Nintendo’s earnings highlight Mario's unfaltering popularity, despite the Switch running out of steam

Nintendo released its nine-month earnings ending December 31, 2024. Its revenues were $6.1 billion, dropping 31.4% year on year, with:

- Nintendo’s dedicated platforms (hardware, software, subscriptions, and accessories) accounting for 94.0%

- Mobile and IP-related income accounting for 5.4%

- Other revenues, including merch at official stores, taking just 0.6%

In terms of units sold:

- Nintendo sold 9.5 million units of hardware (down 30.4% year-on-year)

- It sold 123.8 million units of software (down 24.4% year on year), against a tough 2023 comparison with a new 2D Mario (strengthened by the Mario movie) a new 3D open-world Zelda (Tears of the Kingdom)

- The Switch has now sold over 150 million units since its launch in 2017

Mario (franchise) games dominated Switch software sales

Remarkably, 12 first-party Nintendo games sold over one million copies in the nine months:

Of these 12 games:

- 67% (eight games) have Mario and / or Luigi on the cover art, selling a total of over 22 million units – likely amounting to revenues of over a billion dollars

- 58% (seven games) are in a direct Mario franchise i.e. Super Mario, Mario Kart, Mario Party, and Luigi’s Mansion but not Super Smash Bros.

- Half (six games) have the word “Mario” directly in the title

- Two are 2024 remakes of older Mario franchise titles, one from the GameCube era (2004’s Paper Mario: The Thousand-Year Door) and another from the 3DS era (2013’s Luigi's Mansion: Dark Moon)

Other notable insights:

- Of the million-unit-plus sellers, 2024 launches accounted for half of the units sold (15.78 million)

- The Switch’s launch year, 2017, accounted for the second most, at 20% (6.47 million), thanks to Mario Kart 8 Deluxe and Super Mario Odyssey

- This again points to the long tail of Mario games

As we pointed out in our Switch 2 cheat sheet, we believe Nintendo has been sitting on a goldmine of Mario IP.

To nudge fans to upgrade to the Switch 2, Nintendo will open the software floodgates during the launch window with a new 3D Mario, Mario Kart – both likely Switch 2 exclusives – and other heavy hitters, too.

Zelda did not quite hit those some highs

Zelda: Echoes of Wisdom sold fewer than 4 million copies in the three-month period after launch, by far the fewest of any original Switch Zelda title and fewer than the Link’s Awakening remake in a similar period (4.19 million to a smaller install base) according to Nintendo's financial results from 2020.

A few reasons for this:

Featured Report

Podcasts as a key information source Implications for media companies

Podcasts have begun to rival traditional media as a key source of news and political information for podcast listeners, especially among millennials and Gen Z. To stay relevant, traditional media must...

Find out more…- Echoes of the Wisdom is a top-down Zelda game with more of a focus on puzzles than combat (unlike the 3D open-world Breath of the Wild and Tears of the Kingdom)

- It also launched at the end of the Switch’s lifecycle, with many core gamers knowing this

- Positive media reviews influence new-game purchases for 16% of console gamers. Echoes of Wisdom has a critic score of 85 on review aggregate site Metacritic, versus 97 for Breath of the Wild and 96 for Tears of the Kingdom

Speaking of Tears of the Kingdom, it was notably absent from the one-million-selling list for the nine months, suggesting it won’t have a long tail anywhere near that of its predecessor, Breath of the Wild. Again, this is likely due to the Switch approaching the end of its product lifecycle but also diminishing returns.

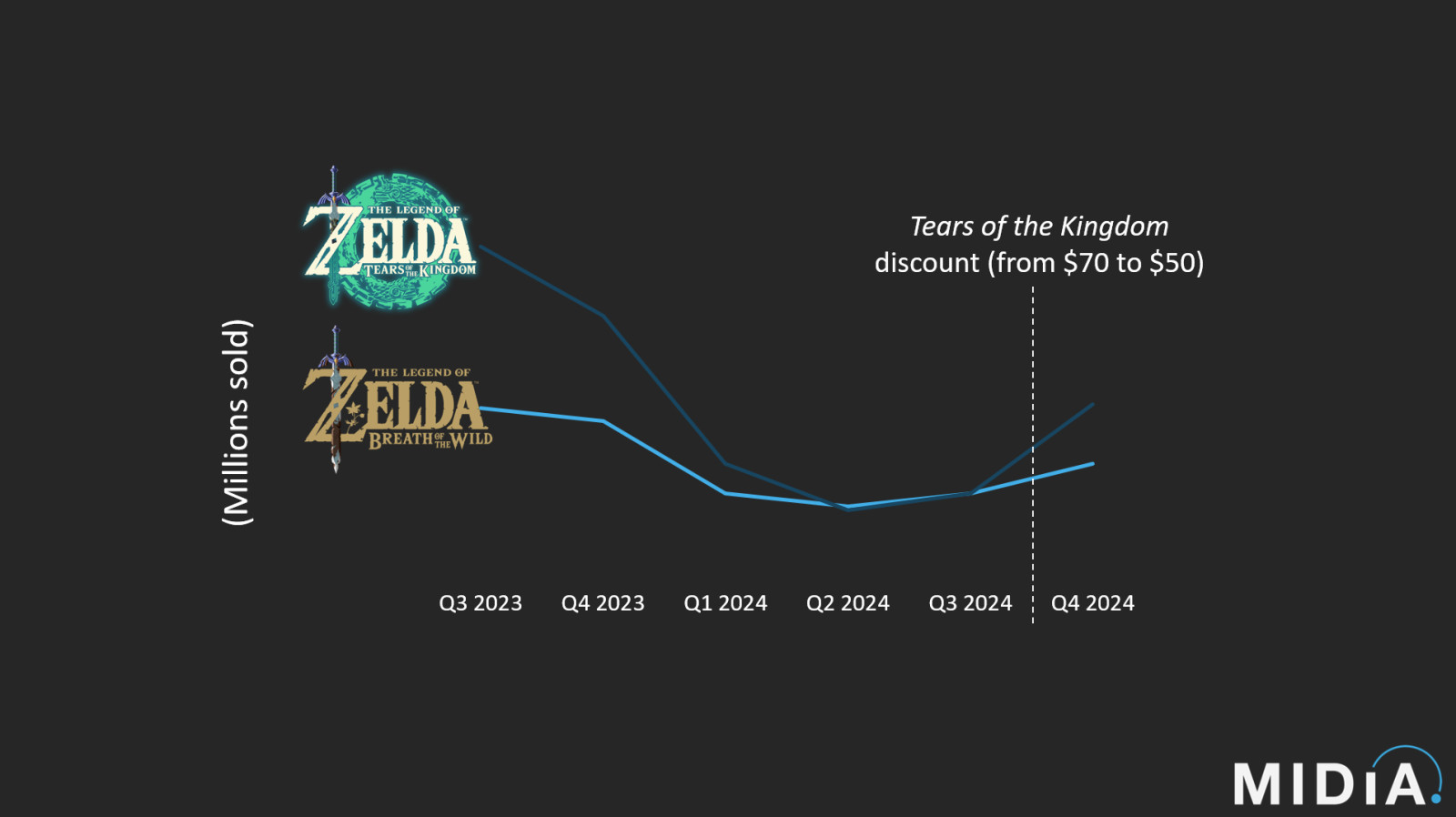

Breath of the Wild hit headlines last year for selling slightly more copies than Tears of the Kingdom in Q2 2024 (per Nintendo Life). However, Nintendo’s new earnings show that trend reversing.

The two titles matched each other’s sales in Q3 2024, while Tears of the Kingdom outsold Breath of the Wild by roughly 180K copies in Q4. This is likely due to a TotK holiday price reduction from $70 to $50 in November 2024 (on the Nintendo store and retail stores). As reported by IGN, it even dropped to $30 in Walmart.

Nintendo’s hardware decline does not signal doom and gloom

Nintendo’s hardware and software earnings were slower than it expected across the nine-month period. Due to this, and a downward forecasted exchange rate revision (150 yen from 140 yen per $1), Nintendo now expects FY25 net profit of 270 billion yen, lower than its older outlook of 300 billion yen.

Nintendo also lowered its FY25 software units forecast from 160 million to 150 million, and hardware from 12.5 million to 11 million.

Nintendo does not plan to discontinue the Switch and will continue supporting it, as revealed in a February 2025 interview Japanese interview with Sankei.

We expected this. As we put it in our Switch 2 cheat sheet, “The original Switch will keep selling as a budget entry point for Nintendo-hungry gamers.”

The slowdown of Switch sales is nothing to worry about for Nintendo – it simply signals that the original Switch’s product lifecycle has ended slightly quicker than Nintendo originally thought. Luckily for Nintendo, the Switch 2 is right around the corner.

As shown in the free version of our global games forecasts 2025-2031, The Switch 2 launch will help console hardware return to growth in 2025 (8.4%):

Get your free report here, with deeper insights into what to expect from the games market’s hardware, software, and subscription revenue.

What comes next for Nintendo?

Naturally, Nintendo’s teams are heads-down focusing on the Switch 2 launch, with a software marketing push on April 2, 2025 (Nintendo Direct) and an IRL Switch 2 Experience series of events across the world soon after.

Speaking of IRL, Nintendo is officially opening its Super Nintendo World theme park in Florida’s Universal Orlando Resort in May, continuing its cross-entertainment vision.

Nintendo also has a suite of upcoming games for the original Switch, including Xenoblade Chronicles X: Definitive Edition (March 20), Pokémon Legends: Z-A, and Metroid Prime 4: Beyond.

Nintendo is the Disney of games. But as always, its cross-entertainment strategy revolves around its core business: its platform, its family-friendly games, and its best-in-class IP.

How will the Switch 2 impact the wider games market? Download this free report to find out!

The discussion around this post has not yet got started, be the first to add an opinion.