Labels are going to become more like VCs than they probably want to be

When you are in the midst of change it can be hard to actually see it. Right now, the music business is undergoing a consumption paradigm shift that is changing the culture and business of music. Streaming may be well established and maturing in many markets but the market impact will continue to accelerate as behaviours continue to evolve and bed in. Whether it is the rise of catalogue or the decline of megahits, everywhere you look, the music landscape is changing. So it is only natural that the role of record labels is going to change too. They have already of course, but shifts like label services deals and JVs are not the destination, instead they are preliminary steps on what is going to be a truly transformational journey for labels.

Record labels often like to compare themselves to venture capital (VC), taking risks, investing in talent and sharing in the upside of success. While that comparison is flawed, its relevance is going to increase, but not in the way many labels will like.

Firstly, where the comparison breaks down: VCs invest money early in a company’s life and then earn back if / when a company has a liquidity event (e.g., it sells, it IPOs, a new investor buys out earlier investors). But record labels invest and then take money immediately. As soon as the artist is generating royalties, the label is earning a return, it does not have to wait until some distant time in the future. What is more, even after the label no longer has an active relationship with the artist, it continues to earn. So a record label basically has a perpetual liquidity event. Which means its risk exposure is lower than a VC. Even if the artist flops, it will have recouped at least some of its outlay. VCs can be left with nothing if a start- up fails.

Labels as VCs

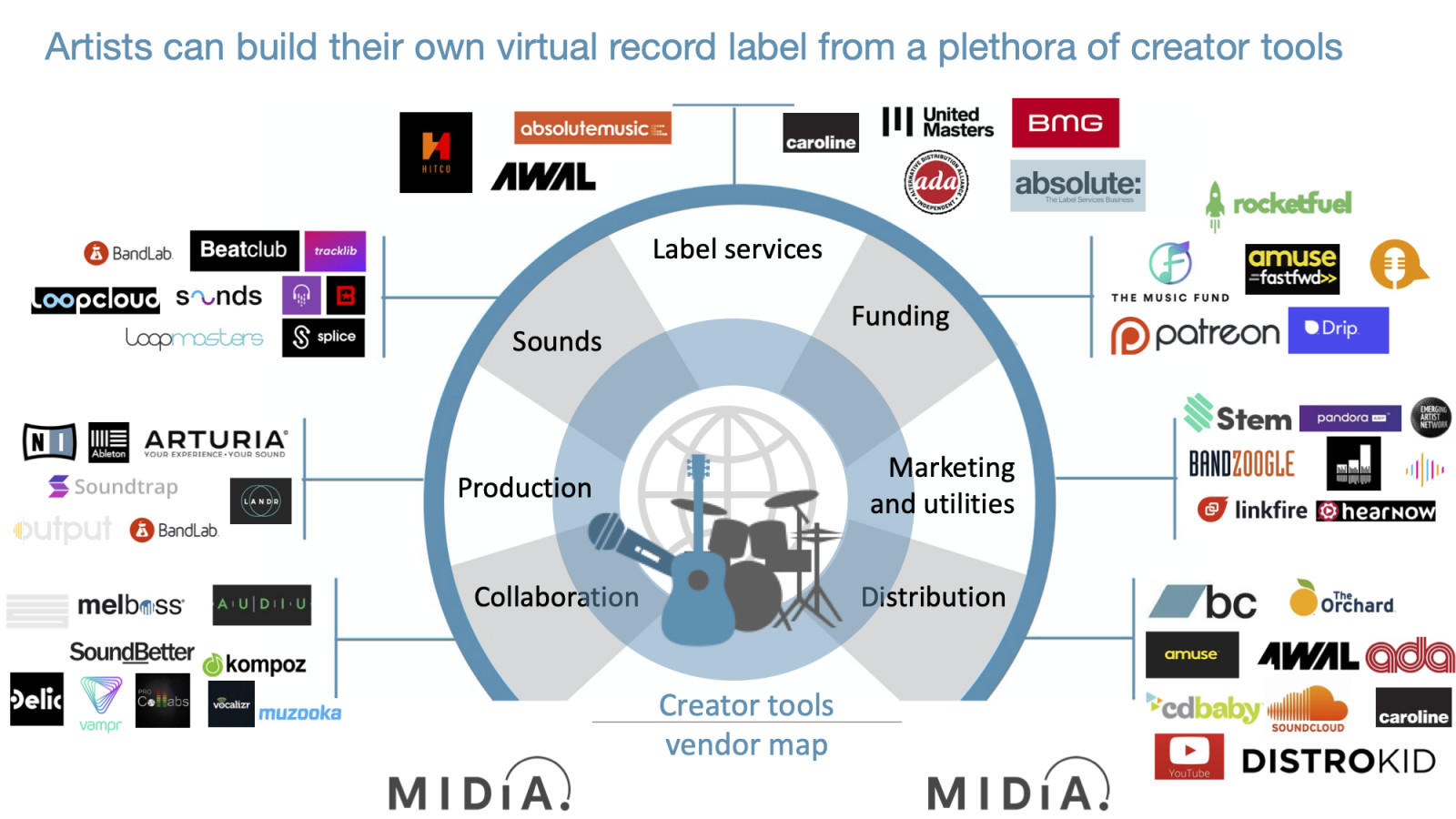

But where the label / VC analogy works best, is when looking at how the role of labels will evolve. VCs are typically earlier-stage investments so start-ups use VCs as launchpads for future success, a means to an end. Labels will likely have to start getting used to the same dynamic. Ever more artists are going their own way, launching their own apps, labels, using D2C sites. But the reason why record labels are around (despite artists being able to create their own virtual label from a vast choice of services - see chart) is that artists still need someone to build their audience (at least in most instances). The investment and A&R support help too, though those services can also be tapped into ad hoc from standalone companies.

Featured Report

Music creator survey Creation: Rise of the new breed

This report is the first of two analysing the results of MIDiA’s 2025 global music creator survey, n = 2,109. This report explores the creation side of the equation and is aimed primarily at creator tools and services companies. The second report focuses on the music creators’ careers and is aimed more at labels, distributor, publishers, CMOs, ...

Find out more…This value chain dependency is what has helped labels to stay relevant despite dramatic industry shifts. But the next stage of this evolution will see a cohort of artists viewing labels as accelerators rather than long-term partners. They will use labels to establish their fan bases and then engage with them on their own terms, sometimes with labels, sometimes not. This is of course already beginning to happen, but it will become an established and increasingly standard career path.

Major labels like to think of themselves in the business of creating superstars. But as the very nature of what a superstar is dilutes, more artists will simply see labels as a launch pad. Start-up Platoon positioned itself as an artist accelerator and was bought by Apple. In many respects it was ahead of its time, pioneering a model that labels will increasingly find themselves filling, even if it is not their preferred role.

Labels as artist accelerators

The repercussions will be massive. Labels, especially majors, will often over invest early to establish an artist. The business model depends on recouping the investment on future earnings. But with ever more artists looking to retain their rights, the labels only have a finite window in which they can monetise those rights, unless they negotiate term extensions. What this means is that labels are becoming a utility for many artists, a stepping stone while their brands are built for them. Like it or loathe it, savvy, empowered artists will increasingly see labels as the launchpad for future independence, and in this respect, labels are becoming more like VCs than ever.

As disruptive as this paradigm shift will be, record labels will find a way to adapt, just as they have to streaming, TikTok, label services, distribution etc. The difference here though is that this may represent a complete recalibration of the role that record labels play in the music industry value chain. This will mean a riskier, more limited role for labels, which in turn will make them more like VCs than they may be comfortable with. Turns out that modelling yourself on VCs can be a risky business in itself.

There are comments on this post join the discussion.