Is QQ Music Worth $10 Billion?

Western appetite for the Chinese market has long been based upon accessing the 1.4 billion consumers. This has in turn impacted valuations of Chinese companies, particularly when eager western investors are involved. However, there is a growing realisation that market potential does not always translate to performance. Now we have Chinese tech major Tencent seeking pre-IPO investment in its music streaming service QQ Music, against a valuation of $10 billion. That is only $3 billion less than Spotify’s valuation. So, is QQ Music worth $10 billion?

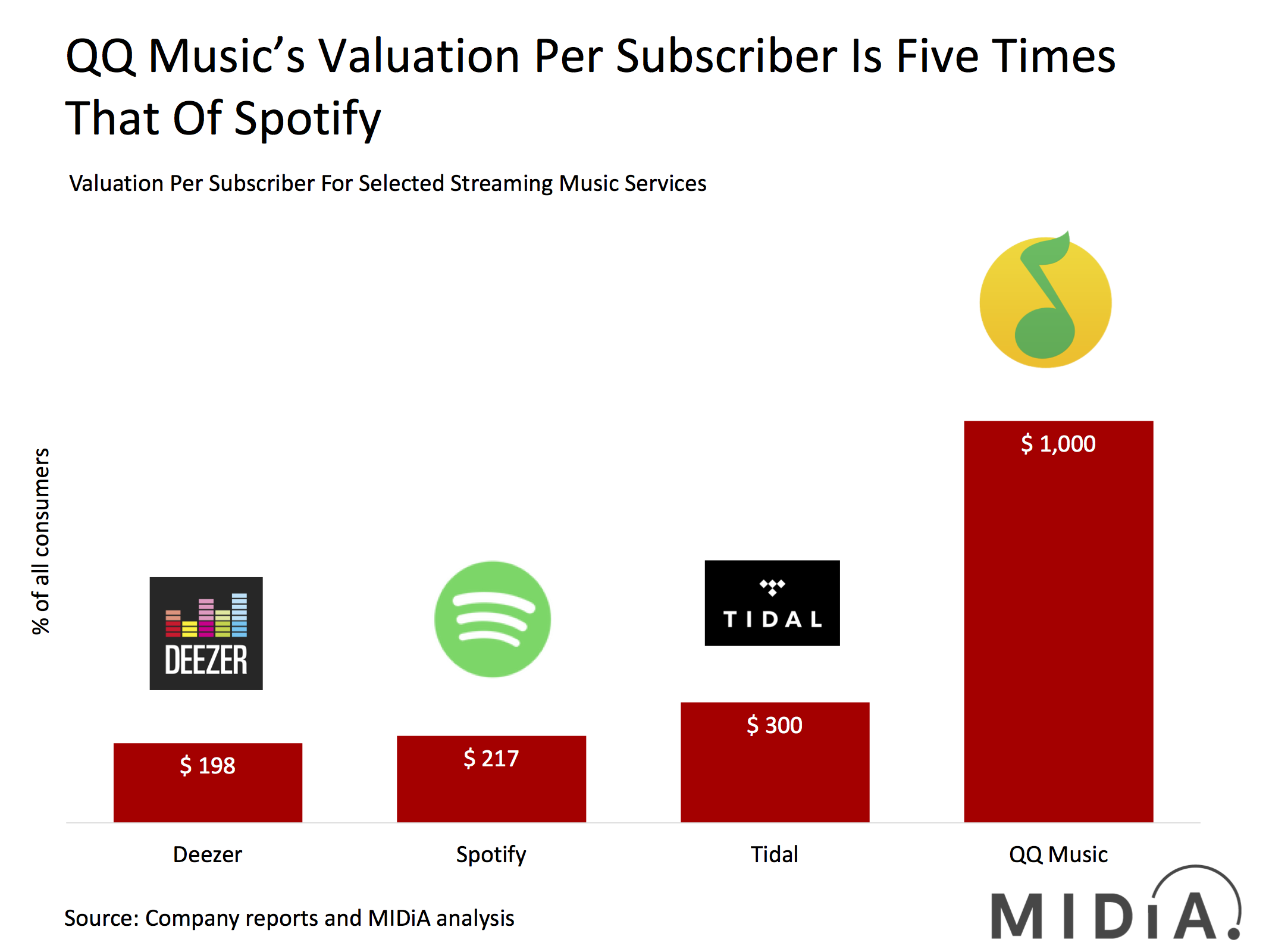

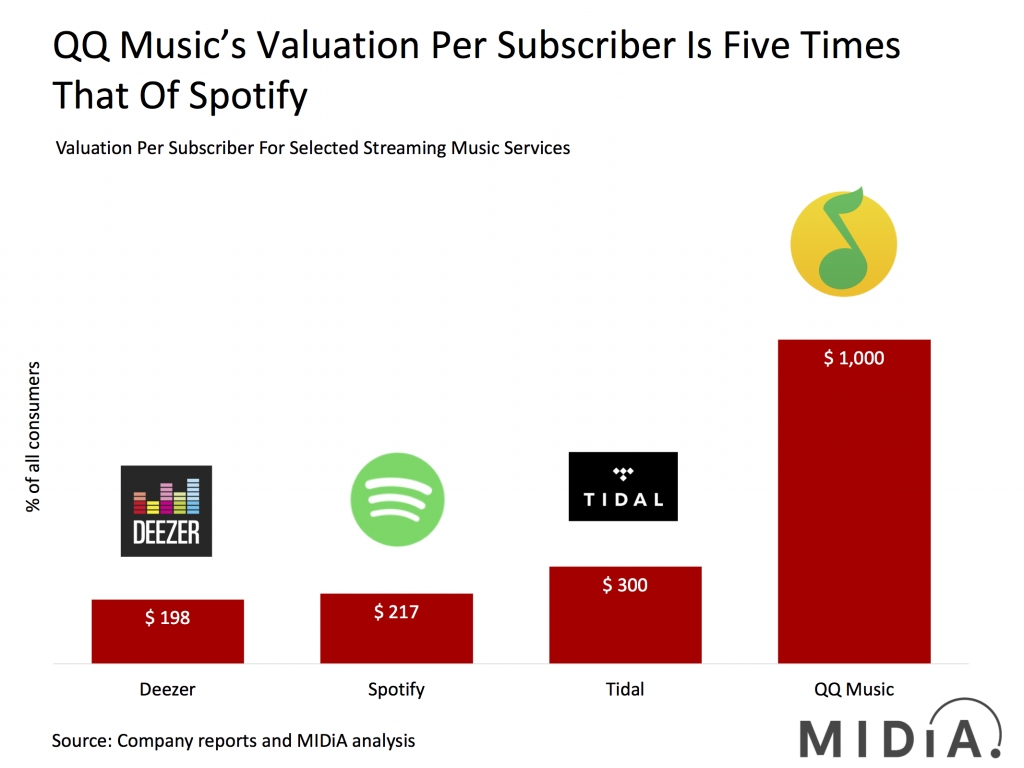

Valuations in isolation can be misleading and therefore need context and scale. For example, Deezer had a valuation of $1.25 billion for its aborted IPO, while Spotify’s valuation is nearly 10 times higher. Moreover, Spotify’s subscriber count (60 million) is nearly 10 times higher than Deezer’s was (6.5 million), leading up to the aborted IPO. So, the best way to make meaningful comparisons between streaming music valuations is to look at the valuation divided by the number of subscribers, to give us a valuation per subscriber metric (see above). Here are a few ways to assess the value of QQ Music compared to other streaming services:

- Valuation per subscriber: On the valuation per subscriber basis Spotify and Deezer’s valuations per subscriber are quite similar ($217 for Spotify, compared to $198 for Deezer). Tidal is significantly higher at $300 (well done that man Jay-Z for talking up the value of his service to Sprint), while QQ Music, with its reported 10 million subscribers, comes in at $1,000. This obviously begs the question, are QQ Music subscribers worth 5 times more than Spotify subscribers?

- Subscriber revenue: The headline consumer retail price for Spotify is $9.99, while the headline price for QQ Music is $1.60. Spotify’s actual average revenue per user (ARPU) in 2016 was around $6.10, so if we scale QQ Music by a similar rate we get an ARPU of $0.98. If we multiply those ARPUs by the current subscriber number for each company, we end up with a monthly subscription revenue of $366 million for Spotify and $9.8 million for QQ Music. Therefore, rather than QQ Music subscribers being worth 10 times more than Spotify subscribers, they actually generate just 3% of Spotify’s subscriber revenue each month.

- Addressable market: Valuations are of course based on potential, not just actual. China has 717 million smartphone owners (30% of the global total) and a GDP of $11.2 trillion (14% of the total). Given QQ Music’s Chinese positioning, that is its addressable market. By contrast, Spotify is a global service, though pointedly not in China, so its addressable market (excluding China) is technically 1.7 billion smartphone owners, and $67 trillion of GDP. QQ Music’s addressable market is in fact smaller, unless of course it decides to roll out to more territories. Likewise, Spotify could also roll out to China.

- Like-for-like comparisons: We also need to be careful about the numbers behind QQ Music. 10 million QQ Music subscribers may not be the same as 10 million Spotify subscribers. Firstly, QQ Music subscription includes karaoke features, such as Bullet Screening, which many would not consider to be music subscribers as such. Additionally, 10 million might not actually be 10 million. Back in Q1 2016, Tencent reported to the markets that it had a little under four million QQ Music subscribers. Then in July 2016, in a Mashable piece, it claimed to have 10 million subscribers. Then nothing until January 2017, when it did another media push, announcing…10 million subscribers. If we take these reports at face value, it means QQ Music had an incredible Q2 2017 then did absolutely nothing, and I mean nothing, thereafter. Whatever the subscriber number actually is for QQ Music, the 10 million figure, at the very least, merits some scrutiny.

So, to answer the opening question, is QQ Music worth $10 billion? That depends. Compared to other streaming music services, the metrics suggest that it isn’t. But, to Tencent’s local investor market, maybe so. 80% of Chinese stock market transactions are from small retail investors, i.e. not institutional investors. So, while a $10 billion valuation might look high to institutional investors, to enthusiastic local retail investors who know QQ Music and have read all the stories about the booming streaming music market, this will appear to be a golden opportunity to get in on the great streaming boom.

Is QQ Music worth $10 billion? It depends on who you are.

There are comments on this post join the discussion.