The mouse that roared: Disney calls time on traditional pay-TV and Netflix in the US

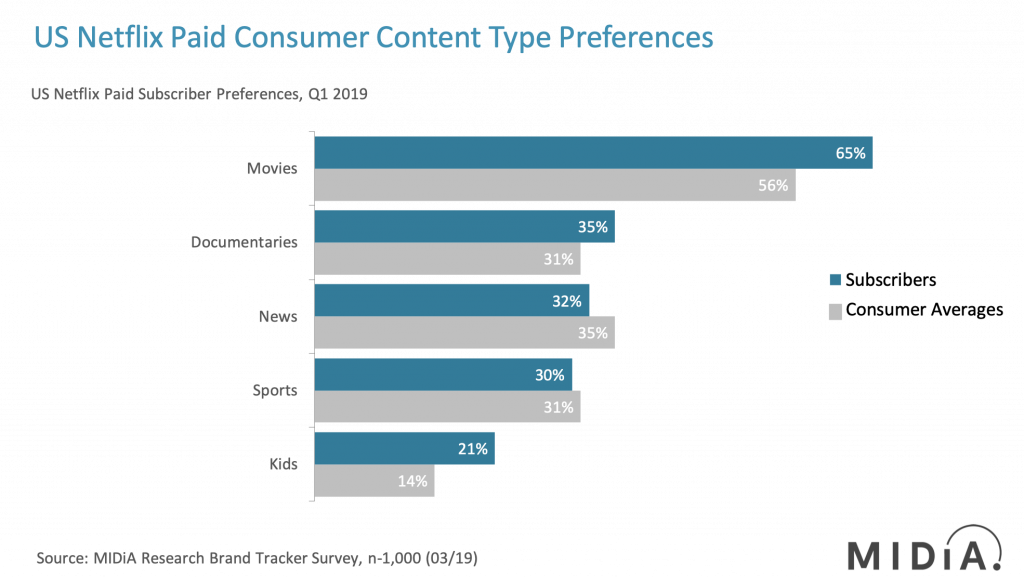

As predicted, Disney has decided to flip the switch and unleash a pay-TV (and Netflix) killer by announcing a Q4 bundle of its streaming services in one joint aggressively-priced offer. On November 12th, 2019 when Disney launches its new direct-to-consumer (D2C) service Disney+, it will be possible to subscribe to a bundled version of Disney+, ESPN+ and Hulu’s ad-supported tier all in one offering for $12.99 per month – the same price point as the recently-increased Netflix standard plan. However, while Netflix only offers scripted drama, kids, factual, and comedy content at this price point, the new Disney bundle will offer this, plus live sports (second tier via both ESPN+ and first tier via Hulu), live news (via Hulu) and second-window blockbuster feature film releases.

The big strategic play in the streaming video market in the US has been defining the value proposition for pay-TV consumers.

The US pay-TV market generated $84 billion in revenue in 2018 on 80 million subscribers (source: MIDiA Research). To put this in context, Netflix’s entire 2018 revenue was $15.8 billion on 58 million subscribers – making US traditional pay-TV subscribers 386% more valuable in gross revenue terms than Netflix subscribers.

To attract those higher-margin pay-TV customers, subscription video on demand (SVOD) services have had to position themselves as either additive services (to complement existing pay-TV subscriptions) or as substitutive services (to replace existing pay-TV subscriptions). Either approach calls for competitively priced, contract-free monthly billing packages.

Featured Report

India market focus A fandom and AI-forward online population

Online Indian consumers are expected to be early movers. They are high entertainment consumers, AI enthusiasts, and high spenders – especially on fandom. This report explores a population that is an early adopter, format-agnostic, mobile-first audience, with huge growth potential.

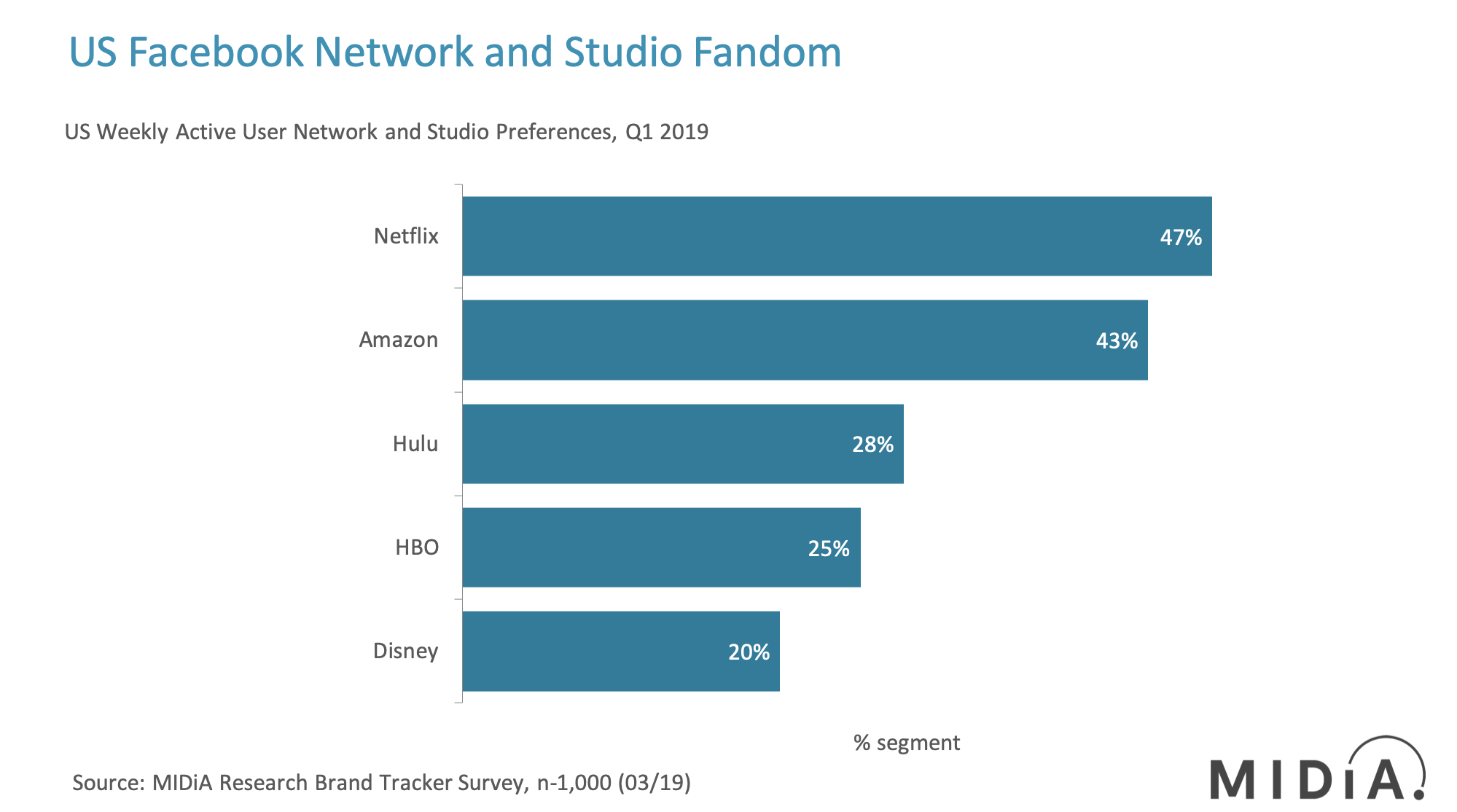

Find out more…The additive services strategy entailed the Netflix-led approach of leading with exclusive content primarily focused around scripted drama. The substitutive approach focused on a contract-free streaming pay-TV approach, championed by pay-TV operators such as DISH and AT&T through SlingTV and DirecTV Now. Disney’s bundling announcement has eviscerated the latter approach and will now test the former, as the increasingly mainstream and uncompetitively priced content on Netflix will be matched by Hulu, and then augmented by exclusive premium mainstream content on Disney+. Add sport and news into the mix, and the mainstream pay-TV subscriber will no longer consider the uncompetitively-priced streaming pay-TV services (Sling TV pricing starts at $25, and DirecTV Now pricing starts at $40 per month) and will instead gravitate naturally to a D2C bundle with a pre-existing strong brand name recognition.

The streaming future will be redefined by additive versus substitutive services

While November 12th will not spell the death of Netflix, it will force the world’s leading SVOD service to closely evaluate where it truly sits in the entertainment landscape. Netflix leadership has been clear in its refusal to broaden out their substitutive offerings (no sports and no hint of news). They now have to double down on demonstrating why they should be an additional monthly reoccurring cost to mainstream US video consumers, when Disney has opened up a new front in the streaming wars. The success of genre-bending originals, such as Stranger Things, hints at core streaming creative unique selling propositions in Netflix – which have been increasingly obscured in the of new and largely derivative content being relentlessly realised on the service.

For the pay-TV operators however, the future of virtual multichannel video programming distributors – as the streaming iterations of cable and satellite services are generically defined in the industry – is rapidly drawing to a close.

The discussion around this post has not yet got started, be the first to add an opinion.