Music subscriber market shares Q2 2021

MIDiA’s annual music subscriber market shares report is now available here (see below for more details of the report). Here are some of the key findings.

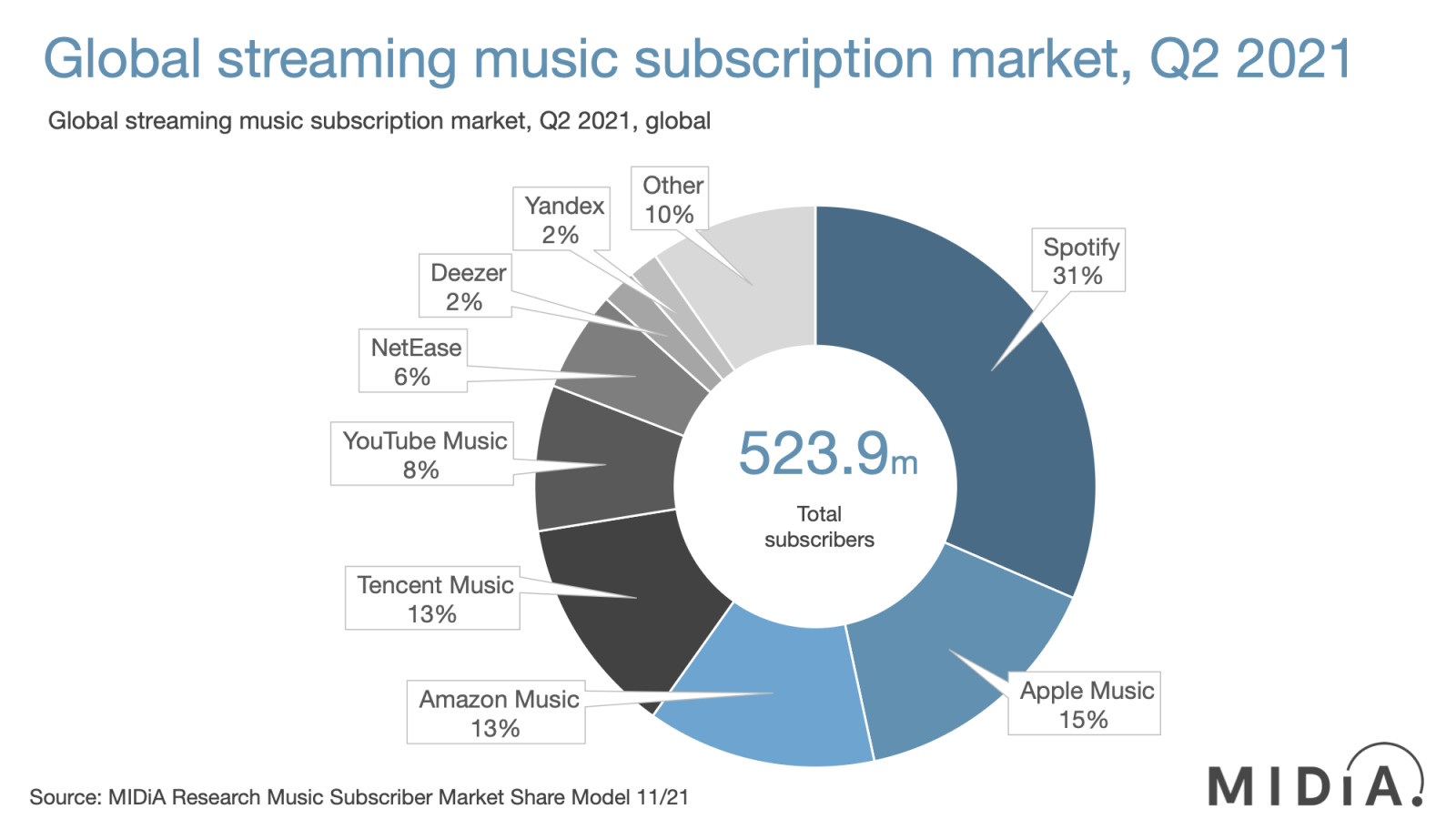

The global base of music subscribers continues to grow strongly with 523.9 million music subscribers at the end of Q2 2021, which was up by 109.5 million (26.4%) from one year earlier. Crucially, this was faster growth than the prior year. There is a difference between revenue and subscribers – with ARPU deflators, such as the rise of multi-user plans and the growth of lower-spending emerging markets – but growth in monetised users represents the foundation stone of the digital service provider (DSP) streaming market. So, accelerating growth at this relatively late stage of the streaming market’s evolution is clearly positive.

Spotify remains the DSP with the highest market share (31%), but this was down from 33% in Q2 2020 and 34% in Q2 2019. With Apple Music being a distant second with 15% market share, and Spotify adding more subscribers in the 12 months leading up to Q2 2021 than any other single DSP, there is no risk of Spotify losing its leading position anytime soon – but the erosion of its share is steady and persistent. Amazon Music once again out-performed Spotify in terms of growth (25% compared to 20%), but the standout success story among Western DSPs was YouTube Music, for the second successive year. Google was once the laggard of the space, but the launch of YouTube Music has transformed its fortunes, growing by more than 50% in the 12 months leading up to Q2 2021. YouTube Music was the only Western DSP to increase global market share during this the period. YouTube Music particularly resonates among Gen Z and younger Millennials, which should have alarm bells ringing for Spotify, as their core base of Millennial subscribers from the 2010s in the West are now beginning to age.

But the biggest subscriber growth came from emerging markets. Between them, Tencent Music Entertainment (TME) and NetEase Cloud Music added 35.7 million subscribers in the 12 months leading up to Q2 2021. Together, they accounted for 18% of global market shares, despite being available only in China. Yandex, in Russia, was the other big gainer, doubling its subscriber base to reach 2% of global market share.

Combined, Yandex, TME and NetEase account for 20% of subscriber market share, but they drive 37% of all subscriber growth in the 12 months leading up to Q2 2021.

The strong growth in subscribers holds an extra meaning going into 2022. The surge in non-DSP streaming in 2021 means that the streaming market is no longer dependent on the revenue contribution of maturing Western subscriber markets (nor indeed ARPU-diluting emerging markets). With non-DSP streaming revenue looking set to have contributed between a quarter and a third of streaming revenue increase in 2021, streaming revenues look set for strong growth, even if subscriber growth lessens. That is what you call a diversified market.

A little more detail on the subscriber market shares report:

Featured Report

Music streaming consumer profile Q4 2024 Stabilisation and fandom slowdown

Consumer music behaviours are both stabilising and showing signs of coming change. Change that could be challenging for all music business stakeholders, especially with regards to fandom monetisation....

Find out more…

The report has 23 pages and 13 figures featuring country level subscriber numbers, revenues and demographics by DSP. The accompanying data set has quarterly subscriber numbers and annual revenue figures from Q4 2015 to Q2 2016 by DSP by country, with 33 markets and 27 DSPs. The report and dataset is available to MIDiA subscribers hereand also available for individual purchase via the same link.

Email stephen@midiaresearch.com for more details.

The discussion around this post has not yet got started, be the first to add an opinion.