The games market will grow by 4.6% in 2025 – in line with the global inflation rate

We just published our flagship games report MIDiA Research’s Global Games Forecasts 2025–2031 and its accompanying dataset.

What you need to know:

- The games market is mature, so double-digit growth is a fantasy and the industry will only see slight growth going forward

- The global number of gamers will keep growing, but ARPPU will slightly decrease over time due to growing gamer numbers in emerging markets

- The oversaturation of live services will see the developer pendulum swing back towards premium games on console and PC

- The mega-budget strategy will slowdown in favour of shorter budgets – outside of the live-service incumbents and a few select “prestige” studios

- Multi-game subscription user growth is reaching maturity, though revenues will grow via pricing increases (and perhaps ad-based tiers) in the future

The report dives into player forecasts, revenue forecasts for software (full-game advertising, and in-game split by cosmetics and progress-based), hardware (console and XR), and subscriptions – all up to 2031, with platform and regional splits.

Ready to dive deeper? Download the free version of the report.

Forget “survive ‘til 25” – it is all about “stick ‘til 26” and beyond (with tempered expectations)

Powered by 3.27 billion gamers (mostly on mobile), the global games market’s revenue – including software, hardware, and subscriptions – will reach $236.9 billion in 2025, up 4.6% year on year.

Against the backdrop of the IMF’s projected 2025 global inflation rate of 4.2%, the global games market is essentially flat.

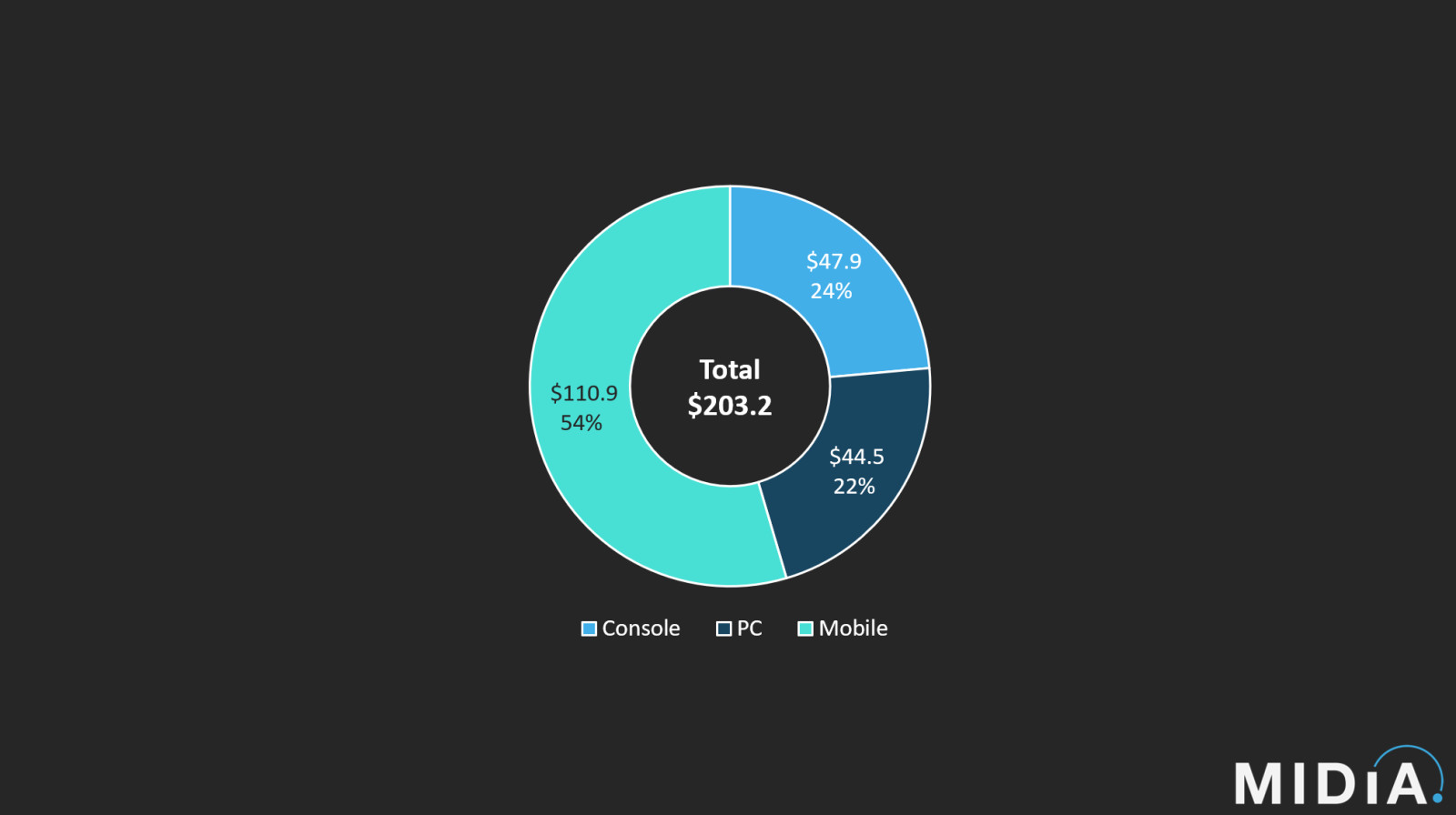

Game software revenues will hit $203.2 billion in 2025. Mobile – as always – will account for over half (55%). Part of this is mobile’s massive userbase:

- Smartphones are ubiquitous, reaching billions of gamers globally

- Mobile also popularised the free-to-play monetisation model, taking cues from MMO games that came before

- Mobile’s convenience, combined with its small, affordable purchases – propped up by hyper-spending whales – appeals to a wide audience

Get a sneak peek at our ARPPU numbers per platform in the free report.

“Survive ‘til 25” was a mantra often repeated in industry circles, with many hoping that the releases of the Switch 2 and Grand Theft Auto 6 in 2025 would revitalise the market and spark the growth enjoyed back in 2021 and 2022.

Make no mistake: These – and other premium releases – will help add more revenues for the market (+6.4% year-on-year growth for console in 2025).

But Nintendo and Take-Two will be the big winners here. GTA 6 will be – to quote Mat Piscatella of Circana – an engagement “black hole”, having a negative impact on other developers' games.

However, the Switch 2 offers up a springboard for third-party developers (or a lifeboat, in Ubisoft’s case) to extend the lifecycles of their game catalogues, promising engagement and revenue boosts for third-party developers big and small.

As for new games on Nintendo’s platform, developers are already building lower-fidelity versions of their games for the Xbox Series S, lower-end PCs, and companion devices like the Steam Deck.

The Switch 2 could therefore be a perfect storm, offering an all-in-one third-party development device – one with PC games (mouse functionality?), Xbox games, PlayStation games, and – of course – Nintendo games.

Looking for hardware revenues toward 2031? Download the free version of the report.

It is time to say goodbye to “survive ‘til 25” and hello to “stick ‘til 26” and beyond but with tempered expectations for future growth in this mature market.

The market (again, also including hardware, software, and subscriptions) will grow from $236.9 billion in 2025 to $280.1 billion in 2031:

Clearly, the years of double-digit growth are over.

Featured Report

Pixels to playlists Music preferences and behaviours of gamers

The global games industry is a $236.9 billion behemoth. It now rivals film, television, and music combined in terms of revenues and is a cultural driver. Yet, for music companies, labels, and platforms,...

Find out more…The full report also includes our more pessimistic bear cases and the factors that could lead us there.

How did we get here after all those promised years of “double-digit growth”?

Like many industries, gaming overextended itself following the black-swan COVID-19 pandemic. During those complicated times, everybody was at home, interest rates were low, and engagement with – and spending on – games skyrocketed.

The growth-at-all-costs mindset was dangerous. Many publishers thought that double-digit growth would continue, greenlighting risky projects and strategies that haven’t hit the market.

Many of these moves ultimately did not pan out. And some have been cancelled after years of development – and a week after launch in Concord’s case.

The games market has reached its maturity phase, and it’s been this way for a while. Esports, blockchain gaming, the open metaverse, generative AI: none of them could meaningfully grow gaming revenues. It was all a wild goose chase.

Meanwhile, inflation rates are high, money is considerably more expensive to borrow (for consumers and companies alike), and there is a cost-of-living crisis.

While mass firings have long been the de-facto way to balance the books, this is counter-intuitive to a healthy business on console and PC:

- It uproots people’s lives

- Pushes talent away from the industry

- And destroys institutional knowledge that makes companies like Nintendo and FromSoftware so extraordinary

The live-service obsession led to challenges on console and PC, but brighter times are coming

Swelling budgets in the live-service space are scaring off new competitors, who already have a long list of live-service failures.

Many publishers, seeing the successes of Fortnite, Roblox, League of Legends, and the like hitched their wagons to the live-service trend.

But the live-service gold rush already had its winners. Dethroning them is nigh-on impossible. There are still gains to be made, as shown by the success of Helldivers 2 at the start of 2024 and Marvel Rivals at the end.

But the attention economy is oversaturated:

- Helldivers 2 was an unexpected viral hit that saw more premium success than anything (retention numbers are low)

- NetEase’s Marvel Rivals saw what looked like a sinking ship (Overwatch 2’s stagnation) and utilised a strong IP to acquire its players and others.

The big live-service players will continue to dominate that segment, owing to inertia and improvements to their live-ops and content treadmills. In-game revenues will mostly bounce between the biggest live-service games. In-game revenues will still grow in absolute terms, though.

What about advertising revenues? Download the free report to get the data.

Swelling budgets here are scaring off new competitors, who already have a long list of live-service failures.

But it is not all doom and gloom.

A silver lining: this live-service floundering showed many publishers that they should have always been playing to their strengths: premium (single-player) games, which most gamers prefer anyway.

Premium successes like Baldur’s Gate 3, Hogwarts Legacy, Black Myth Wukong, Elden Ring, College Football 25, and Marvel’s Spider-Man 2 prove that fandom – and companies catering to it – is still the beating heart of the games industry.

As publishers continue to course-correct, premium games in a packed release calendar will be an important tailwind for gaming’s software revenue growth in 2025:

- Monster Hunter, Civilization VII, and Assassin’s Creed in Q1, of which the former will likely be the big winner, as signalled by our friends at mindGAME Data

- The software lineup for Nintendo Switch 2

- Juggernaut release Grand Theft Auto 6

- And of course the yearly suspects (sports games and Call of Duty) will remain

Longer term, Black Myth Wukong has also proven a Chinese appetite for premium games, setting the precedent for a slew of new titles catering to that market in the coming years.

Indeed, premium games (including DLC) will also have the highest CAGR numbers of all software revenue segments (from $41.2 billion in 2025 to $50.8 billion in 2031). But of course, growth is relative.

Successes from smaller developers and teams, including Palworld, Astro Bot, Helldivers 2, chart a pathway for smaller, more efficient games. Hitting a few singles and doubles is better than taking a swing at a home run and missing.

Game budgets have spiralled out of control – it is time to shrink the scope.

Smaller successes can grow into bigger franchises (and the big success stories of tomorrow). UGC platforms offer a smaller venue to test big ideas. The market is in a place where hedging bets is better than putting all eggs in one basket.

Subscriptions are struggling to find new users, but growth will come from pricing increases

While PlayStation Plus and Xbox Game Pass once seemed like they might change game distribution, the reality is that multi-game subscriptions are already beginning to reach maturity.

As we outlined in our article on games trends to watch in 2025, the attention economy is oversaturated, and consuming games demands more time than other mediums. In terms of distribution, gamers are happily served by the free-to-play markets – or are happy to buy a few premium games a year.

Subscriptions will still see some growth. But the year-on-year growth rate will decrease with each new year, and most growth will come from services increasing their pricing, as the services seek to further grow their ARPPU despite user growth stagnating.

Want to see the multi-game subscription data from 2024 to 2031 for yourself? Download the free report!

Netflix, Google, and Microsoft all hoped subscriptions and cloud gaming would open up games to new audiences and markets, but that will take decades to materialise – if indeed it ever materalises at all.

On the other hand, cross-entertainment – TV and movie adaptations – does amplify gaming’s fandom and mass appeal, both of which are already strong and thriving.

Game growth is slowing, and Hollywood and series rely on rote IP and trends. It is clear to see why so many game companies are licensing out their IP to other media – and other media are happy to olblige.

Elsewhere, PlayStation games are on Switch, games that were once stuck within console’s walled gardens are now coming to PC, and Xbox is releasing its games everywhere.

Meanwhile, mobile developers – affected by Apple and Google’s privacy policies – are starting to adjust to their new normal, as shown by titles like Monopoly GO! and Royal Match rising from the ashes. They are also eyeing console and PC to achieve their goals.

Growth will continue to be difficult to come by in the games market, and these challenging market conditions mean developers are being forced to think smarter to succeed.

Download the free version of our Global Games Forecasts 2024–2031 Report.

As always, you can also reach out to learn more about the full report.

The discussion around this post has not yet got started, be the first to add an opinion.