The attention recession meets the economic recession

We are living in uncertain times. The cost-of-living crisis is hitting consumers’ pockets, driven by rising fuel and food prices. The effects of the pandemic are still present, the global economy may be entering a recession, and the geo-political landscape is being increasingly shaped by conflict. All of this will impact the entertainment industries, but unlike other market sectors, entertainment is already dealing with its own recession: the attention recession. The circumstances bear resemblance to the credit crunch in 2007 when the music industry was still dealing with its own piracy-catalysed recession. But this time, it is a market dynamic that affects all forms of entertainment.

The coming recession may also be unlike previous ones, in that there may be close to full employment – but spiralling inflation will likely mean surging wage poverty. It is the onset of the confluence of these unique market dynamics that inspired MIDiA to launch a brand new coverage area: Critical Developments, to help our client navigate these unchartered waters. We recently published the first report in this service (The attention recession: Post-peak behaviour). Here are some highlights from that report.

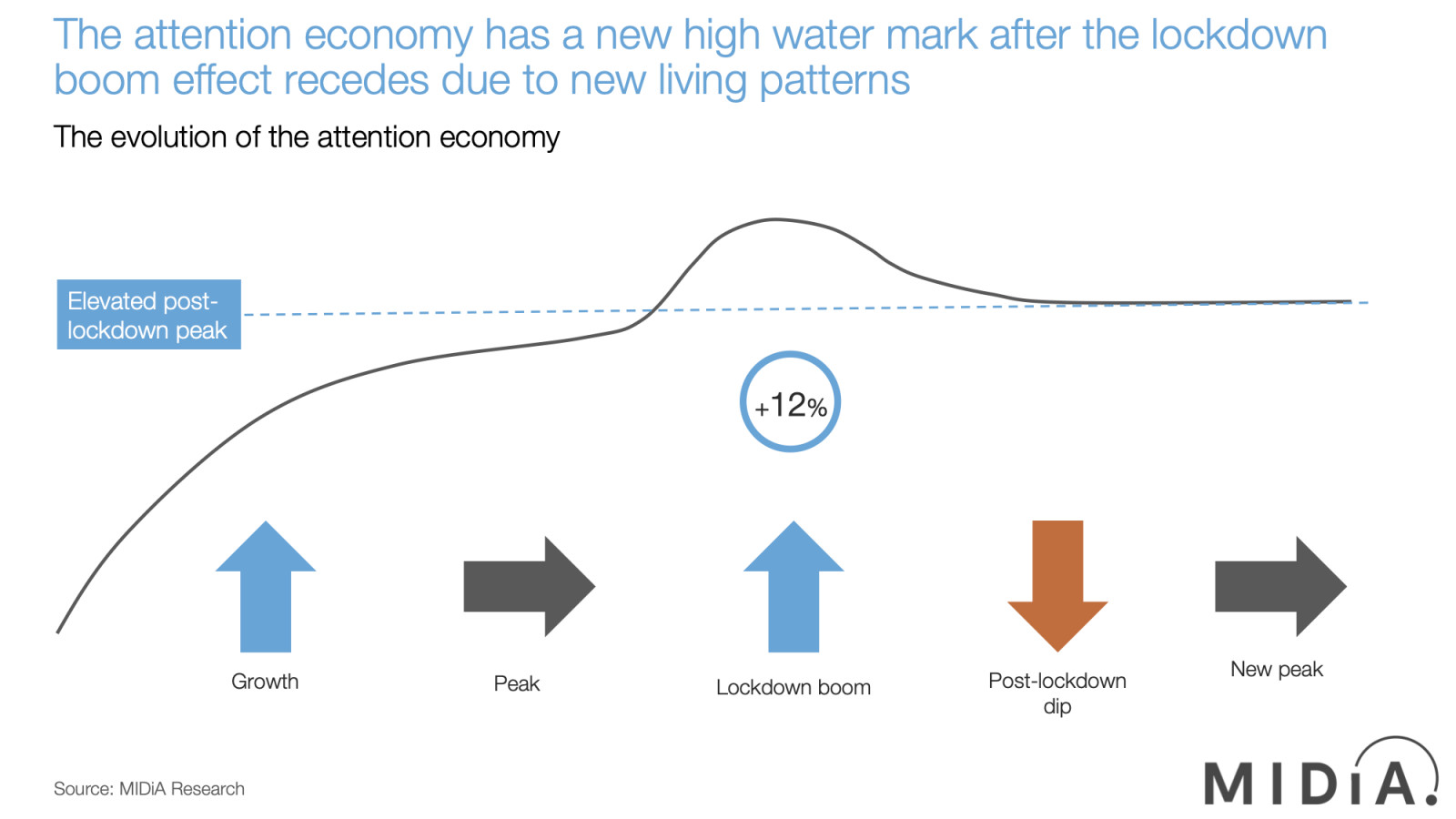

The attention economy has followed five key phases:

- Growth (<2019): Up until 2019, the booming digital entertainment sector filled consumers’ down time. Gone were staring out of the window, being bored at a train station, doing nothing in a Starbucks’ queue, replaced by entertainment. Everything hit new heights in the race for attention.

- Peak (<2019): By 2019 the slowdown had started. With just 9% of addressable consumer entertainment time remaining, many entertainment companies found it harder to maintain growth at previous rates. Growth began to become binary, with a minute gained being done so at another proposition’s expense.

- Lockdown boom (2020-2021): Just before the effects of peak attention began to be felt, the global pandemic hit, opening up a new wave of attention growth. During the lockdown boom, media time went up by 12% and all forms of home entertainment boomed.

- Post-lockdown dip (2021-2022/3): As people started to return to pre-pandemic behaviours, the first signs of contraction showed, but not all sectors were impacted evenly. Pandemic boom sectors, like audiobooks and podcasts, saw larger chunks of their newly-found consumption time disappear.

- New peak (>2023/4): The good news for digital entertainment is that when this contraction period finally ends, and the lockdown deluge recedes, the high-water mark will be higher than pre-pandemic. This is because life patterns are changing, e.g., more working from home.

Attention inflation

Despite this new, higher water mark, entertainment companies across the board are feeling the effects of the post-lockdown slowdown, as evidenced by Netflix reporting the loss of a million subscribers in Q2.Nonetheless, activity is beginning to rise in some categories. Thus, while video weekly active users (WAUs) fell from Q1 2021 to Q1 2022, music, games and social were all up (social, in fact, was the only category to grow without pause from pre- to post-pandemic). But even where entertainment companies are not feeling the pinch, the hours of their audiences have become devalued because of the rise of multitasking: as consumers try to keep up as many of their lockdown consumption patterns as they can, with fewer hours to do so. This is what MIDiA terms attention inflation.

Featured Report

MIDiA Research 2026 predictions Change is the constant

Welcome to the 11th edition of MIDiA’s annual predictions report. The world has changed a lot since our inaugural 2016 edition. The core predictions in that report (video will eat the world, messaging apps will accelerate) are now foundational layers of today’s digital economy.

Find out more…

Economic inflation

It is economic inflation though that is most tangible for consumers, with an average of around a fifth of them stating they would cancel subscriptions across music, video, TV and games if they felt the impact of inflation. It will be the nightlife sectors that will be hit hardest though, with far larger shares of consumers stating they would eat out less and go out less. Even live consumers said they would go to fewer gigs.

The responses are similar to when we asked consumers how they would respond to a potential recession back in 2019, but with one major difference: back in 2019, consumers were generally more concerned then, than they are now. Whether that is misplaced optimism is another thing entirely.

Survive-to-thrive

All entertainment and leisure companies will feel the combined effect of the attention recession. It is a case of simple arithmetic: more time and more spend during the pandemic benefited all companies. Post-pandemic, both of those increases recede, which means that all entertainment companies have to fight hard to hold onto their newly found boosts to revenue and users, let alone grow. The shocks to the global economy and geo-politics will compound matters further. Rising inflation is going to hit all consumers’ pockets (with food and fuel prices being particularly hit), forcing many households to make trade-offs between essentials and luxuries.

In this coming attention recession, it will be the entertainment companies that are able to quickly and fluidly adapt their models, billing, pricing, programming, and user engagement strategies that will be best placed to retain, even win, audiences during the downturn.

For more information on MIDiA’s new Critical Developments coverage area, email jonathan@midiaresearch.com

The discussion around this post has not yet got started, be the first to add an opinion.