Music creator economy: recalibration

The music creator economy has been long in the making but was thrust into the wider music industry’s limelight with the Covid lockdowns triggering a surge in new creators. As with any bubble, many creator tools companies saw their ensuing surge flatten post-lockdown. The market is now settled into a steadier, organic growth pattern, but this lockdown cohort of creators is transforming the music creator economy. The effects, however, will be felt much more widely. Their new needs, expectations, and aspirations will be seen not only in the way they make music but also in how they navigate their careers. The music creator economy is one of the driving forces of the Bifurcation process turning one music industry into two.

This rise of this new generation of creators coincided with structural fissures beginning to manifest in the traditional streaming economy. Streaming has been through a number of cycles with creators: 1) distrust; 2) enthusiasm; 3) royalty dissatisfaction; and now 4) apathy. Our latest music creator report, which presents data from MIDiA’s latest global music creator survey, shows that progressively more creators are starting with lower expectations for streaming. Their royalty expectations are already so low that this is no longer a pain point for them. Instead, they are becoming critical of streaming’s ability to further their careers, focussing on the medium’s closed door between them and their fans. Today’s creators want platforms where they can build high value, smaller fanbases, rather than low value, large-but-anonymous audiences.

Here are a few highlights from the report:

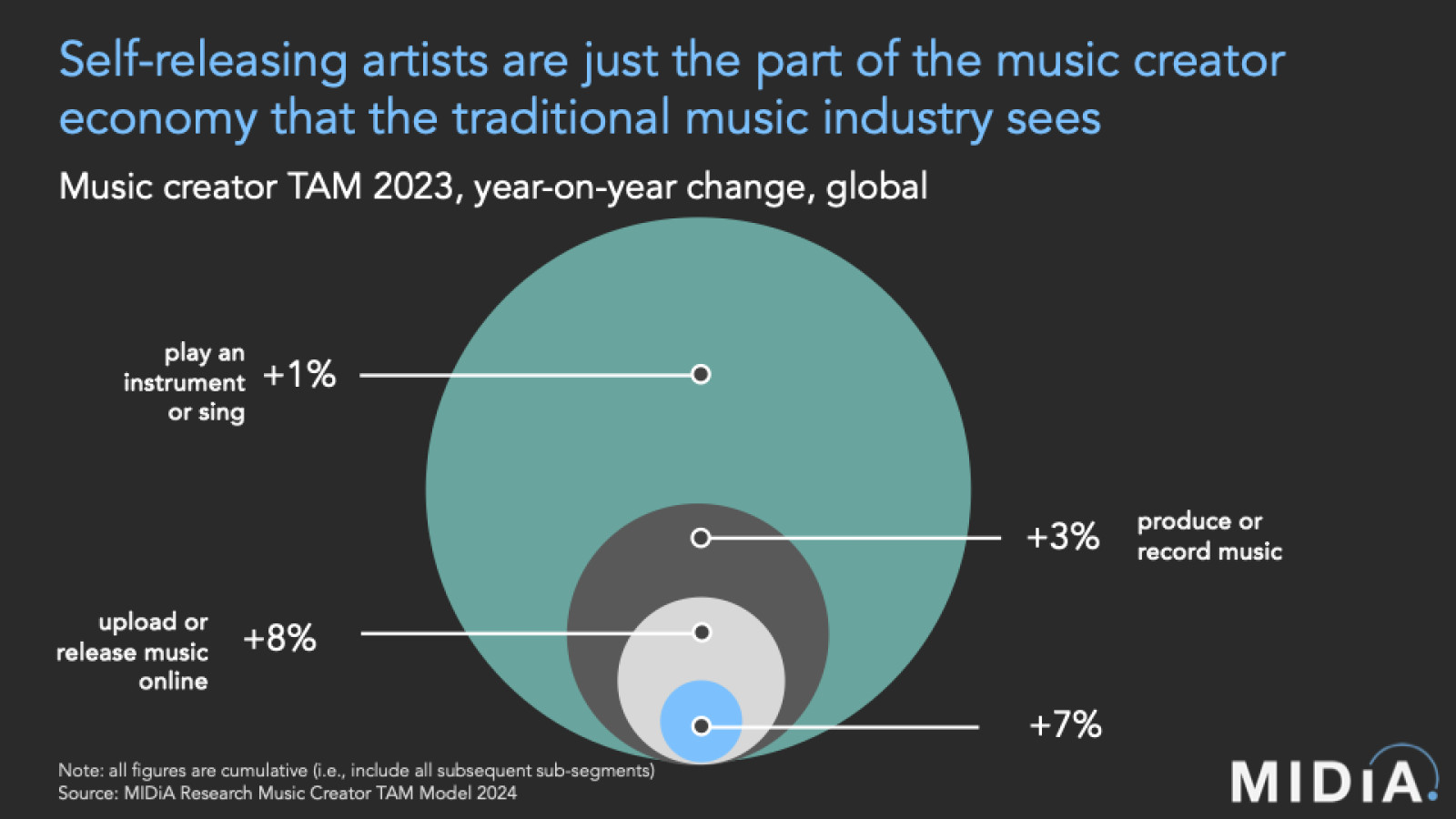

Tip of the iceberg: The traditional music business only sees the smallest segment of the music creator economy – the around seven million Artists Direct that self-release onto streaming via distributors like DistroKid, TuneCore, CD Baby, and Amuse. However, this segment is the smallest component of the base of music creators, and it has been growing more slowly than the share that upload directly to social platforms for a number of years. Though the growth rates for non-DSP and Artists Direct were much closer in 2024 than 2023, a growing share of non-DSP are only uploading to social platforms. MIDiA’s 2024 survey found that a quarter of music creators upload directly to user-generated content platforms like TikTok without using a distributor or label

Long-tail imbalance: Despite the democratisation social and streaming have driven, streaming is still dominated by big artists, with less than three percent of artists accounting for more than nine tenths of all streaming royalties. What’s more, the top 0.009% has increased its share since 2017, so it’s little wonder the long tail is losing faith in streaming. Two-tier licensing is only going to grow the imbalance and represents a closing of the door on the long tail by the music industry establishment. It’s a case of ‘if you can’t join them, beat them’

Featured Report

MIDiA Research 2025–2031 music creator tools forecasts AI comes to town

This music creator tools forecasts report acts as a companion piece to MIDiA’s report “State of music creator economy: AI’s growing reach ” . This report provides analysis, market sizing, and forecasts...

Find out more…

A new generation of creators: Creators with less than five years’ tenure represented close to half of all music creators in 2023. This wave of creators, swelled by the lockdown cohort, brings with it a different set of needs, expectations, and aspirations that will shape tomorrow’s music business. It is a generation that values speed and results from their creation; and control and autonomy in their careers

New expectations: This new cohort of creators is driven by making the best music they can and moving people with their music, even if that is only a few people. They want creative fulfilment and high-quality fan bases rather than large-scale, anonymous audiences. They are thus gravitating to SoundCloud, YouTube, and TikTok – places they can engage directly with fans

Different tools: These newer, younger creators are also prioritising different tools and workflows, spending their time with Splice, Beatstars, Label Radar, and FL Studio. While older, more established creators opt for the likes of Cubase, Pro Tools, and Native Instruments

The report provides detailed data on these themes and much more (reasons for using secondary DAWs, AI, workflows, income splits, user profiles, etc). If you want to understand where today’s music creators are at and want to go, have a read of our report “Music creator survey | Recalibration”!

The discussion around this post has not yet got started, be the first to add an opinion.