Why increased ad-based engagement is hampering Netflix’s revenue growth

Photo: MIDIA Research

Speaking at the Variety Entertainment Summit in Las Vegas, Netflix’s president of advertising, Amy Reinhard, revealed that the company now has more than 23 million monthly active users globally on its ad tier (up from the 15 million announced in November 2023 one year after launching the plan). “Scaling our business is absolutely our biggest priority right now, but we want to make sure we are doing that in a meaningful way for the members,” she said. This new information comes after Netflix announced that ad-tier subscriptions accounted for approximately 30% of all new signups in the 12 countries where it has launched the platform. Reinhard also revealed that the company is bullish on engagement for these new ad-supported subscribers, announcing that more than 85% are streaming on the platform for two hours or more per month.

Netflix’s foray into advertising was a bold move contrary to its original streaming mantra of delivering on affordable ad-free subscription video on demand (SVOD). MIDiA previously argued that the prime catalyst behind the decision to move into advertising was the need to signal to investors that Netflix is serious about maintaining its market dominance and margin growth in the face of streaming TV competition (effectively SVOD with news and sports coverage replicating traditional pay-TV plans). This was particularly important for Netflix’s domestic market where pay-TV has historically been a cornerstone of household entertainment.

Ad-obsessed investors have pushed Netflix into a low revenue growth dynamic

Featured Report

Pixels to playlists Music preferences and behaviours of gamers

The global games industry is a $236.9 billion behemoth. It now rivals film, television, and music combined in terms of revenues and is a cultural driver. Yet, for music companies, labels, and platforms,...

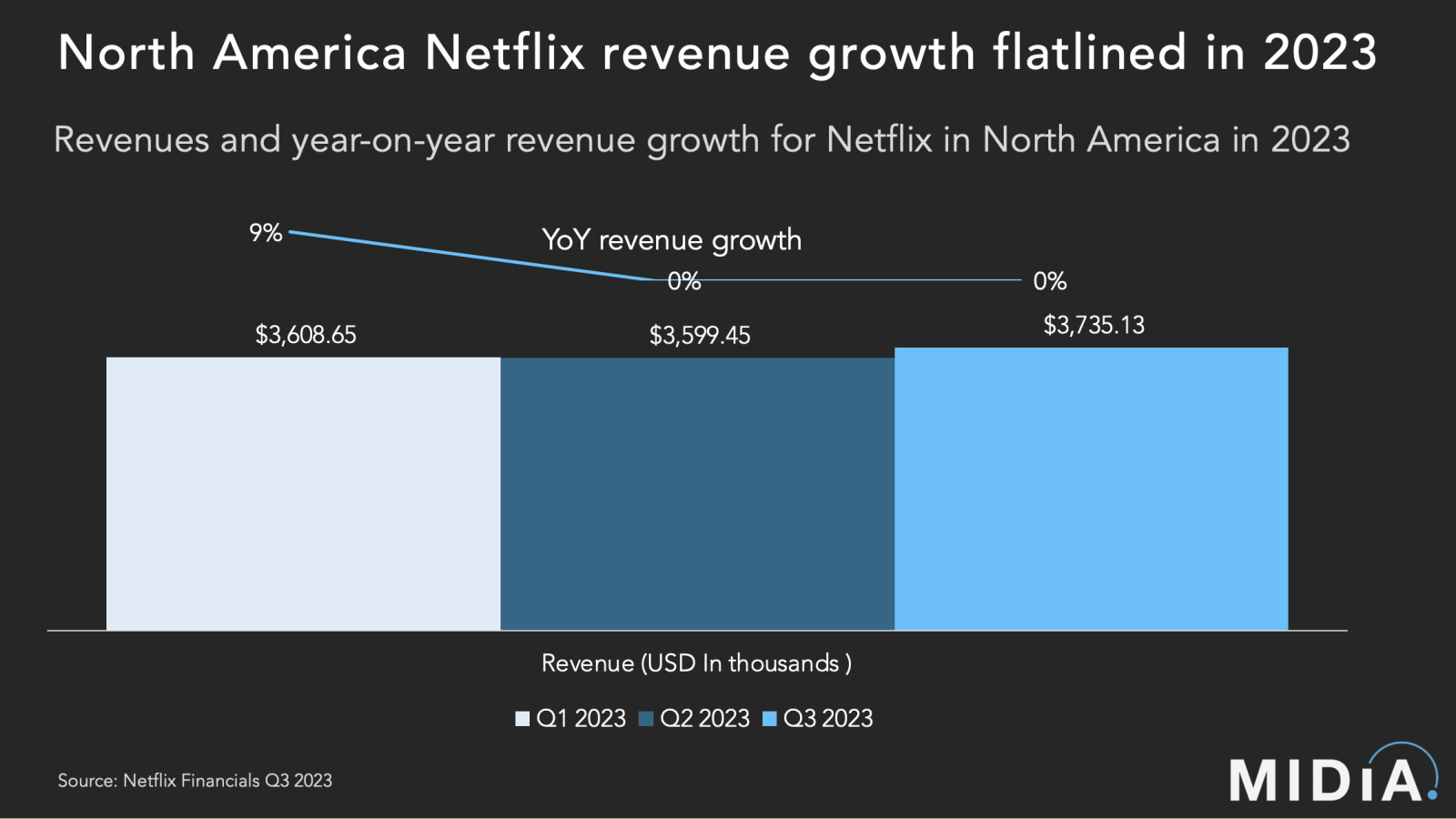

Find out more…By pressuring Netflix to become more like its streaming-TV competitors, Netflix has sacrificed its ad-free USP while also impeding revenue growth. As the above chart demonstrates, revenue growth has shrunk in the US and Canada for Netflix in 2023, with year-on-year average revenue per user (ARPU) growth down from 9% in Q1, to 0% in Q2 and Q3 2023. Effectively, the upside in investor sentiment for introducing an ad-supported tier has come at the expense of sustained growth in its core domestic market.

Additionally, engagement with the new category of ad-supported users might be above what Netflix initially expected. However, two hours per month equates to half an hour per week – not even enough to watch one standalone piece of content before factoring in the ad-viewing time. This is less than a quarter of the daily viewing time of the average Netflix subscriber in H1 2023 according to MIDiA’s estimates. With nearly a third of all new subscribers coming through the ad-supported plan, engagement on the Netflix platform is likely to noticeably decline in 2024 in the countries with the Basic with Ads offering.

If the take-up ratios for the ad-supported plans are confined to new subscribers, then the engagement impairment will be minimal (Netflix added 8.8 million net subscribers between Q1 and Q3 2023), however, the 23 million MAUs implies that nearly two thirds of these ad-supported subscribers are existing subscribers down-sizing to the cheaper Basic with Ads plan. Additionally, the negative growth impact on other regions is uneven, with Asia-Pacific (APAC) experiencing three consecutive quarters of negative ARPU growth from Q1 2023 to Q4 2023. This is particularly problematic as MIDiA forecasts that APAC will be the main growth driver for SVOD for the remainder of this decade. Out of the 12 countries with Basic with Ads, three are in APAC (i.e., South Korea, Japan, and Australia).

Netflix in 2024 has a choice to either focus on growing the business fundamentals or to appease Wall Street. Either direction will bring fresh challenges to a maturing business adapting to an increasingly competitive entertainment landscape.

The discussion around this post has not yet got started, be the first to add an opinion.