The Attention Recession: How inflation and the pandemic are reshaping entertainment

Netflix and Meta were the canaries in the proverbial mine for the attention recession and it is looking increasingly likely that difficult times lie ahead. If the attention crunch was not enough on its own, it has been compounded by the perfect storm of headwinds: the cost of living crisis, rising interest rates, energy and global grain supply constraints, and the Russo-Ukrainian war. The question is not whether the entertainment sector is going to be impacted by these trends, but rather by how much and for how long? The good news is that MIDiA is going to help answer these questions in our upcoming free-to-attend webinar; The Attention Recession: How inflation and the pandemic are reshaping entertainment.

Here is an early overview of some of what we will be covering:

Back in late 2019 when it looked like the world might be entering a recession, MIDiA asked consumers about how they expected to change their entertainment behaviours and spending if they found themselves facing financial pressures. Now, more than two years later, as the world faces a cost of living crisis, we asked almost exactly the same questions once again. Even though the already-present cost of living crisis is far more tangible to most consumers than a potential financial recession, broadly speaking, consumers are less concerned now than they were in 2019. Whether that is misplaced optimism is another thing entirely…

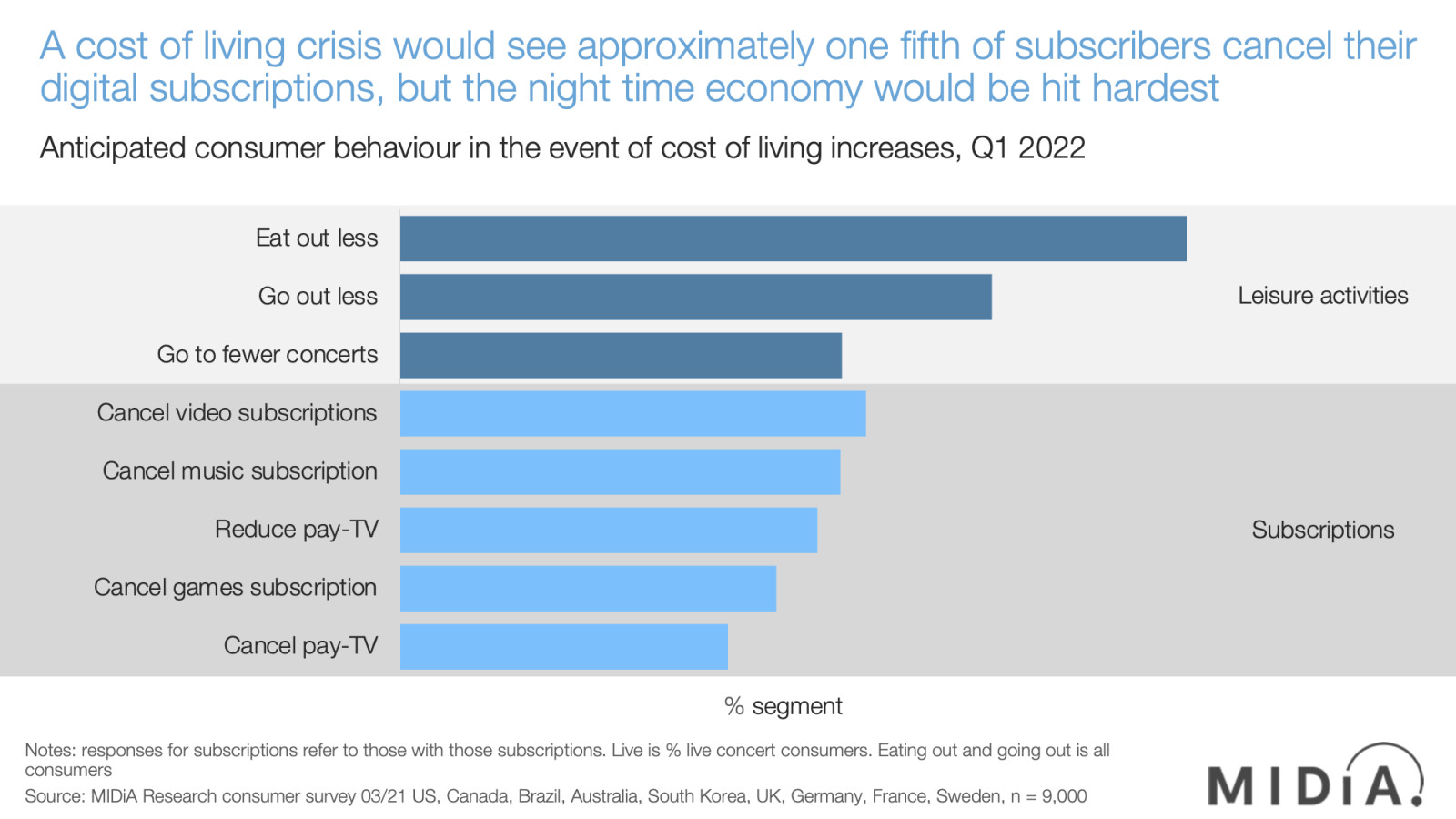

However, what is consistent between the 2019 and 2022 responses is the tendency for consumers to prefer options to do less of something rather than stop entirely. So, going out and eating out less both get significantly higher response rates than cancelling subscriptions. This makes sense: going out less does not mean stopping going out entirely, but cancelling a music or games subscription is an all-or-nothing decision.

Featured Report

Defining entertainment superfans Characteristics, categories, and commercial impact

Superfans represent a highly valuable yet consistently underleveraged audience segment for the entertainment industry. What drives this disconnect is the fact that – despite frequent anecdotal use of the term – a standardised, empirical definition remains absent, preventing companies from systematically identifying, nurturing, and monetising th...

Find out more…Video subscriptions are a bit different of course as the majority of subscribers have more than one video subscription. Cancelling one is similar to going out less: it is a do-less decision, not a do-nothing decision. Given the finite number of TV shows released each month that match an individual’s tastes, more consumers will likely become savvy switchers, dipping in and out of different video services to watch the shows they want, when they are available. While video services can try to counter this with annual subscriptions, these are a hard sell during a cost-of-living crisis. Far better to start thinking about user retention in a more fluid way, considering the share of a subscriber’s months you can retain during a calendar year rather than expecting all twelve of them.

This concept of what MIDiA terms dynamic retention is just one illustration of how the coming period of uncertainty is not just going to be about economic disruption, but a catalyst for business and technology innovation. Something that also applied to the pandemic, that accelerated the adoption of already emerging trends, such as remote working, video conferencing, and virtual concerts.

There is no doubt that life is going to get difficult for many consumers over the coming months, which in turn means that entertainment companies (as consumer centred businesses) are also going to feel the pinch. For some companies the focus will be to survive but for others it will be to thrive. One company’s challenge can be another’s opportunity. Recessions always leave scarring, with the process acting as something of a reset, clearing out the dead wood from the pre-recession economy and setting up the next gen companies that will define the post-recession economy.

In this coming attention recession, it will be the entertainment companies that are able to quickly and fluidly adapt their models, billing, pricing, programming, and user engagement strategies that will be best placed to retain, even win, audiences during the downturn. Truly effective monetisation may not come until later, but audience acquisition and retention start right now.

Join us on Thursday 26th of May at 4.30pm BST / 3.30pm CET / 11.30am EST / 8.30am PT to hear much more on these themes from MIDiA’s analysts. Sign up for free here.

The discussion around this post has not yet got started, be the first to add an opinion.