The Narrative Of Spotify’s Filing Is That The Best Is Yet To Come

Spotify just filed its F1 for its DPO. The most anticipated business event in the recorded music industry since, well…as long as most can remember, is one big step closer. The filing is a treasure trove of data and metrics, and while there won’t be too many surprises for anyone who follows the company closely, there are nonetheless a lot of very interesting findings and themes. The full filing can be found here. Below are some of the key points of interest:

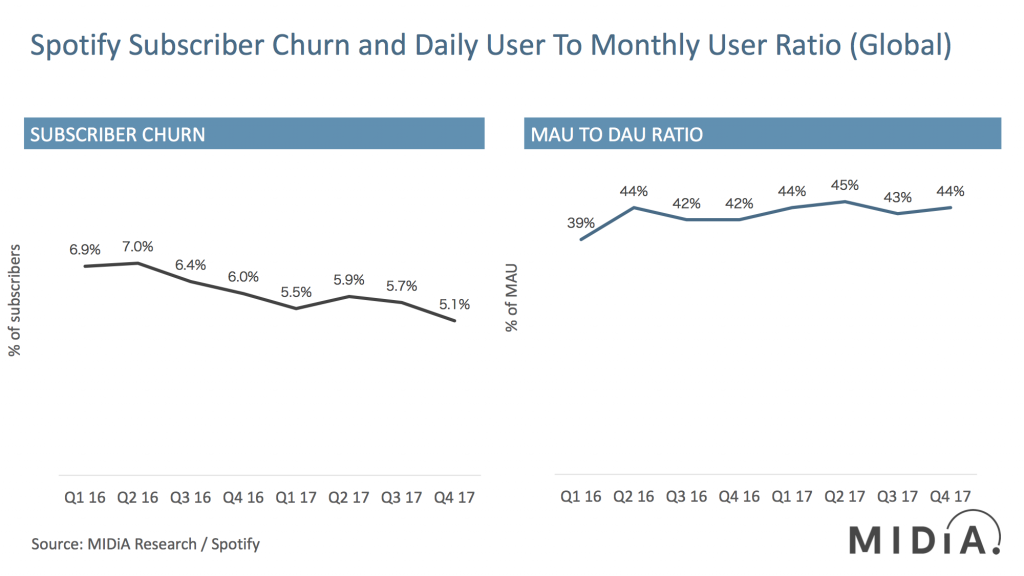

- Most of the numbers are heading in the right direction: Monthly active users (MAUs), subscribers, hours spent etc. are all going up, while churn and cost ratios are heading down. Premium ARPU, which has been declining, was an exception: 2015: €7.06, 2016: €6.00, 2017: €5.24. These figures reflect pricing promotions. Spotify was never going to have fixed every aspect of its business in time for its listing; that was never the point. What Spotify needs to convince potential shareholders is that it is heading in the right direction. The narrative that emerges here is one of a company that has helped create an entire marketplace; it has made great ground so far and is poised for even bigger and better things. That narrative and the clear momentum should be enough to see Spotify through. As I’ve previously noted, investor demand currently exceeds supply. If you are a big institutional investor wanting to get into music, there are few options. Pandora aside, this is pretty much the only big music tech stock in town. As long as Spotify can keep these metrics heading in the right direction, it should have a much smoother first few quarters than Snap Inc did, even though a profit is unlikely to materialise in that time.

- Spotify is baring its metrics soul: Spotify has put a lot of metrics on the line, setting the bar for future SEC filings. While competitor streaming services will be busy plugging the numbers into Excel so they can compare with their own, the rest of the marketplace now has a much clearer sense of what running a streaming service entails. One really encouraging development is Spotify’s introduction of daily active user (DAU) metrics. As we have long argued at MIDiA, monthly numbers are an anachronism in the digital era—a measure of reach not engagement. So, Spotify is to be applauded for being the first major streaming service to start showing true engagement metrics.

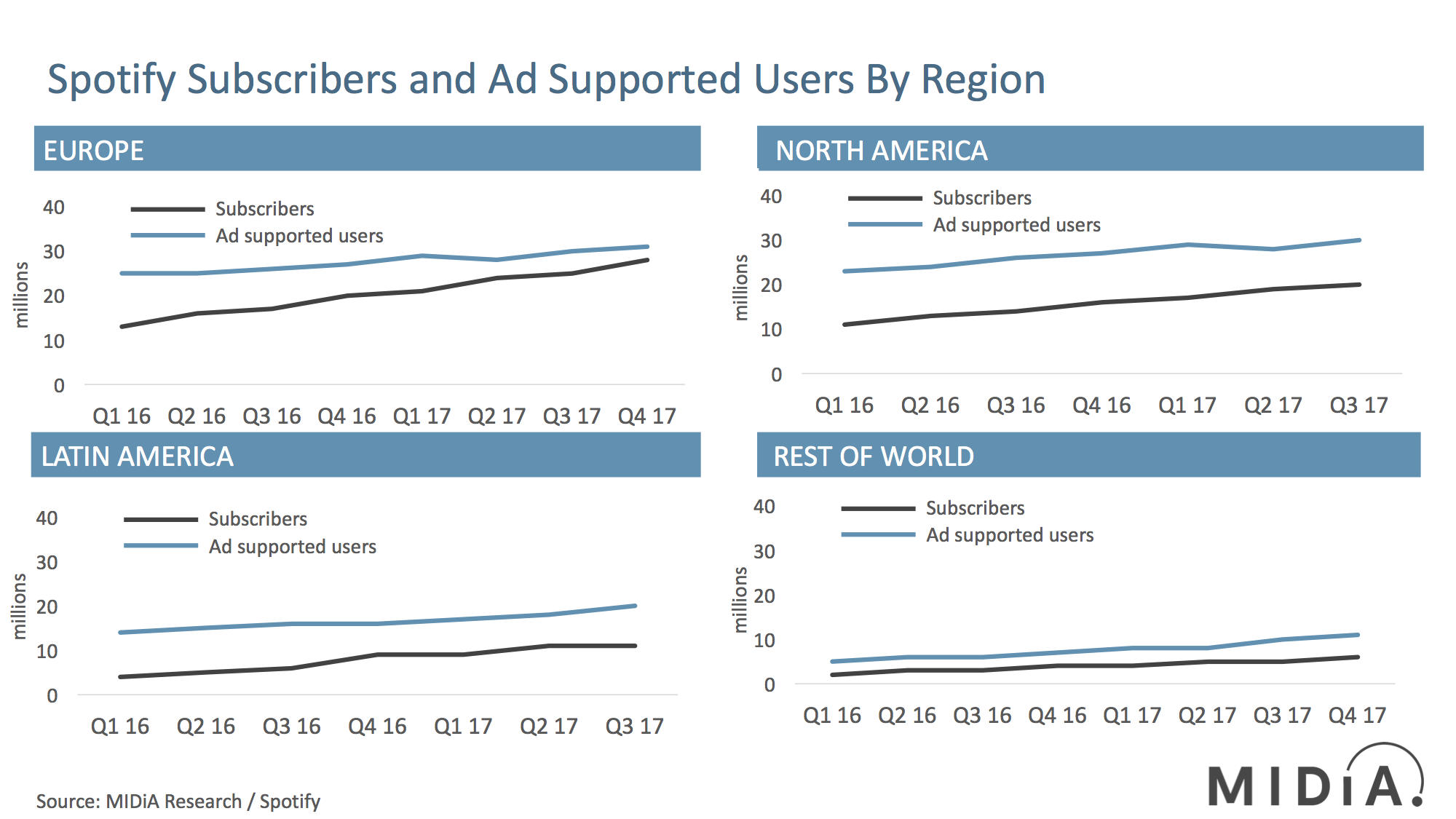

- Users and engagement are lifting: Spotify had 159 million MAUs in 2017, with 71 million paid and 92 million ad supported. Europe was the biggest region (58 million total MAUs) followed by North America (52 million), Latin America (33 million) and Rest of World (17 million). The latter two are the fastest growing regions. Meanwhile, 44% of MAUs are DAUs, up from 37% in Q1 2015, which shows that users are becoming more engaged, although the shape of the curve (see chart below) shows that when swathes of new users are on-boarded, engagement can be dented. Consumption is also growing (a sign of both user growth and increased engagement): quarterly content hours went from 17.4 billion in 2015 to 40.3 billion in 2017. There are some oddities too. For example, ad supported MAUs actually declined in Q2 2017 by one million on Q1 2017 and in Q4 2017 only increased by one million on the previous quarter to reach 92 million.

- The future of radio: Spotify puts a big focus on spoken word content and podcasts in the filing, as it does on advertiser products. It also lists radio companies first and subscription companies second as its key competitors. Meanwhile ad supported flicked into generating a gross profit in 2017, going from -12% gross margin in 2016 to 10% in 2017. Premium gross margin was up from 16% to 22% over same period. As MIDiA predicted last year, free is going to be a big focus of Spotify in 2018 and beyond. The first chapter of Spotify’s story was about becoming the future of retail. The next will be about becoming the future of radio. And the increased focus on spoken word is not only about stealing radio’s clothes, it is about creating higher margin content than music. None of this is to say that Spotify will necessarily execute well, but this is the strategy nonetheless.

- Spotify is still losing money but is trending in the right direction: Spotify’s cost of revenue in 2017 was €3,241 million against revenue of €4,090 million with an operating loss of €378 million. However, losses are not growing much (€336 million in 2016) and financing its debt added a whopping €974 million in 2017, from €336 million in 2016. Part of the purpose of the DPO is to ensure debt holders, investors and of course founders and employees get to see a return of their respective investments in money and blood, sweat and tears. Once that is done, financing costs will normalise. Also, Spotify’s new label licensing deals are kicking in, with costs of revenue as a share of premium revenue falling from 84% in 2016 to 78% in 2017. Spotify is not yet profitable but it is getting its house in order.

All in all, there is enough in this filing to both convince potential investors to make the bet while also providing enough fodder for critics to throw doubt on the commercial sustainability of streaming. Spotify’s structural challenge is that none of the other big streaming services have to worry about turning a profit. In fact, it is in their collective interest to keep market costs high to make it harder for their number one competitor to prosper.

But, in the realms of what Spotify can impact itself, the overriding trend in this filing is that Spotify is well and truly on the right track. For now, and the next nine months or so, Spotify will likely remain the darling of the sector. After that, investors will start wanting a lot more if they are going to keep holding the stock. Spotify is promising that the best days are yet to come. Now it needs to deliver.

The discussion around this post has not yet got started, be the first to add an opinion.