Music publishing forecasts: strong growth and more to come

Following hot on the heels of our future of songwriting report, MIDiA is pleased to announce the release of our latest music publishing forecasts report. Here are some highlights.

Thus far, the 2020s have been a good decade for the music publishing industry. Revenues have continued to grow, streaming royalty rates have improved and institutional investment has flowed into publishing catalogues, even after rising interest rates. Covid lockdowns were a speed bump, decimating the live and background components of performance royalties, but the effect was temporary, with live’s post-Covid rebound being particularly strong.

Throughout the earlier stages of the streaming era, publishing was something of a back seat passenger, with the agenda set by labels and DSPs. A state of affairs reflected in the comparably small share of revenues allocated to publishing royalties. But, as the market matured, publishing rights found their voice. Favourable rates board rulings in the US, active lobbying efforts, and increasingly effective licensing strategy from CMOs and publishers have had the combined effect of increasing publishing’s share of the streaming economy –– with further improvement likely. The dispute between publishers and Spotify over its interpretation of the bundling provisions in the US are an important and contentious issue. However, the response from the publishing industry reflects its newfound confidence.

Publishers have also proven able to carve out a favourable space in the new, emerging sections of the streaming economy. The ‘non-DSP’ deals with platforms like TikTok, Meta, and Snap provide for a higher share of royalties flowing tor publishers than for standard DSP deals. In the 2010s, publishers, rightly or wrongly, acquired a reputation for slowing innovation. Now they are spearheading it.

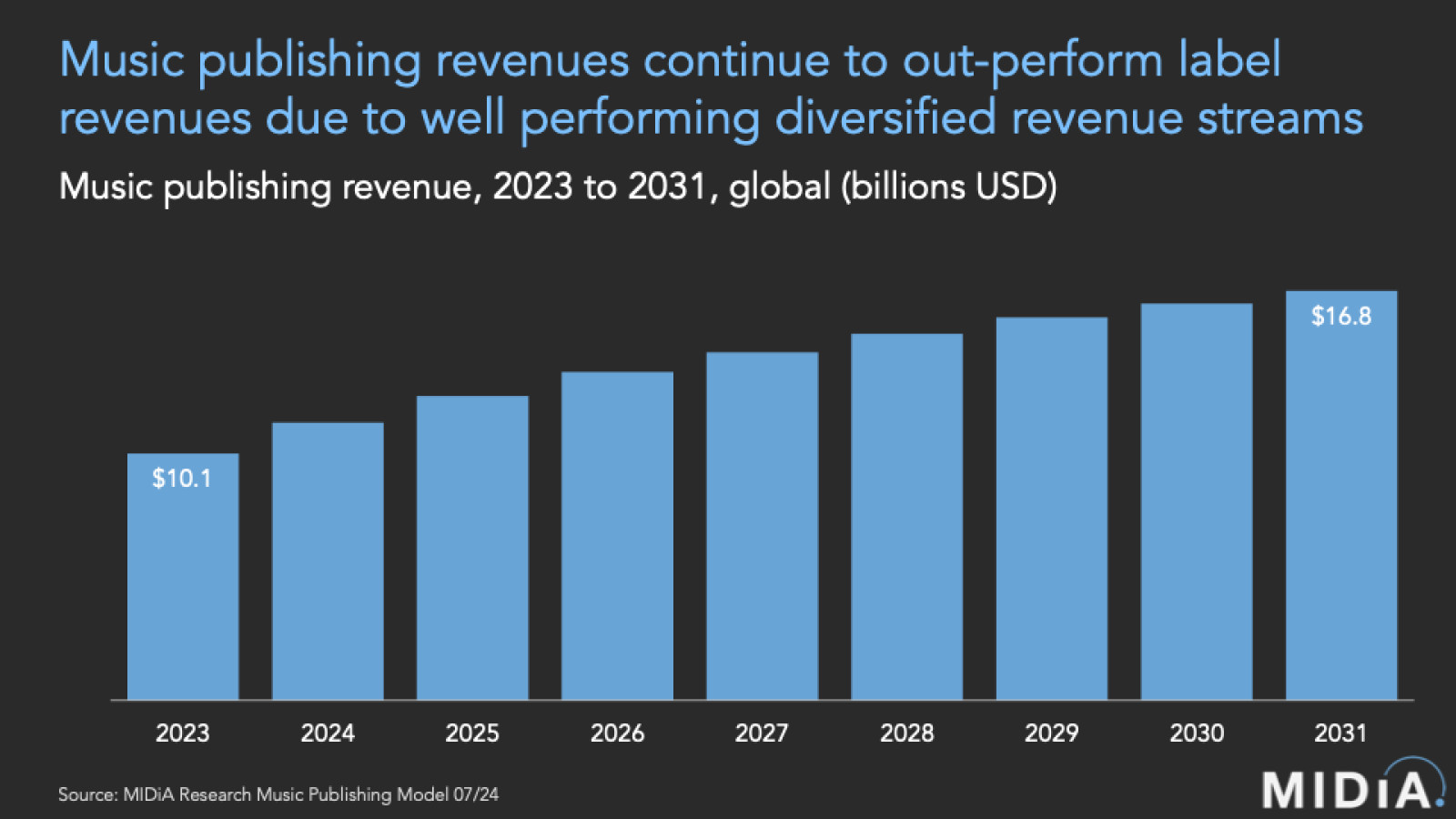

Global music publishing revenues grew strongly again in 2023, up 12.0% to reach $10.1 billion. This is compared to record label trade revenue growth of 9.1% in 2023. Music publishing continues to outgrow label revenues. Warner Chappell had the strongest growing revenues in 2023, up 16.6% on 2022 to reach $1.1 billion, while Sony Music Publishing remained the largest publisher, though Universal Music Group made up ground, growing 10.5% to reach $2.1 billion. Independents meanwhile grew 12.7%.

Featured Report

Music subscriber market shares Q4 2024 Full stream ahead

Streaming market metrics are bifurcating. Label streaming revenues were up in 2024, indicating a much anticipated slow down in revenue growth. Yet, at the same time, music subscriber growth was nearly double that of label streaming revenues for 2024. As is so often the case, there are many factors at play.

Find out more…The ability of music publishing to grow faster than recorded music is in part due to publishers having different levers to pull than the labels. For example, the surge in live revenues post-Covid and non-DSP streaming (where publishing typically enjoys a significantly larger share of royalties than DSP streaming. Meanwhile, the continued rise of subscription video on demand (SVOD) is providing much needed impetus to TV / video performance royalties. These factors will help fuel future market growth.

Not everything will grow unchecked. Public performance royalties will be hit by changing lifestyles (continued demise of the high street, more home-based working, etc.); live music revenues will peak due to market saturation and ticket price inflation; and traditional mechanical royalties will fall when the physical music boom ends.

But these factors will be more than offset by the growth sectors, most important of which will be streaming. The music publishing business is now a streaming-first industry, with streaming revenues having crossed the 50% mark in 2022, and they will close to double between 2023 and 2031. This strong streaming growth will help total music publishing revenues reach $16.8 billion by 2031, an increase of nearly two thirds on 2023 levels.

This is just a small preview of what is in the final report, which includes revenues split by streaming; other digital; total digital; performance; sync; other; as well as country level forecasts for 39 markets; regional splits for revenue categories and publisher market shares. MIDiA clients can access the full report and dataset here. To find out more about how to become a MIDiA client and to access this report, email businessdevelopment@midiaresearch.com

The discussion around this post has not yet got started, be the first to add an opinion.