The Emerging Video Content Bubble

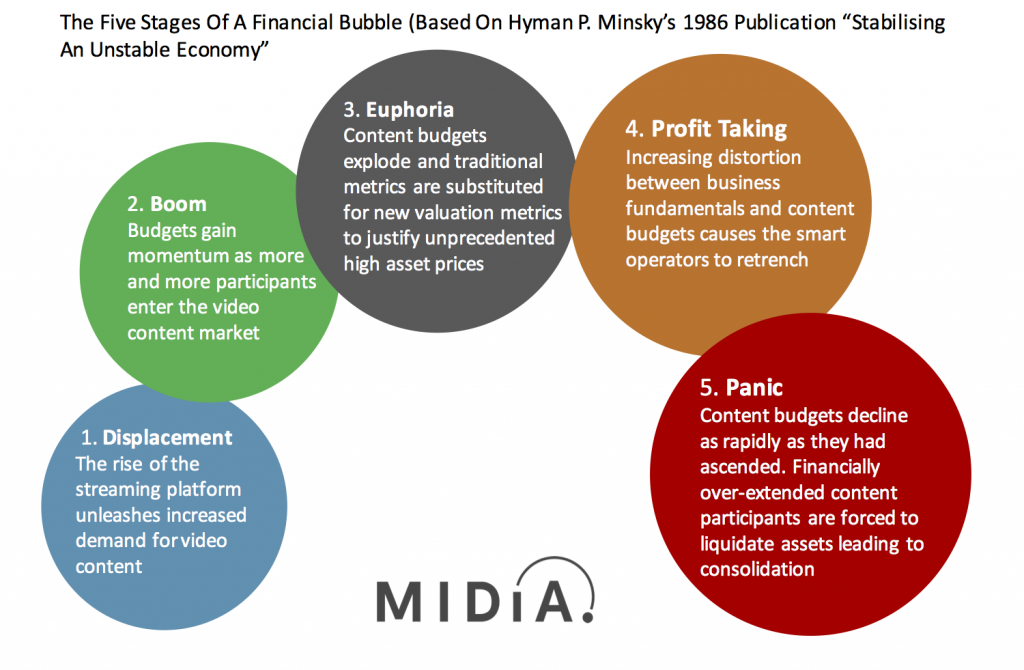

For the TV industry, the current period of video content spending is a golden era. Content budgets are the highest they have ever been, as are revenues for the top 22 global TV networks. However, the video content business is inadvertently fuelling a speculative financial bubble, where investment returns are moving increasingly out of synch with the market fundamentals. To get a sense of how the video boom fits into the traditional framework of a financial bubble, it is worth comparing the underlying trajectory of video content to the five-stage financial bubble model:

- 2013-2015: Displacement caused by SVOD and platform economics: A displacement occurs when investors get enamoured with a new paradigm. Digital platforms are technological catalysts that have dislocated content budgets and the traditional ROI metrics for TV content. Firstly, SVOD services – as typified by global leader Netflix, have fuelled the use of content budget announcements to advertise increased investment in originals. This in turn forces competitors to increase their content budgets in order to compete effectively against SVOD’s market-distorting deal-making. Secondly, the rise of platforms such as Amazon have led to much more diverse and nuanced businesses consisting of overlapping, and ostensibly complementary business channels within a single company. This creates the perception that direct budgetary ROI is no longer possible or even desirable as a content investment KPI. Thirdly, the reduced costs of delivering content via digital distribution platforms (with promotional functionality) operating as part of the user’s wider ecosystem, have led to the perception that the long-tail phenomenon is able to kick in, allowing for previously impossible forms of distributed incremental revenue acquisition.

- 2016-2017: Boom caused by market share competition – Prices gain momentum as participants enter a market. During this phase, the asset class attracts widespread media coverage. Content budgets escalate as more participants enter. The tech, finance, and entertainment medias are full of coverage of new SVOD content being commissioned beyond the regulatory restraints of linear TV, such as the hype around Grand Tour, the $250 million Amazon reboot of the BBC car show Top Gear. The fear of missing out spurs more speculation, drawing more participants into the sector. For example, Facebook and Snap Inc commissioning original content as a counter-weight to challenges in their core business models.

- 2018? Euphoria – the perception of a new normal: During this phase asset prices explode and traditional metrics are substituted for new valuation metrics to justify the unprecedented high asset prices. Talk of increasing original content expenditure, industry transitions and platform economics are used to justify abnormally high valuations.

- Profit Taking: The smart operators heeding the warning signs between escalating assets valuations and the underlying fundamentals of the sector start to close out their positions and take their profits. As of yet there is no widely defined example of what profit taking might look like in the video content landscape. The most likely form would be in significant industry budget holders refusing to bid for content at inflated prices and scaling back content budgets.

- Panic: Asset prices reverse course and decline as rapidly as they had ascended. The widespread use of debt-financing means that many budget holders will be unable to see a minimum return on monetizing their assets in the new reduced asset valuation market and will be forced to dispose of content at a loss, or even put themselves up sale to avoid insolvency.

What are the indictors telling us about the emerging content bubble?

In MIDiA Research’s new report The Emerging Video Content Bubble, we examine the financial reports of 22 of the world’s largest TV Networks, models of content spending for digital platforms, alongside MIDiA’s Brand Tracker quarterly consumer survey data, to build a detailed view of both the supply and demand sides to the video content equation. We show exactly what is being spent, by whom, and how ROI is changing. The data collected and presented in the report underlines the pronounced trajectory of content commissioning away from the underlying business fundamentals, and towards the speculative realms of bubble economics.

If you are not currently a MIDiA Research client and would like to find out how to access this report, please contact us directly at stephen@midiareseach.com.

The discussion around this post has not yet got started, be the first to add an opinion.