The 2 Spotify Charts You Need To See

Tuesday’s media scrum around Spotify’s financials illustrate that whatever ground Apple and Tidal may have made in recent months, Spotify clearly remains the poster child / bellwether for streaming. The stories oscillated between the broken nature of the underlying economics to how streaming is the future of the music business. Both are true. But a closer look at the numbers reveal some even more important findings.

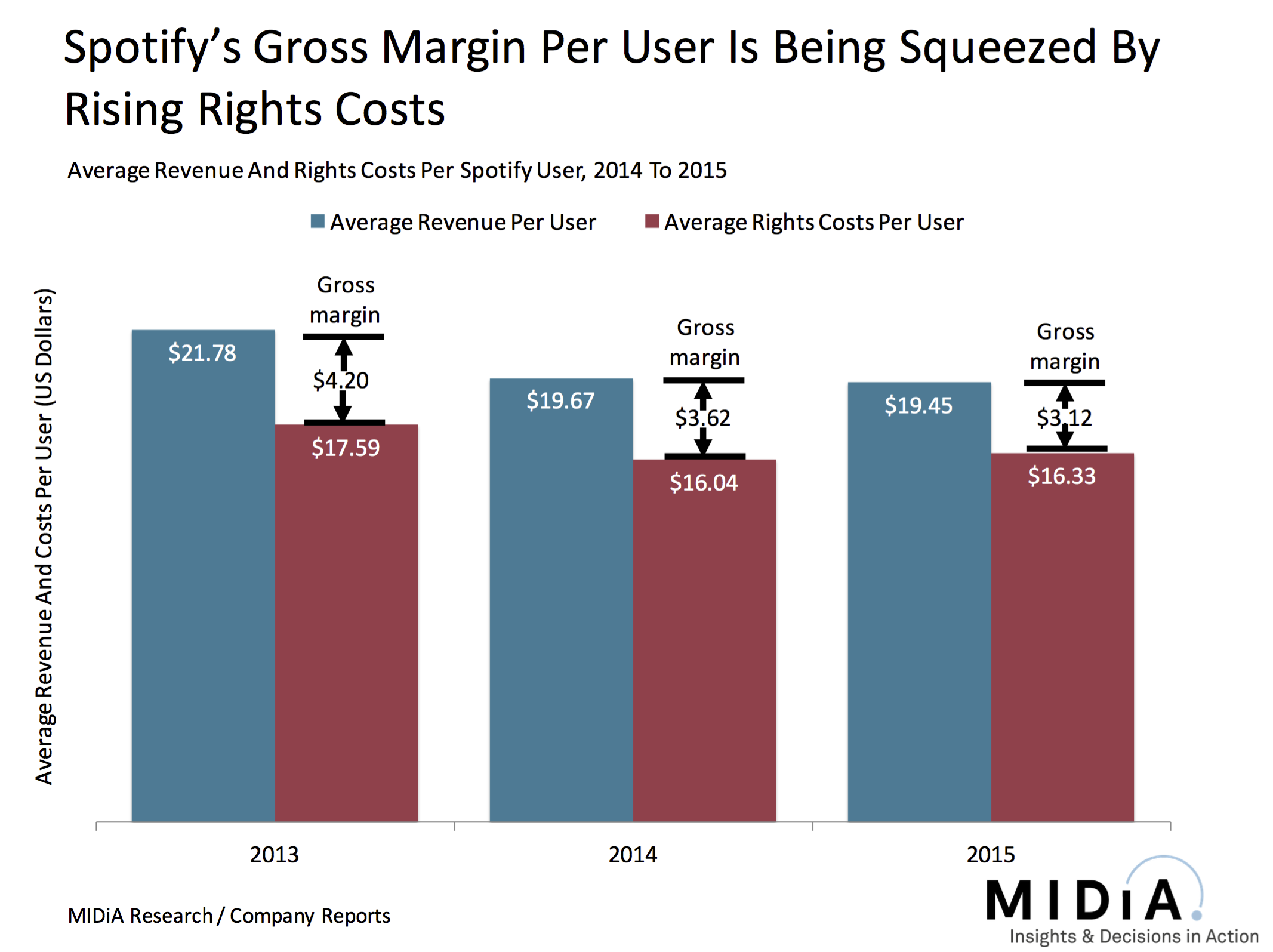

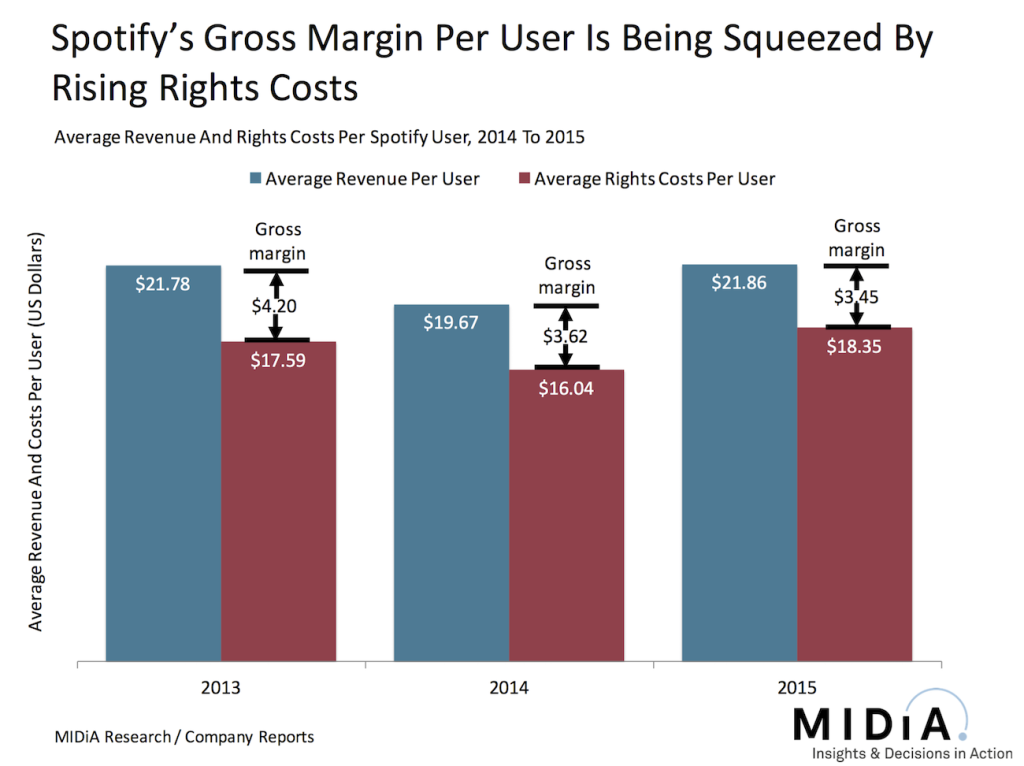

Rights costs are the Spotify’s Achilles Heel. Rights and associated costs accounted for 83% of Spotify’s 2015 revenue, up from 81% in 2014 and this resulted in a dramatic fall in Spotify’s gross margin per user: down from $4.20 in 2013 to $3.45 in 2015. This is particularly challenging for a model with already wafer thin margins. A number of factors underpin this decline:

- Discounted promotions: Promos such as the £0.99 for 3 months have supercharged Spotify’s growth for the last 18 months. But as labels only contribute part of the cost this means that Spotify loses more margin with every new promo user

- Advanced label payments: When Spotify strikes its licensing deals with labels it makes advanced payments and guarantees based on its expected growth. This means that for a growth stage company like Spotify, booked rights costs will always be higher than current booked revenue. This has obvious cash flow implications. Also, should Spotify’s growth slow and it miss those targets, it will still have to pay the monies guaranteed to labels, at which point the rights costs share will rise even further

- Publisher rates: Over the last couple of years, music publishers have been asserting their role in the digital music value chain, pushing for more equitable rates. The net result is that publishing rights costs can now range up to 15%, depending on the deal, up from a low of 10% in some cases. This upward momentum will continue, and as labels aren’t decreasing their rates, it means less margin for Spotify and other streaming services

As Spotify edges towards an IPO it is doing everything within its power to get its house in order. It is investing in video to show Wall Street it is attempting to lessen its dependence on the labels and it is improving is cost ratios virtually everywhere else in its business, other than rights. Between 2013 and 2015, the Average Cost Per User (ACPU) for Research and Development fell from $2.12 to $1.61 and for Marketing it fell from $3.23 to $2.77. But Rights ACPU grew from $17.59 to $18.35. In fact, even in terms of costs as a % of revenues, every single expense Spotify reported fell except Rights (and Depreciation and Amortization which increased slightly). It is rising rights costs that are keeping Spotify from commercial sustainability.

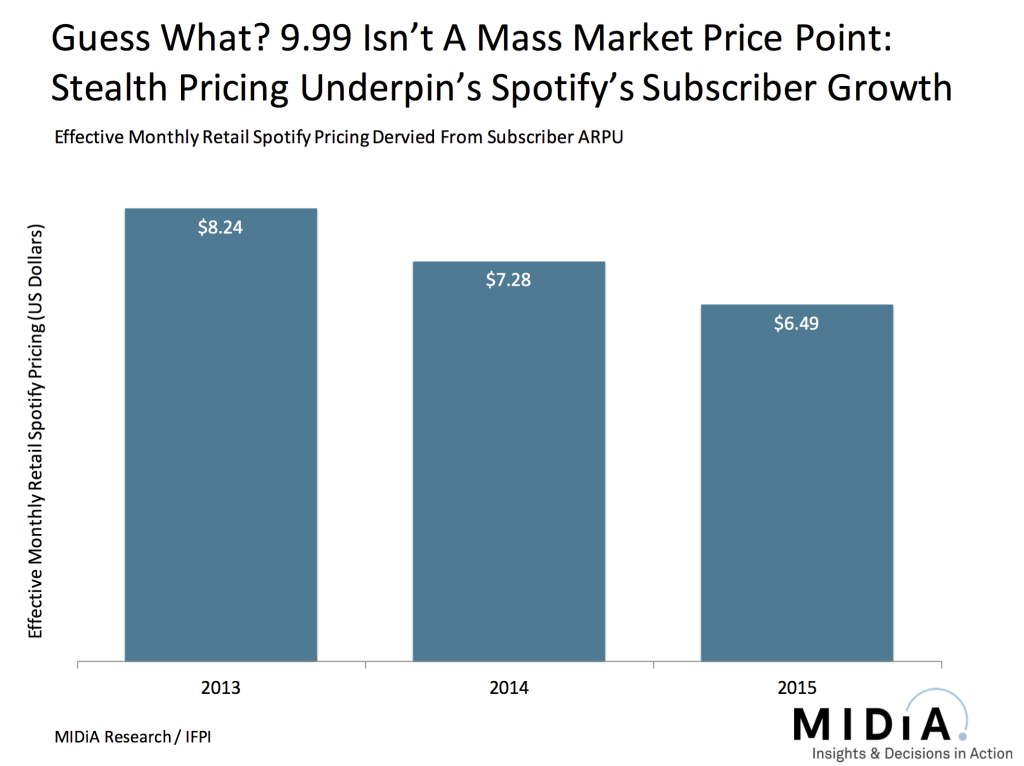

There is another really important part of Spotify’s growth story: subscriber ARPU has fallen from $79.09 in 2013 to $62.30 in 2015. This is a result of multiple efforts to drive growth, including the price promos, telco bundles and student discounts. All of which are viable tactics but the fact they are necessary to drive Spotify’s growth underscore a point I have been making for years: 9.99 is not a mass market price point, and Spotify’s subscribers agree: transforming the ARPU into an effective monthly retail price, Spotify’s average price point is now just $6.49, down from $8.24. It is about time that the music industry stopped pretending that this isn’t the reality of the market and instead starts pursuing proper pricing innovation rather than by stealth via discounting, which only serves to confuse consumers about long term value.

The music industry is in a transition phase. In such periods, the old and new worlds co-exist and collide. There are statistics that both sides of any argument can hold up in their defence, in fact they can often hold up the very same numbers to support opposite perspectives. Similarly, the comparisons you chose to benchmark with, can paint entirely different pictures. Such is the nature of transitions of human and business behaviour. For example, 83% of Spotify’s gross revenue going to rights is clearly too high and unsustainable, yet $0.00098 per song going to artists is clearly too low and unsustainable. Something needs to give, for both ends of the value chain.

Maybe if/when Spotify gets to 50 million subscribers it will feel it has enough clout to compel rights holders to rethink licensing economics. Perhaps it will take Spotify getting to a 100 million to make that happen. Perhaps it will never happen. But if it doesn’t, the economics of streaming will remain so broken that only companies with ulterior business objectives will remain viable players, enter stage left streaming’s Triple A: Apple, Amazon and Alphabet (Google). The labels need to ask themselves whether that is the streaming future they want…

There are comments on this post join the discussion.