The Premier League Faces Some Tough Choices What Ever Happens With This Week's Broadcast Rights Bids

This is a big week for the English Premier League with the bid submissions for the 2019-2022 broadcast rights due to be delivered tomorrow. The Premier League is the world’s most lucrative football league, with 14 of the 30 largest revenue generating clubs competing in the league. The current £5.14 billion TV broadcast deal for 2016–2019 is worth nearly twice that of the German Bundesliga, which is the largest European football league by attendance. The 2016–19 deal was itself a massive 71% increase on the deal secured in 2012 for the 2013–2016 rights. All the expectations are that this week’s bidding process will be a further inflationary exercise for the perceived value of premium live sports for video audiences. This is in spite of the mutual carriage deal signed between Sky and BT (the two incumbent domestic broadcast rights holders) December 2017, which allowed cross promotion of sports packages on each other’s services. But, while the sports leagues reap record profits from the increasing revenues—witness the Bundesliga’s 85% increase in the value of its broadcast rights for 2018–2022—all is not well on the consumer demand side of the equation.

Why pay-TV companies over bid for sports content and why they are increasingly worried

Live sports has been integral to the pay-TV ecosystem ever since insurgent sports broadcaster ESPN made sports rights financially viable in 1987. In that year, the sports network launched Sunday Night Football for NFL fans in 1987, taking advantage of the double revenue possibilities opened up by the US Cable Communications Policy Act of 1984. ESPN was able to charge pay-TV operators for carriage deals (the right to carry the network on the pay-TV service) which effectively subsided the cost of its sports rights acquisitions and allowed it create a high margin TV advertising around the live coverage. Where the networks went, the operators followed and it resulted in an explosion in TV sports broadcast rights valuations. With competing networks and operators bidding against each other over the years, the annual valuation for NFL rights deal now stands at $6942.5 million. This is a phenomenal 45-fold increase on the $152.7 million 1987–1990 deal.

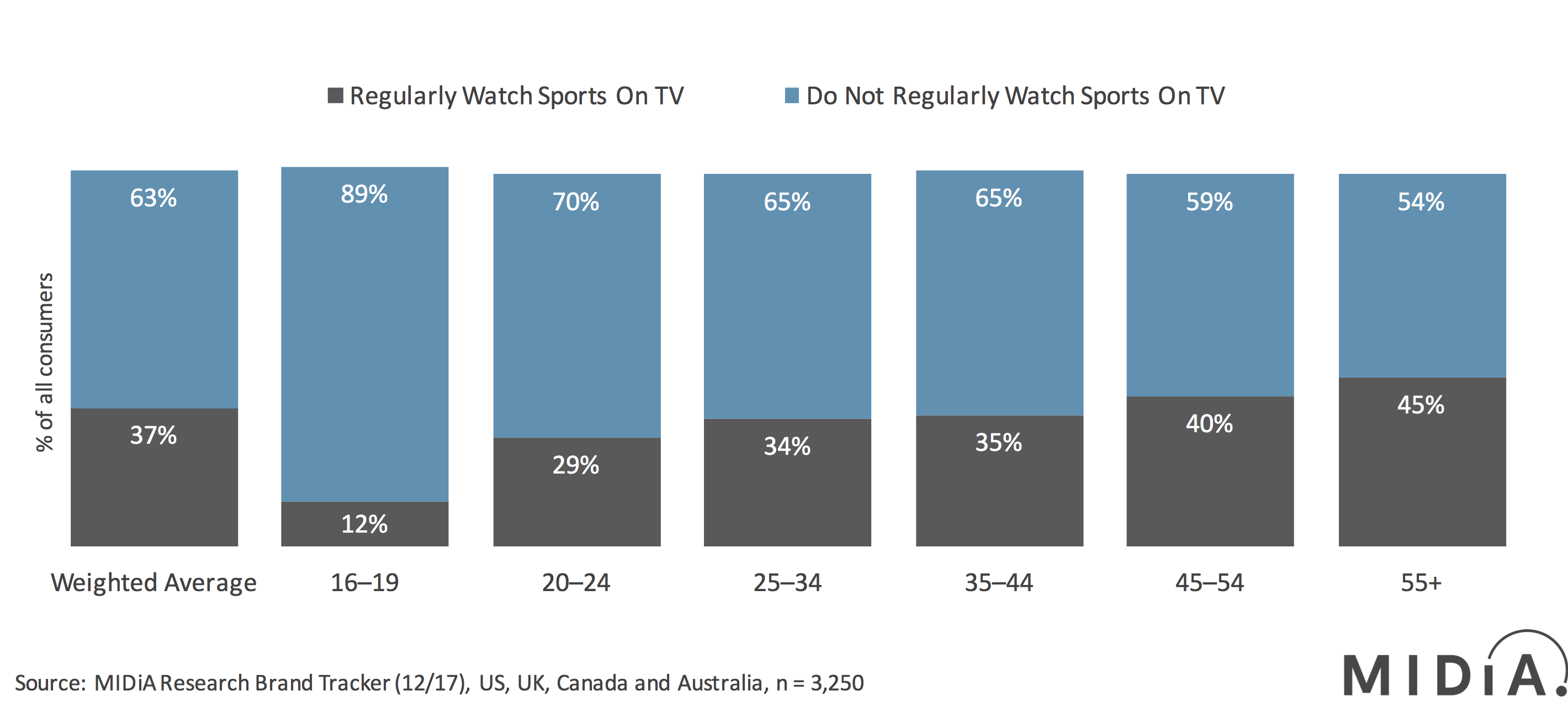

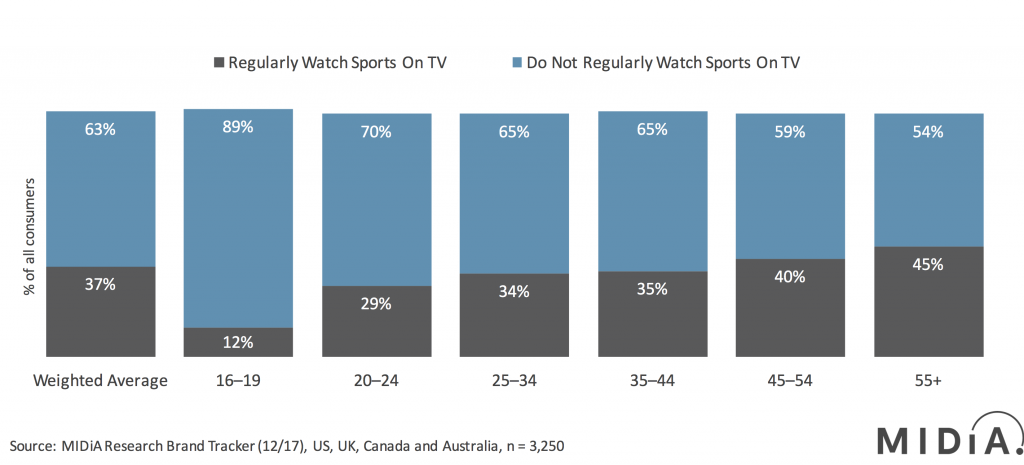

However, Sunday’s 7.1% year-on-year decline in the super bowl’s audience highlights an emerging reality for the digital media landscape. With the plethora of on-demand entertainment options available, sporting events have a reduced hold in their command of audiences’ attention. In the past, audiences had limited viewing options on linear TV. Digital options led by subscription video on demand (SVOD) services are now unravelling sports once compelling proposition. In the face of increased choice and competitive pricing, long-form live content becomes less appealing, as backed up by the demographic viewing data from the MIDiA Research brand tracker:

Premium live sports coverage is now facing a demographic ticking time bomb, with only 12% of 16–19 year olds now regularly watching sports events on TV. This is significant because this age group is the first to have been raised with social video as a key part of their entertainment mix. Essentially, they’re conditioned to short-form and super-short-form content, whereas a 15-minute YouTube video is a significant time commitment. Therefore sitting through a three-hour NFL game, or even a 90-minute football game is a constrained value proposition compared to the alternatives a mere swipe away for them.

Whatever the headline numbers from the new premier league broadcast rights deal today, expect more stories about the premier league instigating straight-to-consumer SVOD services to accelerate, as the world’s most valuable football franchise starts to plan for an increasingly fragmented future audience relationship.

The discussion around this post has not yet got started, be the first to add an opinion.