Sports and the tech majors: A competitive partnership

We’re pleased to announce the launch of our Sports research practice. The Sports vertical provides comprehensive global analysis of the key players unleashing disruption in the business of sport broadcasting, streaming and e-sports alongside detailed and segmented analysis of consumer engagement by service. Overlaying this is our thought-leading trend and implications analysis for the business of sports video.

To celebrate this launch, we’ve made one of the first new reports in this lateral – Sports and the Tech Majors | A Competitive Partnership – available free to download.

The service is now available to MIDiA Research subscribers. Details of how subscribe to this service can be found below. Here follows a brief summary of the report.

Sports and the ech majors: A competitive partnership

With pay-TV in decline spurred by the cord cutting era, the right to air sports remains one of the exclusive offerings cable can provide to keep consumers subscribed and engaged. However, with the D-Day for sporting rights coming up in 2021 when all of the major rights will go back up for tender, and with the NFL saying it will choose engagement over price for the winner of its next rights bid, now is a critical time to reflect on who is being positioned to come out on top – and what this will mean for the future of sports viewing. To address this, MIDiA has released a new report on Sports and the Tech Majors – a competitive partnership (available to download free at the end of this article).

The tech majors have been making relatively low-key moves but are nevertheless building audiences and platform capabilities to support sports streaming. With the rise of streaming and the fall of cable, their underdog status in the sports viewing world seems set to be overturned.

Featured Report

Defining entertainment superfans Characteristics, categories, and commercial impact

Superfans represent a highly valuable yet consistently underleveraged audience segment for the entertainment industry. What drives this disconnect is the fact that – despite frequent anecdotal use of the term – a standardised, empirical definition remains absent, preventing companies from systematically identifying, nurturing, and monetising th...

Find out more…Facebook needs sports streaming, and live video, to re-engage increasingly unengaged audiences

Post the Cambridge Analytica scandal, data privacy has been forefront in the barriers tech majors face with consumer retention, and Facebook has been amongst the hardest hit. With a large portion of its user base having migrated off of its core platform altogether, at a detriment to revenue, it needs to seek new revenue strategies – particularly in emerging markets. This is why it’s Facebook Watch global rollout is of such significance. However, so far Facebook’s video engagement has failed to generate the uptake necessary to take consumer attention away from streaming heavyweights and sport-centric services alike.

Amazon subscribers over index for sports content compared to Netflix

Amazon is poised to make a run at acquiring sports premium domestic rights in 2021, displaying the three key drivers to meet the needs of rights holders: capital, tech and reach. With Amazon subscribers already over-indexing for sports consumption compared to the consumer average and other streaming heavyweight Netflix, it only makes sense that it is looking to double down on sports to expand its offerings to audiences.

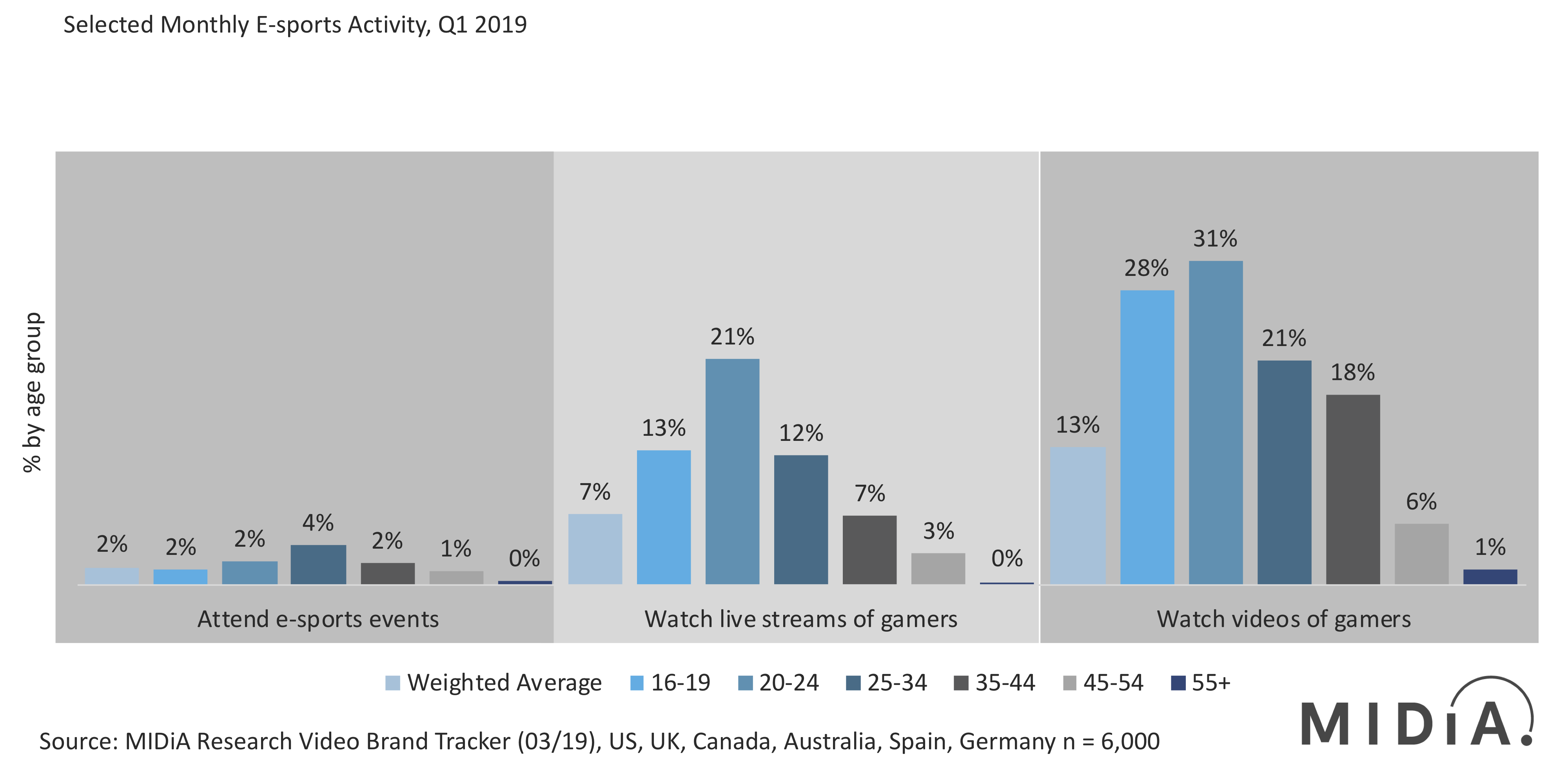

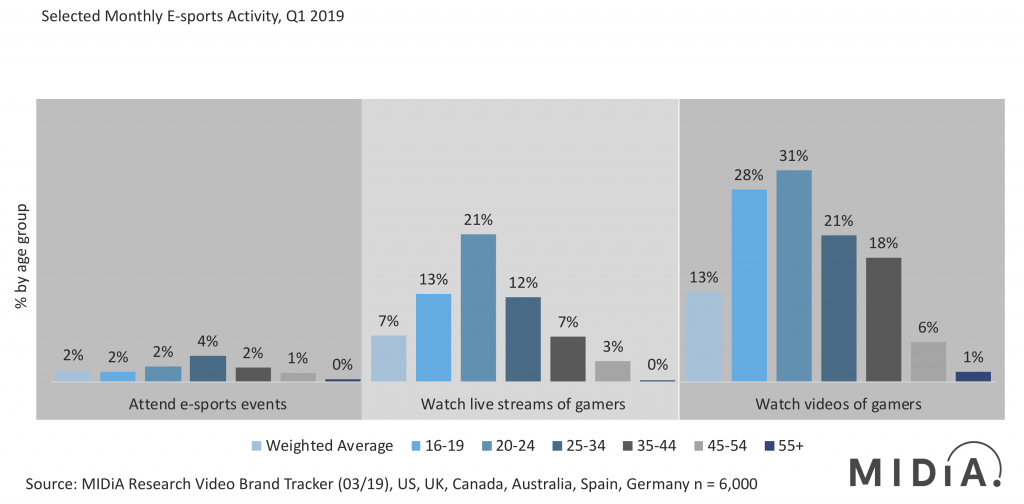

Although niche, esports is no longer super niche, and Amazon (as the owner of Twitch) is in prime position

E-sports viewing is growing in popularity, particularly among younger consumers. While the e-sports industry is still only at the start of its journey towards becoming a mainstream offering, as a streaming-only proposition it provides a weathervane for the way sports viewing is going to evolve as consumer demands shift over time. As the owner of Twitch, Amazon is primed to capitalise both on the growth of the esports industry and the viewership of streaming sports overall as the propositional distinctions fade between the two for increasingly mainstream audiences.

Is the timing right for an Apple sports acquisition?

Apple has long known that it would peak in hardware sales and has begun innovating and acquiring to lay the groundwork for a transition to a services-led business model. Restricted due to its stringent family-friendly requirements, Apple’s streaming video service needs an acquisition that could give it a boost and will best find this in the rated-for-all confines of sports. DAZN, as the most promising insurgent in the sports broadcast space, could be a target for acquisition by Apple, which could arm it to win big in the rights frenzy of 2021.

Disney’s hedge on streaming

Disney, too, needs to seek out new revenue sources and a competitive distinction for its upcoming video streaming services. To become the future go-to video destination, Disney would be best served by bundling ESPN+, Disney+ and Hulu; with these propositions, combined with the leveraging of its hefty brand equity, it could easily become a substitutive service for video consumption.

The discussion around this post has not yet got started, be the first to add an opinion.