The frequency factor - when daily just isn’t enough

In our digital lives today, we tend to use our favourite apps throughout the day. So, why does the entertainment tech industry still focus on daily, weekly, or, in way too many cases, monthly usage (we’re looking at you, Spotify!). The answer is simple, the less frequency your measure of activity, the bigger your audience figure. We are at the point where we need to move beyond inflated vanity metrics. Even the radio industry now measures in weekly usage terms. Meanwhile, Meta has long reported daily users. However, even daily stats are not enough to really understand an audience’s behaviour. This is why MIDiA has launched frequency tracking in our new report: "Entertainment behaviour: The frequency factor". Here are some of the key insights from the report.

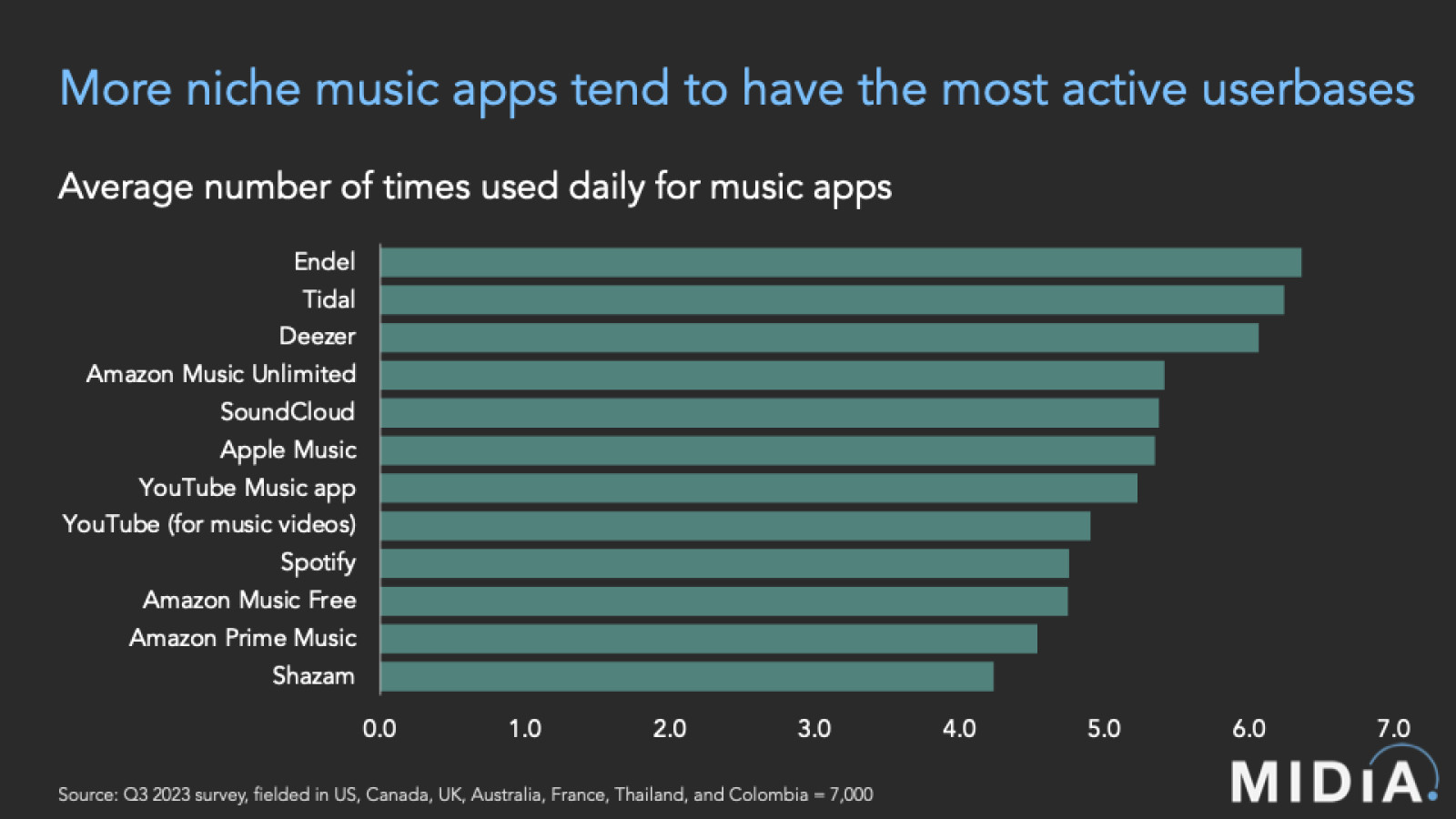

We tracked entertainment consumption across music, video, games, podcasts, radio, and social. For each we measured total time spent, the day parts in which these activities were conducted, and then the usage of the most popular apps for each. This is where we dialled up the measurement, looking not only at weekly and daily usage, but also how many times a day the apps were used.

It will come as little surprise to learn that today’s entertainment consumer fits a lot into their week, with consumption fragmented across a mass of behaviours. Video leads, accounting for over 40% of time, followed by audio (boosted by a still sizeable audience of radio listeners), music, social, and finally games. When you think about the role social media plays in our lives, this usage hierarchy might feel counter intuitive. But this is where measuring frequency of daily behaviour comes into its own, providing us with clear pointers as to why this is the case.

For example, Netflix daily active users (DAUs) use the app around four times a day, while TikTok DAUs are on the app more than six times a day. Around a sixth of TikTok’s users are on the app more than five times a day, compared to 5% or less for Disney+ and Apple TV+.

There are big variations within entertainment formats too. For example, it is the more niche music apps like TIDAL, Deezer, and Endel that have the highest rates of daily frequency, while more mainstreams apps like Spotify and Amazon’s Prime Music have some of the lowest. For example, Deezer’s daily frequency rate is more than a third higher than Prime’s, while TIDAL’s is just under a third higher than Spotify’s.

Featured Report

Cultural movements A new take on mainstream for the fragmentation era

Entertainment has become nichified, mainstream has become smaller, and audiences have fragmented. While this has been crucial to the rise of the long tail and the creator economy, there is a need for a...

Find out more…Daily frequency is still only part of the answer, however. To truly understand entertainment behaviour, we need to look at when they are consuming different forms of entertainment and what else they are doing at the same time.

When we look at which time of day people consume entertainment, social and music have the largest shares in the morning. Both steadily lessen in share towards evening but social rebounds at nighttime. The more passive music behaviour then makes way for video and audiobooks. As evening turns to night, people typically do less and so have more attention for less passive formats. It is the primary activity that really shapes entertainment behaviour. For example, a fifth of consumers listen to music at work / school, which is more than four times higher than for video. Similarly, more than twice as many active podcast listeners do so while on a walk compared to active gamers that play games while walking. Some entertainment formats are tailor made for doing alongside daily activities, while others might result in you walking into a lamp post.

If you like what you have read here, check out the full report. It is awash with data, featuring a 60-slide report and a data file with nearly 400 segments and more than 300,000 data points (yes, you read that correctly!).

If you are not yet a MIDiA client and would like to learn more about how to become one, or how to get access to this report and data, please email commercial@midiaresearch.com.

The discussion around this post has not yet got started, be the first to add an opinion.