Streaming’s growth plan in the connection economy

During Universal’s Capital Markets Day, Universal Music Group (UMG) chairman and CEO Lucian Grainge cited some “fundamental facts” of the music business (per Music Business Worldwide). These include the promise that “streaming will continue to propel many years of industry growth”. However, the past few months have provided plenty of indicators that music streaming is at a turning point. The latest is RIAA’s figures on the slowing growth in the US market, with 3.5 million paid subscribers added year-on-year compared to 6.6 million the previous year.

This follows Universal Music Group seeing free streaming revenue decline year-on-year in Q2 2024, whilst subscriber revenue remained unchanged. Furthermore, Spotify is also seeing slowing growth, adding 24 million users in H1 2024 compared to 52 million in the previous six months.

This comes at a time when consumers are increasingly saturated with entertainment options. MIDiA’s data shows that on average, consumers spend more time watching TV, using social media, or listening to audio (podcasts and audiobooks combined) than listening to music on streaming platforms.

This stands in contrast with another of Grainge’s facts –– that music is “the most enjoyed and influential form of media”. Of course, music often plays a key role in other forms of media, but the time consumers spend is increasingly competitive and difficult to monetise. If streaming is not competing in the attention economy as effectively as other forms of entertainment, then it needs to change to find new paths for growth. This is where Grainge’s final fact comes into play: “superfandom is a core component of music economics”.

The connection economy

Passive, background listening is part of what has driven music streaming’s growth over the past decade, but this has come at a cost. The convenience of music has pushed it into the background and passive consumption has not translated into deeper connections to artists.

When artists and their teams aspire to metrics of success that revolve around the number of streams and listeners they can generate, it puts the focus on a high velocity of output that fits into passive listening habits for largely isolated listeners. This is where AI-generated music has the potential to outperform human creators, so it is no surprise to see reports that AI-generated music has crept into Spotify playlists (per Slate), and at its worst, been fraudulently uploaded onto artist profiles (per Idioteq). As AI-generated music improves, how is the passive consumer going to tell the difference?

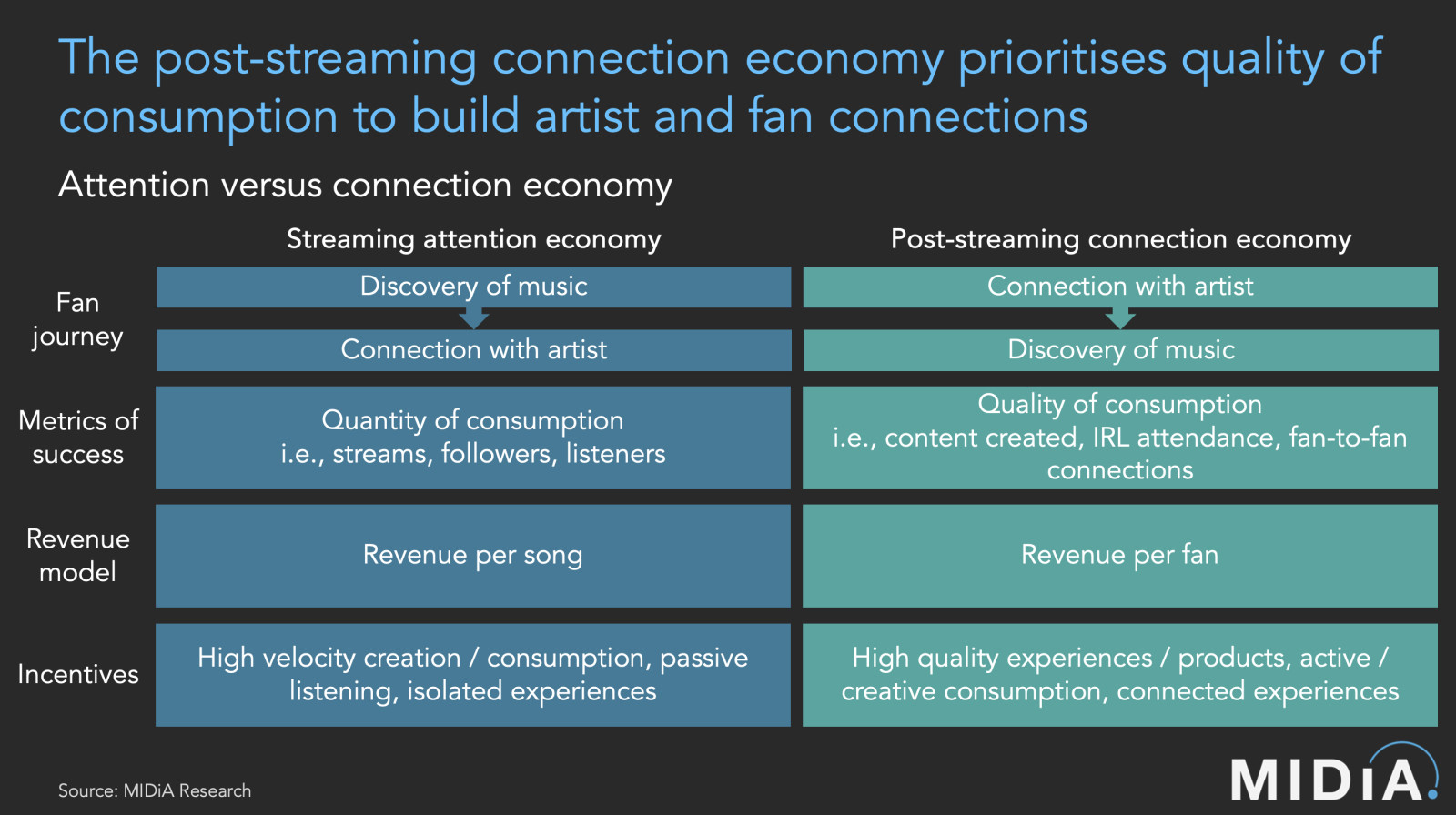

However, one area in which humans can do better than AI is building connections with fans –– that is exactly why we need to think of music in a connection economy rather than an attention economy. The next phase of growth for the music industry is about prioritising artist-to-fan connections and the quality of consumption. Consumers are running low on time to listen to any more music. This means that the music industry has the perfect opportunity to grow by offering quality experiences, products, and active engagement that connect artists with fans and fans with each other.

Featured Report

Music subscriber market shares Q4 2024 Full stream ahead

Streaming market metrics are bifurcating. Label streaming revenues were up in 2024, indicating a much anticipated slow down in revenue growth. Yet, at the same time, music subscriber growth was nearly double that of label streaming revenues for 2024. As is so often the case, there are many factors at play.

Find out more…From streaming services to fan platforms

Earlier this year, Spotify expressed plans to release a ‘superfan club’ tier providing access to merch and tickets for $18 a month, with UMG in the mix to launch a suite of fandom products. However, this hypothetical ‘super premium’ tier could be missing a key element –– a non-digital proposition.

When MIDiA asked consumers about their fan bases and scenes, the most agreed-with statement was about the importance of connecting in real life in addition to digitally. Fandom is about community. Rather than more digital products sapping their time and money, fans need places to gather and connect in order to build communities.

Business Insider reports that Gen Z is increasingly engaging with in-real-life social clubs (such as book clubs and running clubs) and Taylor Swift superfans recently stormed The Black Dog pub in London due to its connection to the singer. These kinds of behaviours are a testament to the demand for meaningful off-platform connections. The digital environment will always have a limited ability to capture the value of superfandom. Therefore, a superfan club tier needs to do more than offer products and services in an app: it needs to offer a clubhouse in the real world.

Superfan club model

The next phase of streaming in the connection economy should be akin to how football and sports clubs operate. Fans pay for membership simply for the opportunity to purchase tickets, with priority for higher value experiences further established by loyalty points.

The superfan club model can establish a real-world hub that only subscribers have access to, which then hosts live experiences (concerts, podcasts), products (merch, brand collabs), and cross-entertainment experiences with artists (gaming, video, live streaming), with the most valuable experiences only available to the most engaged fans.

This model of scarcity would be elevated with a real-world hub that can host the higher value, real-world experiences that connect fans to artists. However, it is unrealistic to expect this to solely be an artist club subscription model. Superfan clubs also need to be based around genres, scenes, and identities (e.g., third culture kids or the Latinx community), or even around labels themselves.

However it is designed or curated, the success of a superfan tier and streaming’s next growth phase will be defined by its ability to bring fans together in person. This means providing a space to support artists and scenes in the real world, allowing fans to connect in ways that they cannot in the digital world.

This is not a substitute for streaming growth. If anything, this is the model that creates the resonance needed for music to compete in a saturated entertainment landscape. In other words, music can’t keep growing in the attention economy without going all-in on the connection economy.

The discussion around this post has not yet got started, be the first to add an opinion.