Radio strategies 2020 & beyond

This is part 2 of our blog on Radio’s future and focuses on strategies for radio networks. MIDiA’s full report “Radio Is Switched On Again / Strategies for 2020 and Beyond” is now available to subscribers. To discuss radio strategies in more detail with Mark Mulligan & Keith Jopling contact stephen@midiaresearch.com or press@midiaresearch.com.

Daniel Ek has stated again he wants radio’s money. In the recent Spotify Q1 results and surrounding PR, Ek rightly points out that Radio is bigger than the entire streaming business – it is. At $35 billion (PWC, 2019), commercial radio advertising is almost 50% larger than the global music streaming market at $23.8 billion, and over five times larger than the ad-funded music streaming market ($6.6 billion). Although radio revenues are largely flat, it remains something of a surprise just how resilient the radio advertising industry continues to be.

Radio is holding onto this revenue for dear life. So far, successfully. Radio network revenues in the USA stood at $14.6 billion in 2019 (BIA). While over-the-air advertising remained totally flat, digital income rose to $1 billion in 2019 (Radio Advertising Bureau and Borrell Associates), an increase of 25% - steeper growth than the on-demand audio streaming ad-funded market in the USA. Traditional radio networks have woken up to digital and are chasing down revenues more effectively than the streaming services. Consider that the biggest ad-supported streaming player, Pandora, posted $1.2 billion in advertising revenues for 2019 - an increase of 10%. Meanwhile Spotify’s ad revenue also grew by 10% in 2019 to €136 million.

But wait, isn’t radio yesterday’s music consumption model? If that is the case, why aren’t listeners, listening hours and revenues falling off a steep cliff? Perhaps it is, but the current measurement systems, media buying relationships and audio ad networks are propping up the business like very old rusty stanchions.

One thing radio networks have bought themselves is time. Yes, the recent pandemic (and the period leading up to it) have seen radio networks make mass layoffs in the USA, and the figures there have been hit by the pandemic impact on the commute. But elsewhere, radio has seen a boost, as I wrote about in part 1 of this blog post here.

Radio has no choice but to hang onto and indeed, build on, its advertising revenue income. Radio is not a subscription business (the obvious exception being SiriusXM). Even the new radio service launched by Sonos will be ad funded. This is important; the hard focus on a primary core business model is key to radio’s success, and is why Spotify has found it tougher than it first imagined winning revenues from radio (it has been too busy driving the success of its subscription model).

New strategy hot buttons for radio

Featured Report

Music catalogue market 2.0 Bringing yesterday’s hits into the business of tomorrow

The music catalogue acquisition market bounced back from a slightly cooled 2023 with a new fever in 2024. What is being bought is changing, however, as investors look to diversify their portfolios and uncover new growth pockets in an increasingly crowded market.

Find out more…While Spotify’s podcast bet is that over time, all radio consumption moves from broadcast to on-demand, radio knows this too – the end game for both is digital platform consumption – whether programming is listened to live or on-demand. The radio industry’s priorities have been to hold onto revenues and audiences while migrating content to digital platforms.

From 2020 those priorities must change to be more forward looking and progressive. Radio networks need to develop new business models and revenue sources faster, a strategy that requires first and foremost, having brands with meaning to consumers across platforms.

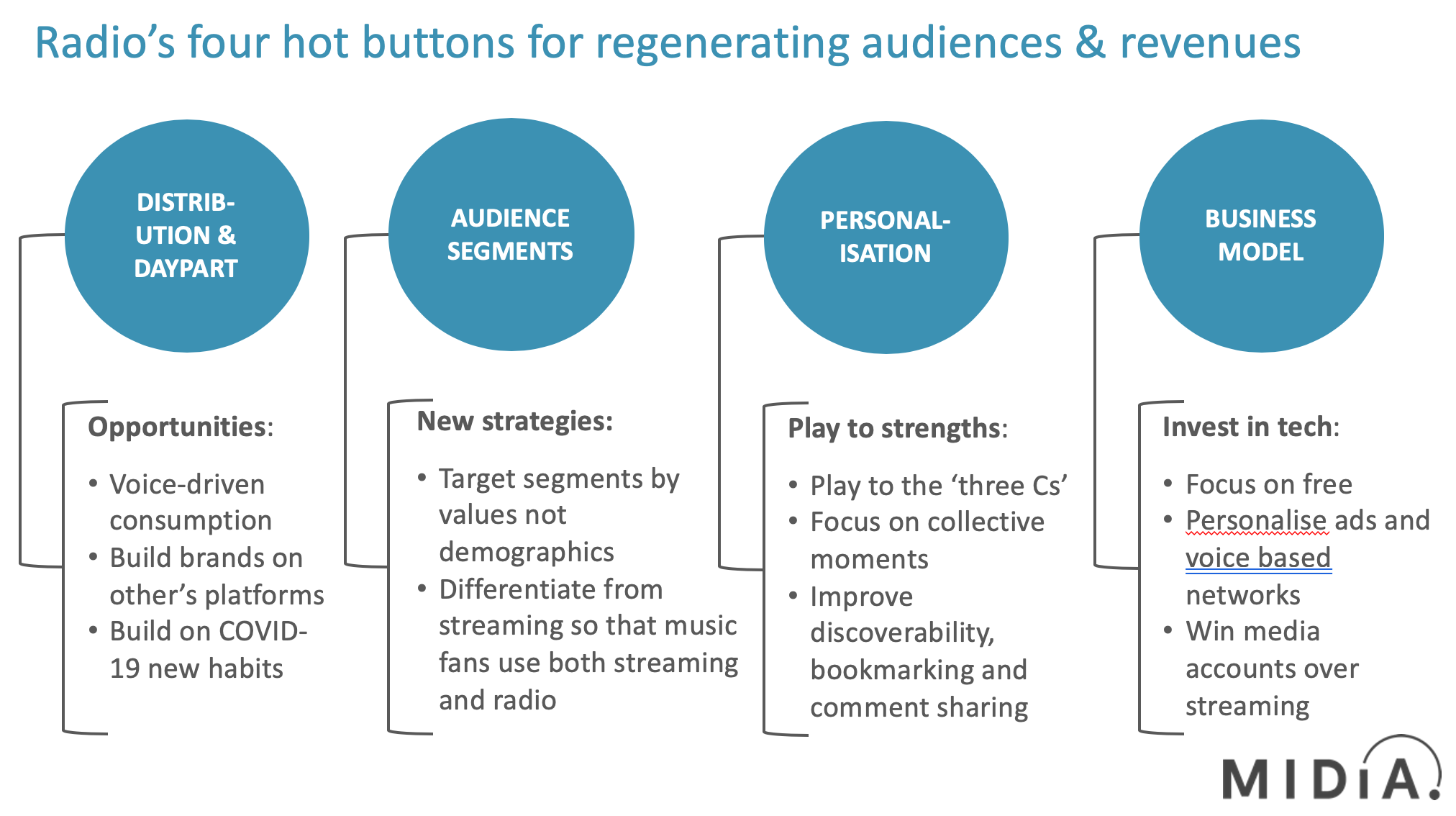

For radio to thrive in the streaming era, radio networks need to focus on differentiation in each of the key areas in which they compete: distribution/daypart, audience segments, content personalisation and business model. We are calling these ‘hot buttons’ to help the idea of radio networks applying a stronger focus to their audience growth strategies.

Audience segments – serving listeners with different values in a market overlapping with streaming

One of the most intriguing challenges for radio brands is the focus on audience segments not well-served by streaming but more futureproofed than the current (older) demographic profiles being targeted. Up until now, radio has commanded a broad audience, but also a dedicated audience, a proportion of which has yet to convert to music streaming. From here, radio network brands must differentiate from streaming and target their own audiences confidently and with a braver instinct – led by music passion and expertise and supported by data and insights.

Radio networks usually focus on audience personas defined by demographic. In the UK, Magic’s laser focus on ‘40+ women’ is commendable and suitably narrow for the station to own (although it does share the segment with Heart and BBC R2). Contrast this with Magic owner Bauer’s recently launched modern classical brand Scala, who’s target group is an audience of ‘cultural explorers’ more akin to The Economist’s appeal to ‘the globally curious’.

Indeed, the streaming music landscape has gone so broadly mass-market that to compete, radio networks must think more along the lines of sentiment (what old school marketers called psychographics). Radio can focus on locality, values, genre interest and attitude in a way that cuts across multi-generational demographics – the way to grow audiences not just hold on to older listeners. Consider music fans who crave a vinyl or editorial experience much deeper than offered by streaming services – a broad demographic including those in their early 20’s who are not excluded from the notion of nostalgia.

In our ‘Radio Is Switched On Again: Strategies for 2020 and Beyond’, we explore all four hot buttons in more depth in the context of wider impacts on the radio sector.

The discussion around this post has not yet got started, be the first to add an opinion.