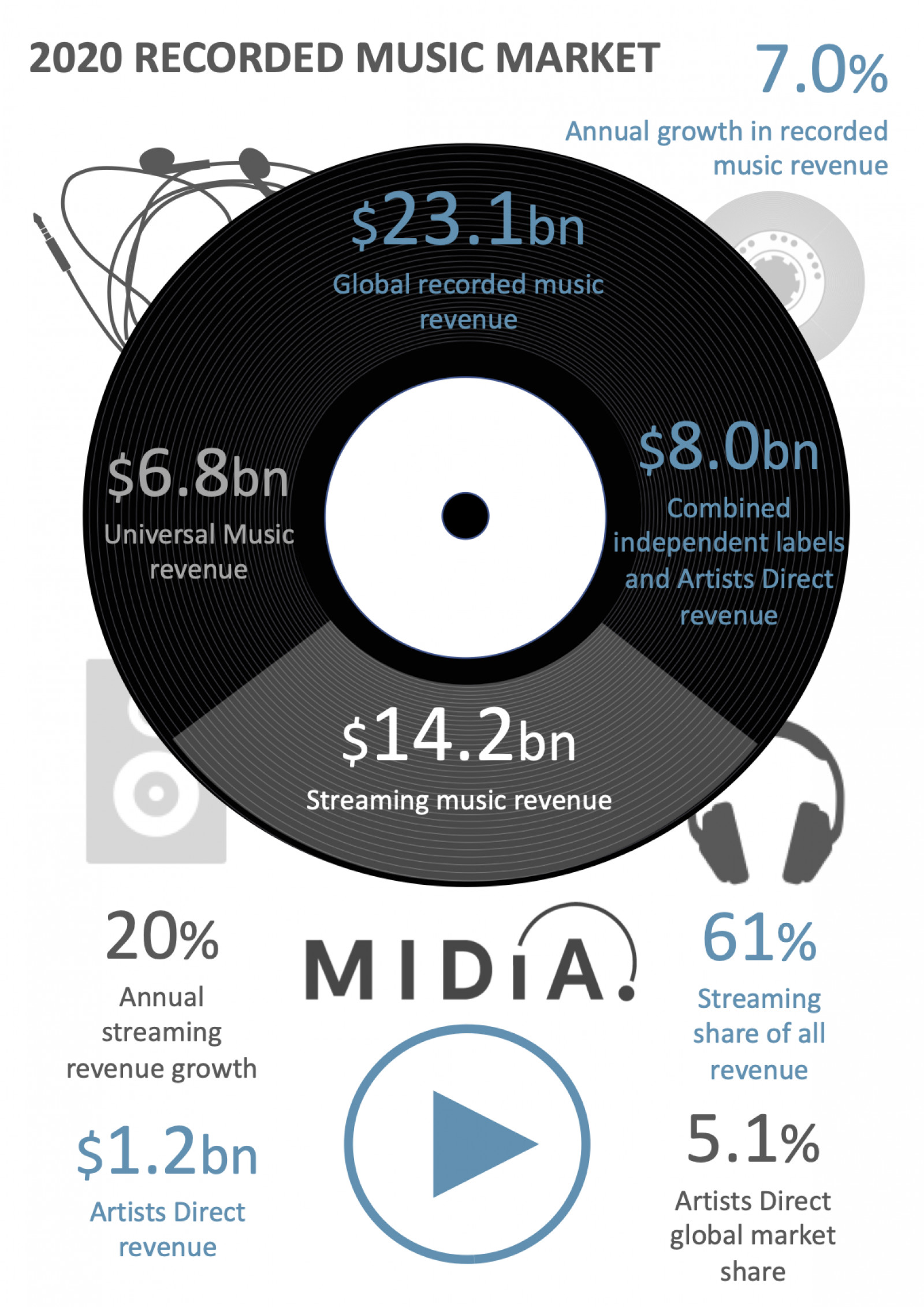

Recorded music revenues hit $23.1 billion in 2020, with artists direct the winners – again

The global pandemic caused widespread disruption to the music business, in particular decimating the live business and impacting publisher public performance royalties. Although the recorded music business experienced a dip in the earlier months of the pandemic, the remainder of the year saw industry revenue rebound, making it the sixth successive year of growth. Global recorded music revenues grew 7% in 2020 to reach $23.1 billion in record label trade revenue terms. The growth rate was significantly below the 11% increases seen in both 2018 and 2019, and the annual revenue increase was just $1.5 billion, compared to $2.1 billion in 2019. These metrics reflect the dampening effect of the pandemic. Global revenue was down 3% in Q2 2020 compared to one year earlier, but up to 15% growth in Q4 2020, suggesting a strong 2021 may lie ahead if that momentum continues.

Streaming growth driven by independents (labels and artists)

Streaming revenues reached $14.2 billion, up 19.6% from 2019, adding $2.3 billion, up from the $2.2 billion added in 2019. So, 2020 was another year of accelerating streaming growth and, given that Spotify’s revenue growth increased by less in 2020 than 2019, this indicates that it is for the first time meaningfully under-performing in the market, due to the rise of local players in emerging markets and strong growth for YouTube. For the first time, the major labels under-performed in the streaming market – but not all majors were affected in the same way. Sony Music Entertainment (SME) was entirely in line with streaming market growth, Universal Music Group (UMG) slightly below and Warner Music Group (WMG) markedly below. Independent labels and artists direct both strongly overperformed in the market, collectively growing at 27% and thus increasing their combined streaming market share to 31.5%.

Featured Report

Streaming strongholds High-potential markets for global music players

While the balance of music streamers continues to tip towards global south markets, their smaller ARPU rates limit their revenues. Meanwhile, periodic price-rises and the advent of supremium will reinforce the contributions from the West. This report highlights streaming strongholds, those markets which, underscored by high music engagement and his...

Find out more…Market share shifts

The major record labels saw collective market share fall from 66.5% in 2019 to 65.5% in 2020. While this shift is part of a long-term market dynamic, most of the dip was down to WMG reporting flat revenues for the year. SME gained share and UMG remained the largest record label with 29.2% market share. Independent labels also saw a 0.1 point drop in market share, but there was a very mixed story for independents. MIDiA fielded a global survey of independent labels and the data from that helped us track the contribution of independents. Independent labels as a whole grew by 6.7% (i.e. slightly below the market), but within the sector there was a massive diversity of growth rates, with smaller, newer indies tending to grow faster than the market (some dramatically so) and larger, more established indies growing below the market rate. There were also many independents (of all sizes) that saw revenues fall in 2020.

The unstoppable rise of independent artists

In 2019, artists direct were the stand-out success story, massively outperforming the market. History repeated itself in 2020 with artists direct growing by a staggering 34.1% to break the billion-dollar market for the first time, ending the year on $1.2 billion and in the process increasing market share by more than a whole point, up to 5.1% in 2020. The continued rise of independent artists reflects the clear and pronounced market shift towards this new, emerging generation of artists. With lots of private equity money now pouring into creator tools companies like Native Instruments, expect this space to heat up even further in 2021. The recorded music business is changing, and it is changing fast.

There is a comment on this post, add your opinion.