to $60 billion. This equates a 10-year additional investment in its theme parks business that accounted for 37% of company revenues and 68% of operating income in the second quarter of 2023. In the Disney media and entertainment distribution segment, its direct-to-consumer business lost $512 million in the same quarter. Over the same period, the parks and experiences division within the parks, experiences, and products segment generated $989 million in operating income.

With CEO Bob Iger already clear about selling off Disney’s linear channel’s business (which has generated $1.9 billion in Q2 2023 operating income despite experiencing a 23% year-on-year decline), Iger is now focusing on shoring up his long play strategic streaming strategy through reinforcing Disney’s cash-generative physical experience businesses.

We are only at the beginning of the streaming TV consolidation era

Since Bob Iger’s return to running Disney in November 2022, Disney’s stock price is down around 19.1% while the S&P 500 index has gained 9.6%. However, this contrasts the 12 months prior to Iger’s replacement of Bob Chapek, when the share price fell 32.4%. The underlying narrative around the declining stock price up to that point had been the escalating direct-to-consumer costs that nearly doubled year-on-year to $1.5 billion in Q3 2022 from $630 million in Q3 2021. Iger’s return has therefore been framed around rationalising the cost base (year-on-year direct-to-consumer losses halved in the Q2 2023 to $512 million down from $1.1 billion in Q2 2022).

Featured Report

MIDiA Research 2026 predictions Change is the constant

Welcome to the 11th edition of MIDiA’s annual predictions report. The world has changed a lot since our inaugural 2016 edition. The core predictions in that report (video will eat the world, messaging apps will accelerate) are now foundational layers of today’s digital economy.

Find out more…When Iger announced Disney’s direct-to-consumer strategy at an investors event in April 2019, he did so knowing that the alternative was to become part of the decline, rather than part of the disruption. Streaming enabled Disney to leverage its global family-based intellectual property in a way that national and regional pay-TV partners would be unable to do and allowed a 100-year-old company the opportunity to become a driving force in the new wave of entertainment consumption. With established and well-funded subscription video companies such as Netflix and Amazon Prime Video already in the market, Disney would have to rely on a loss-leading ramp up to subscriber acquisition before it could realise cost synergies between its existing production output and the cost of running its flagship Disney+ service. That journey is far from complete and is exacerbated by the lack of consolidation still prevalent in the marketplace. It has also come at the unfortunate time of rising interest rates and a growing appetite for profitability from investors – hence the decision to double down on the theme parks business. The harder it is to ride out the near-term turbulence, the greater the need to support cash generative business units with significant growth upsides (the international parks division saw a 94% increase in year-on-year revenues for Q2 2023).

Disney’s IP edge is now matched by its IRL edge

Putting to one side the strategic direct-to-consumer rationale for doubling down on its theme parks division, investors should welcome the reinforcement of Disney’s theme parks business because it delivers another compelling unique selling point for the company against its streaming competitors. Theme parks are the ultimate monetisation model for in real life (IRL) experiences. The post-lockdown surge in demand for physical real-life entertainment not only created a temporary attention recession, but it also created new opportunities for non-pure-play digital media groups to compete in the emerging streaming TV era. This has been evidenced by the return of the music festival and a string of multi-billion dollar box office hits enthralling consumers outside the home post-COVID. As MIDiA identified in the great movie reset, the combination of younger consumers eager to experience new releases in the cinema can lucratively combine with older bill payers happy to watch the same content on a streaming service a month later. Having assets to combine across IRL provides multiple competitively advantageous ways to monetise content and super serve the content consuming fan bases. Disney is the clear leader in this regard and now looks set to stay this way and generate much needed free cashflow to support its still developing streaming businesses.

There is a comment on this post, add your opinion.