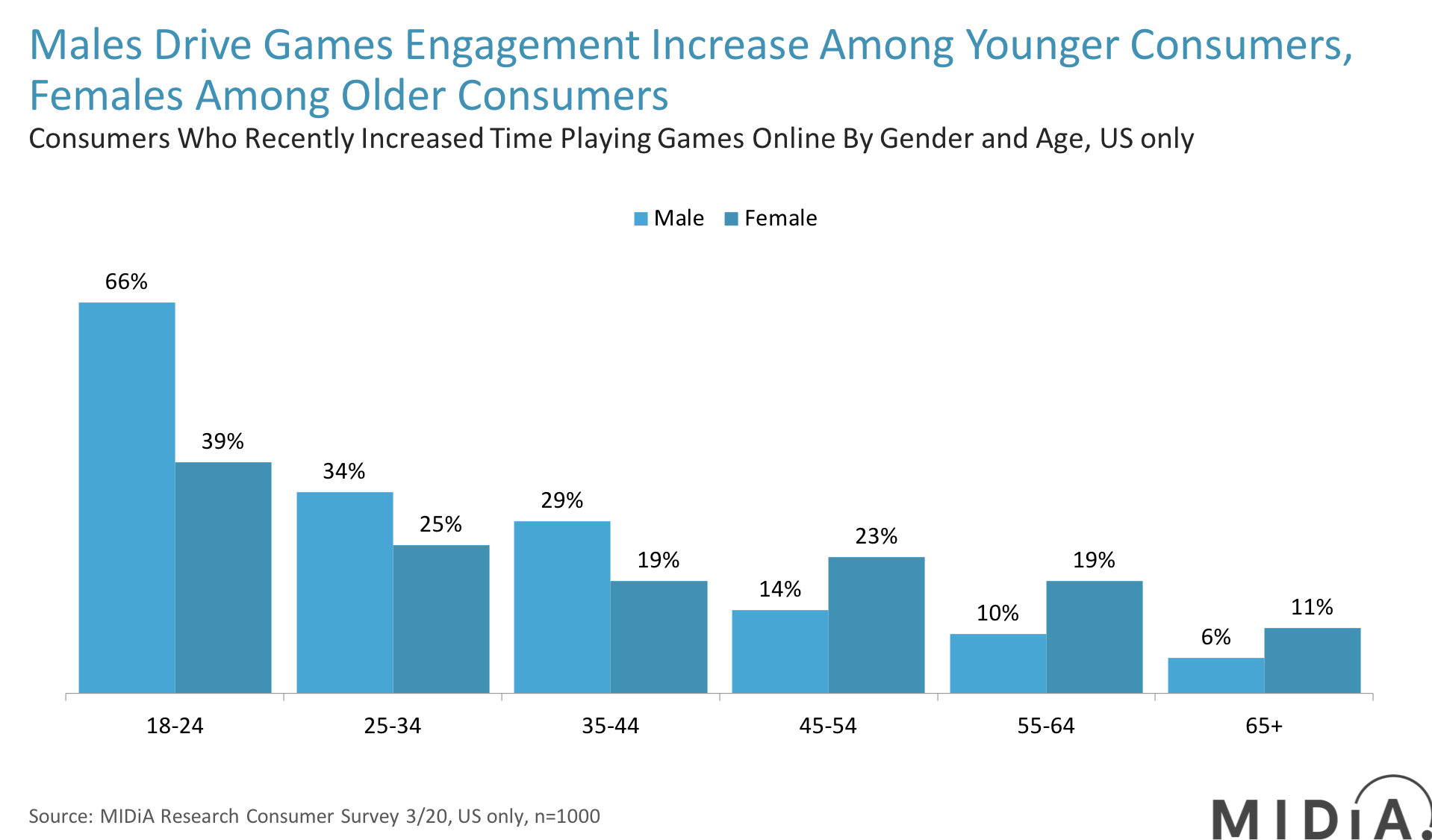

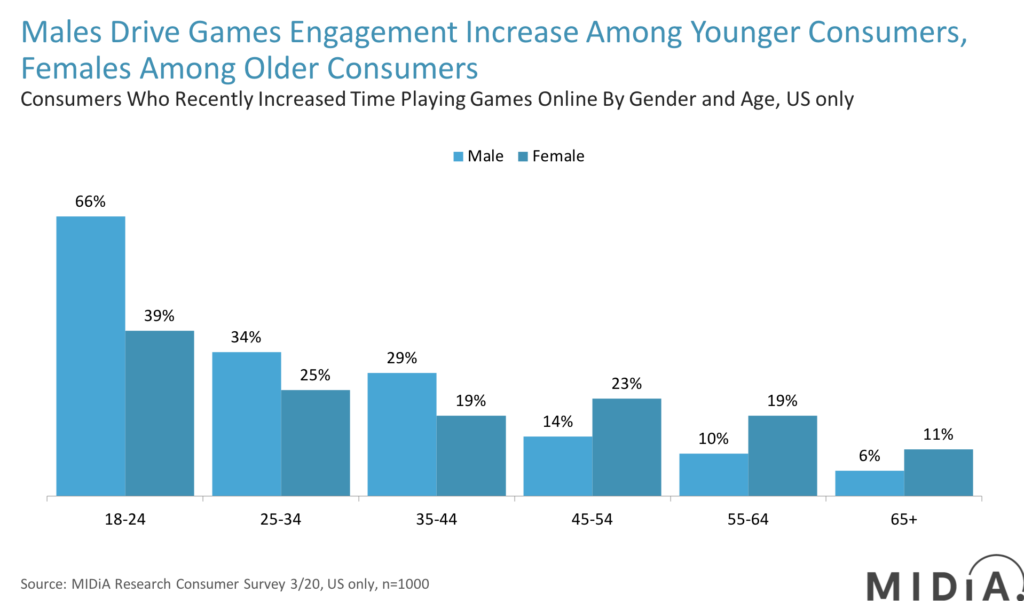

The gaming boom is driven by different genders in different age groups

We know that we are experiencing a spike in games engagement during this crisis. 21% of adult consumers in the US say they’ve spent more time playing games online ‘in the last two weeks’ (fielded in the 3rd week of March).

While games engagement increased evenly among females and males (21% female versus 20% male), gender penetration varies significantly when looking at different age groups.

In the younger groups (18-24, 25-34 and 35-44), the penetration of consumers who have increased their gaming time skews heavily male. However, for consumers aged 45 or more, it is the exact opposite with females leading the increase in games engagement.

Featured Report

AI futures Culture wars

AI is transforming culture, entertainment, business, and society at a rate unprecedented in the digital era. Unlike previous tech, AI is evolving at the speed of computing, not the human brain. Delivering as quickly as it promises, AI is breaking the mould.

Find out more…

- Better return on investment (ROI) for in-game ad campaigns: Products targeting age 45+ females are likely to see higher than usual ROI on ad campaigns run inside games. Freemium games advertising is often about cross-promoting other games, but in the times where large brands are redistributing marketing budgets from live and out-of-home towards digital, freemium casual games are certainly one channel to consider.

- Adjusting in-game offerings: It is highly advised to look at which demographic segments have most spiked in usage, because they may not be the same as the demographic distribution of your usual user base. If you had a 50/50 gender split in a game, but the increased engagement was mostly driven by females, this should inform the design and targeting efforts of your new skin or other in-game items for sale.

- Inform cross-entertainment opportunities: Many brands (be they TV shows, music artists, fashion brands, or sports teams) will be looking to sustain a fandom momentum between seasons/albums/clothing lines/matches as their standard production flow is disrupted. Gaming worlds are well positioned to accommodate this, whether it be through virtual concerts, premiering video footage, messaging or competitive interaction. Periodically reviewing which demographics are most engaged during this time should be at the core of informing who to partner with.

If you would like to explore cross-entertainment opportunities for your particular case, do not hesitate to drop us a line.

The discussion around this post has not yet got started, be the first to add an opinion.