What HYBE and UMG’s Q3 earnings tell us about superfans

Photo: MIDiA Research

“Superfan” has been this year’s buzzword in the music industry. From Universal Music Group (UMG) setting its superfan agenda at the start of the year to Warner Music Group announcing its plans for a superfan platform, much of the Western music industry has shifted its focus to monetising fandom. In South Korea, HYBE expanded internationally to bring K-pop-style fandom culture to the US and Latin America. UMG and HYBE’s ten-year partnership for exclusive distribution rights and further collaboration on HYBE’s fan platform Weverse, announced earlier this year, also demonstrates the major labels’ fandom focus. Marketing to superfans is increasingly viewed as the strategy that will spur new growth as streaming revenue gains lessen. The direct effect of these changes will be difficult to quantify at first. However, HYBE and Universal’s Q3 earnings reports put the potential into perspective.

Expanded rights showed greatest growth in Q3

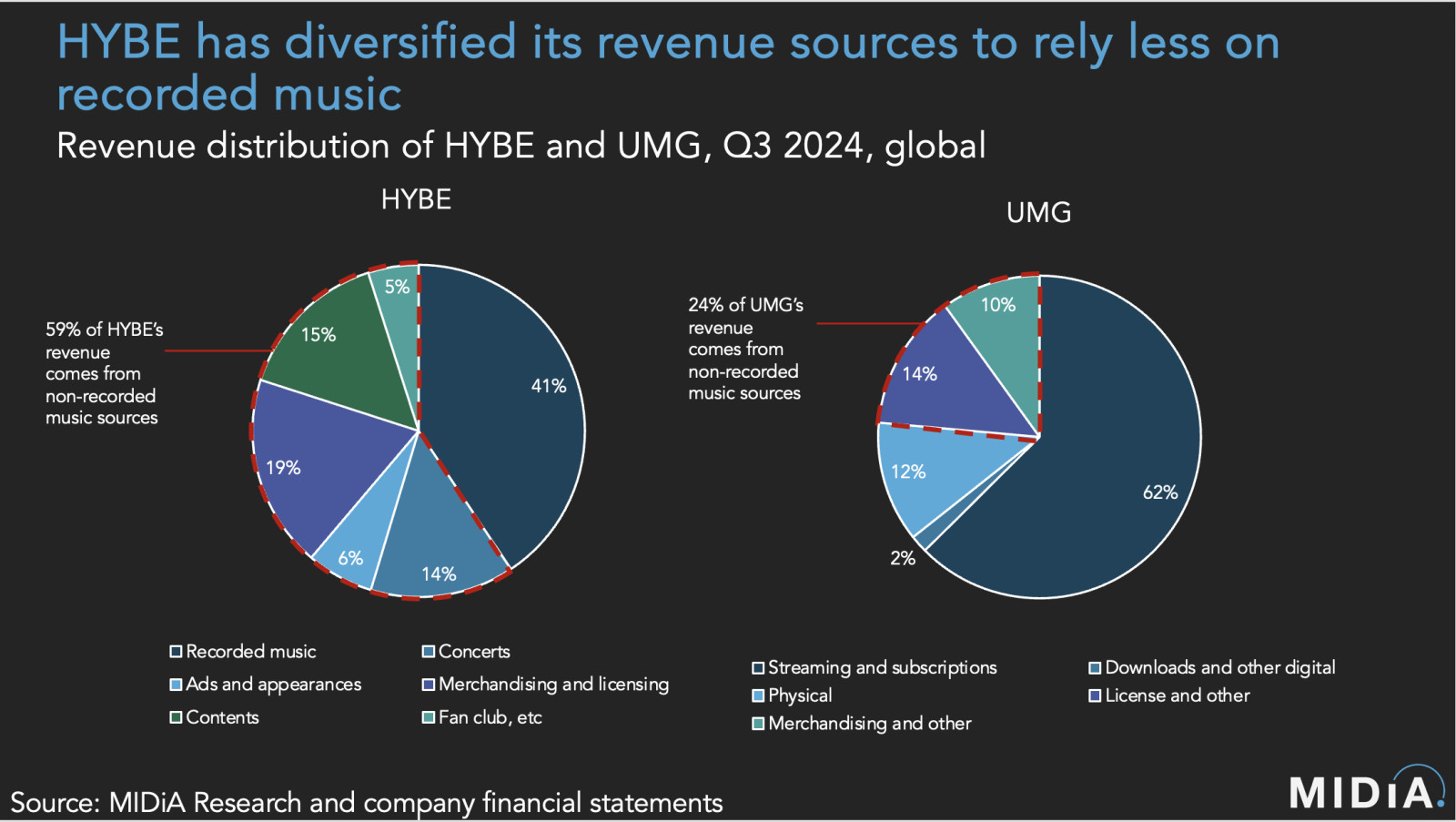

HYBE had a lacklustre Q3 overall, reporting a 1.9% YoY drop in revenue despite relatively strong album releases for the quarter. However, HYBE’s revenue diversification helped offset its 18.8% year-over-year (YoY) drop in recorded music revenue. In fact, only 41% of HYBE’s total revenue comes from recorded music, with 30% of recorded music revenue coming from streaming — a stark contrast to the majority of Western record companies.

Furthermore, HYBE’s revenue is divided between “artist direct-involvement” revenue — products that rely on the artist being an active participant, such as recorded music and concerts — and “artist indirect-involvement” revenue like merchandise and fan clubs, which do not require the artist to be present. The distinction between artist-direct and artist-indirect products enables HYBE to generate revenue regardless of whether an artist is in an album release cycle and acts as a safety net throughout fluctuations in revenue. Conversely, 76% of Universal’s total revenue comes from recorded music, with 62% of total revenue coming just from streaming and subscriptions. Recorded music is, of course, the core pillar of the music industry, but as the Western streaming market begins to mature, fandom and expanded rights revenue are increasingly important.

This upward trend is already visible in Universal’s quarterly earnings report. The most significant revenue growth came from licensing, which rose 20.4% YoY. In their press release, UMG credited this in part to “greater live and brands income and increased direct-to-consumer related activities”, both of which move past the album release structure upon which recorded music is most dependent. This same trend presents itself in HYBE’s earnings report — merchandising and licensing revenue rose 15.7% YoY and contents revenue (which includes Weverse) rose 63.6% YoY.

Featured Report

Streaming strongholds High-potential markets for global music players

While the balance of music streamers continues to tip towards global south markets, their smaller ARPU rates limit their revenues. Meanwhile, periodic price-rises and the advent of supremium will reinforce the contributions from the West. This report highlights streaming strongholds, those markets which, underscored by high music engagement and his...

Find out more…Implementing HYBE’s fandom strategy in the West

However, it will not be easy to implement HYBE’s strategy wholesale in the West. The first, and probably largest, challenge is that UMG and other Western rightsholders do not always have ownership in the rights required to effectively monetise fandom, as expanded rights (or at least, the bulk of ownership) typically remains in the hands of the artists. This precedent makes it difficult to try to acquire those rights, especially from superstars — while their expanded rights would be the most lucrative, they would also be the most protective of their rights and have the most leverage to keep them. Conversely, HYBE and other South Korean entertainment companies control nearly all artist branding. The artist’s public brand is effectively the property of the label, which can utilise the brand ‘assets’ however it likes.

Another challenge in monetising superfans has already begun to present itself as higher prices for merchandise and live events are beginning to alienate a large number of fans. Similar to streaming, fandom is not infinitely scalable. As the market growth slows, the new strategy will be to extract as much money as possible from current fans. However, nurturing the market rather than simply harvesting fandom will prove to be more successful in the long run. Just because you can monetise a fan does not necessarily mean you should. Care needs to be taken with where a fan is in their fandom journey.

Trying to ‘optimise for ARPU’ too soon may prevent that fandom reaching its full potential. Longer term, if fans are over-monetised, there will come a point where they start to resent being the product. HYBE is a pioneer of superfan merchandise, but the company is also beginning to test the upper limit of how much fans are willing to pay and what they are willing to pay for. Merchandise cannot be seen as only a means to extract money from fans because, while superfans are more willing to spend money on their favourite artist, they are also the most cognisant of what they are being sold.

While 2024 was the year of the superfan, it has also been the year of the fandom trough. However, HYBE’s Q3 earnings show that investing in fandom and diversifying revenue sources can be a successful endeavour. Superfans may not be the only solution to stagnating subscription revenue, but nurturing fandom and investing in expanded rights can help offset it.

The discussion around this post has not yet got started, be the first to add an opinion.