How big can music merch get? MIDiA’s latest report charts the course to $16B by 2030

Over the weekend, Billie Eilish launched a pop-up merchandise shop in SoHo, New York, where fans could choose from items like a $20 pair of shoelaces, $30 belt, $30 necktie, and $60 necklace. Partnered with American Express, the experience, which previously opened in Tokyo, also included a photobooth, hangout area, and larger-than-life statue of Eilish’s “blohsh” mascot.

In the last decade, the merchandise market has evolved far beyond the typical fare of cheap t-shirts and hats. Pop-up experiences and bespoke items like Eilish’s have become normal parts of superstar album rollouts — last year, Taylor Swift’s “Eras Tour” merchandise made the news as often as the concerts did. As streaming matures, labels are turning attention to monetising fandom, with merch an obvious place to start. But with superfans a niche group to begin with, the question is how much bigger the merch market can realistically grow, and where the untapped potential lies.

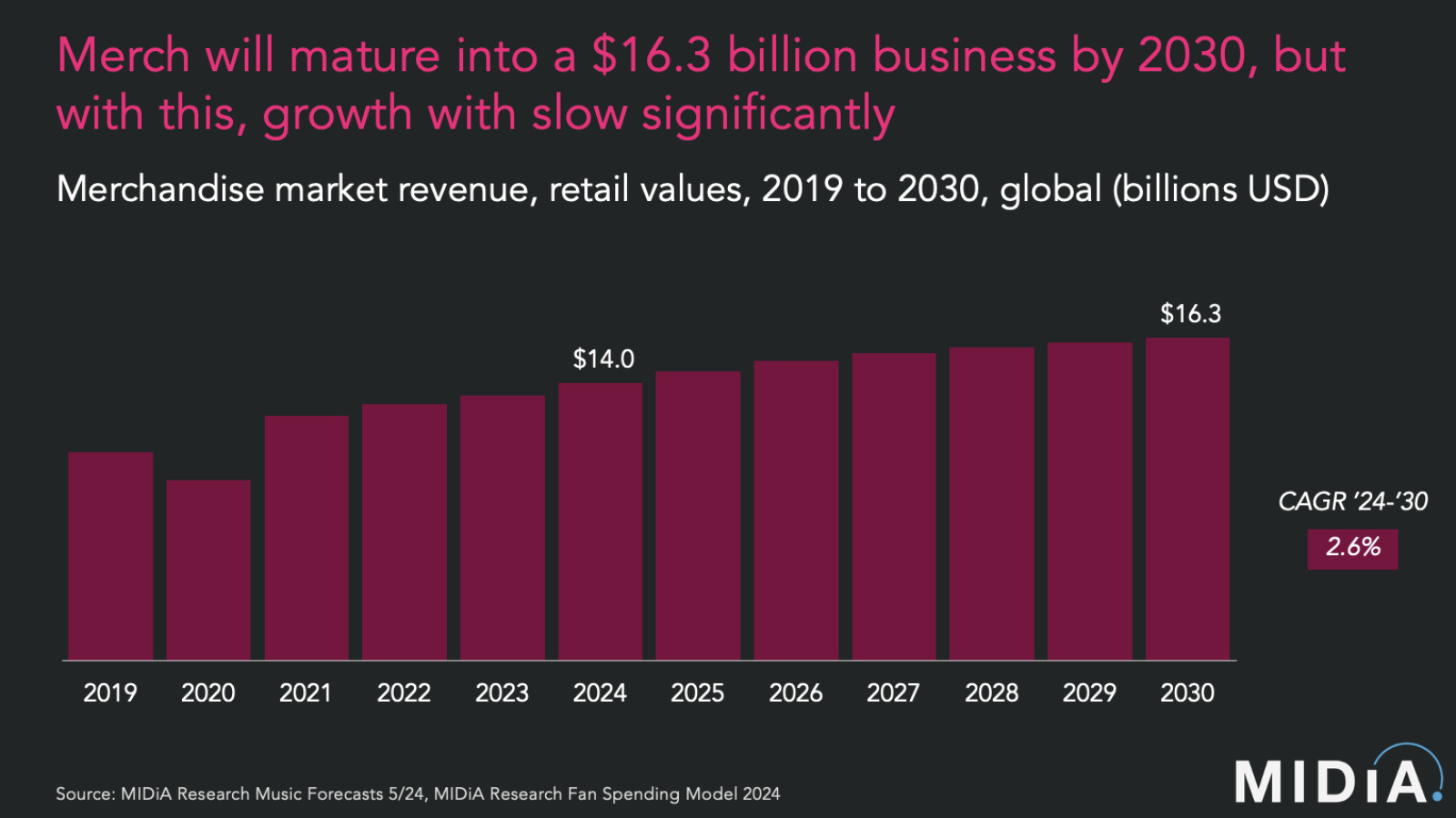

All of this is the subject of MIDiA’s latest report: “Music merchandise demand | Who, what, and where.” Including digital merchandise (like in-game items), physical merchandise (e.g., shirts, hats), and physical music (vinyl, CDs, cassettes), the global merchandise market will rise to become a $16.3 billion industry by 2030. But as the market matures, annual revenue growth will fall to 1.6%. The report explores key dynamics underpinning the future of merch, including:

Featured Report

Ad-supported music market shares Spotify ascending

Ad-supported streaming has always occupied a unique and slightly contentious place in the music industry ecosystem. On the one hand, ad-supported still represents an effective way to reach consumers at scale, creating a wider subscriber acquisition funnel.

Find out more…The vinyl revival may slow, but its underlying drivers will remain: Despite the unexpected revival of vinyl as a fandom item — rather than a consumption one — physical music revenue will hit a peak in 2026. Among the reasons, consumption-driven physical music purchasing is in decline as global regions shift to streaming (like Japan, where CDs remain a popular consumption format today). The growth of fandom-driven purchases is not enough to offset the ongoing decline of those which are consumption-driven. Nevertheless, vinyl is experiencing a revival for a reason: Consumers crave a tangible connection to the music and artists they love. Many are purchasing records to display in their homes or cherish as keepsakes — without ever planning to listen to them. So, some of the energy that is currently spent figuring out how to improve vinyl audio quality and ease the expensive, time-consuming production process might be better spent developing (higher-margin) products that fill the same needs for fans. Look out for an upcoming blog post exploring this deeper.

Unofficial merch sales are eating into the market: Alarmingly, roughly a quarter of merch purchasing behaviours are detached from the music industry. That is because they come from unofficial vendors, like fan-made merchandise and Etsy pages, or the second-hand market. There is a growing opportunity for artists to collaborate with fan merchandise creators and yet-unlicensed sellers — whom rightsholders have usually either taken legal action against, or chosen to turn a blind eye to. But fan-made merchandise is just one reflection of a wider shift towards merch that has utility and / or interactivity. For example, in-game merchandise often comes with utility, as battle pass rewards often come in the form of cosmetic rewards. There is also a growing array of in-real-life merch products that take the form of practical daily items, such as Japanese Breakfast’s chopsticks or Lady Gaga’s rain boots. Even more interactive are customisable merch items and fan-made merch. As new generations seek to create and remix culture rather than just consume it, the more useful and interactive merch can be, the better.

It all begins with fandom: The past decade of streaming has focused on scaling the passive masses, with fandom left somewhat to the wayside. The best way to grow the merch sector is by focusing on building deep, engaged fanbases, the type to buy merchandise in the first place. However, there must be balance. Fans’ willingness to spend should not be taken for granted, as when they feel taken advantage of, the backlash can be swift (pun intended). With the current emphasis on monetising fandom, labels are in danger of “overharvesting” fandom — stripping this resource to the point where there is less of it to regenerate from in the future (perhaps too many $20 pairs of shoelaces could see fandom come undone!). Do not forget that the entire merch business rests on fandom, and it must be nurtured, not harvested.

As the music industry focuses on future growth drivers beyond streaming, merch is an important piece of the puzzle, with much room to grow. But what is clear is that the merch market will require innovation of its own.

MIDiA clients can learn more by accessing the full report here. If you are not a client but would like to learn about how you can access this report, please reach out to enquiries@midiaresearch.com.

The discussion around this post has not yet got started, be the first to add an opinion.