Global Recorded Music Revenues Reach $36.2 Billion in 2024 Amid Slower Growth

Non-major labels gain share for third consecutive year, as streaming revenue growth decelerates

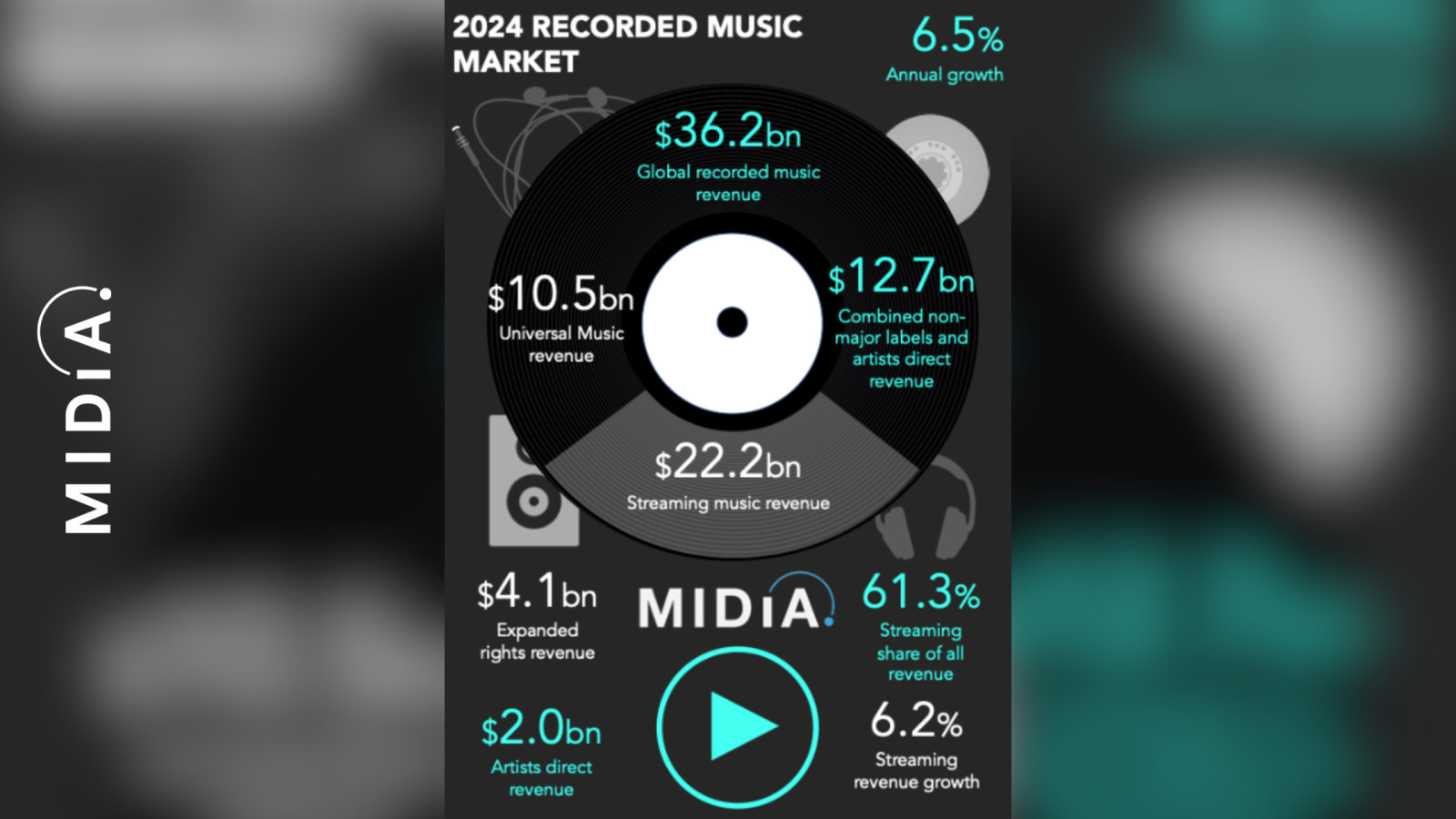

[London — Thursday, 13 March 2025] — Global recorded music revenues rose to $36.2 billion in 2024, marking a 6.5% increase year-on-year (excluding expanded rights, the total was $32.1 billion), according to MIDiA Research’s'Recorded Music Market Shares 2024' report. While this reflects continued market expansion, the growth rate slowed compared to the 9.7% growth in 2023. Growth has oscillated throughout the 2020s and 2024 was no exception. Growth boomed in 2021 before slowing in 2022. The same pattern repeated in 2023 and 2024.

Non-major labels continue to expand market share

Non-major labels increased market share for the third consecutive year, with revenues climbing 8.2% to $10.7 billion, thereby increasing their market share from 29.2% in 2023 to 29.7% in 2024.

Non-major labels were especially successful in streaming, where their revenues rose 8.4% to $5.4 billion, outpacing the 5.4% growth posted by major labels. They also saw substantial growth in expanded rights, surging to $1.6 billion, a segment where Asian labels played a crucial role –four leading Asian labels alone accounted for 65.5% of that total. This reflects the deep integration of fandom-driven models and broader rights ownership within their artist rosters. However, physical sales remained a challenge for non-majors, with revenues declining 6.4%, compared to a 3.6% dip for major labels.

Streaming revenue growth slows sharply

Streaming still dominates revenues but its impact is lessening. For the first time, streaming’s share of total recorded music did not increase in 2024. Streaming revenue grew by a more modest 6.2% in 2024 compared to 10.3% in 2023. 2024 streaming revenues were $22.2 billion, representing 61.3% of all revenues (69.1% excluding expanded rights). The contribution of streaming to overall industry growth also fell to 58.5%, down from 64.6% in 2023.

The much-anticipated streaming revenue deceleration –despite recent price increases –has now arrived. Industry attention is turning to super-premium tiers and new monetisation models to re-ignite growth.

Artists Direct face headwinds but maintain modest growth

Artists Direct – self-releasing artists distributing via platforms such as Amuse, CD Baby, DistroKid, and TuneCore –saw revenues of $2.0 billion in 2024. The Artists Direct sector has faced various brakes on growth, including the arrival of minimum stream earning thresholds (i.e., ‘Artist Centric’) as well as robust fraud fine systems applied by DSPs. Yet despite these headwinds, Artists Direct revenues actually grew slightly faster in 2024 than in 2023, up 4.7% compared to 4.5% in 2023. Perhaps most significantly the number of artists in this segment grew more than three and half times faster than revenues, to reach 8.2 million.

Featured Report

Music subscriber market shares Q4 2024 Full stream ahead

Streaming market metrics are bifurcating. Label streaming revenues were up in 2024, indicating a much anticipated slow down in revenue growth. Yet, at the same time, music subscriber growth was nearly...

Find out more…Market share dynamics

In terms of market share dynamics, only Sony Music Group and non-major labels gained share in 2024.

Universal Music Group (UMG) retains the largest market share with revenues of $10.5 billion but lost 100 basis points of share in 2024

Sony Music Group (SMG) emerged as the fastest-growing major label for the second consecutive year, increasing revenues by 10.2% to grow market share 700 basis points to 21.7%. SMG was also the fastest growing major label in the first half of the decade, growing by a total of 73.9% between 2020 and 2024

“With so much uncertainty in the global economy, 6.5% annual revenue growth is an achievement in itself. Nonetheless, the streaming slow down, coupled with another down year for physical, has emphasised a steadily increasing amount of market volatility. Which makes the fast growing expanded rights segment so important for the industry. Not only does it do the crucial job of monetising fandom, it is fast becoming a hedge against stodgy streaming growth and the yo-yoing physical sector.

One crucial element to keep an eye on is the long tail of independent artists. Measures like minimum earnings thresholds are taking a toll on Artists Direct revenue, and helping major labels throw speed bumps in the ongoing erosion of their market share. Yet it is doing nothing to halt the growth of releasing artists who compete for ears.” – Mark Mulligan, Managing Director and Senior Music Analyst at MIDiA Research

The full report will be available here. For any questions or to arrange an interview, please reach: Tsion Tadesse, PR and Communications Executive, MIDiA Research via Press@midiaresearch.com or tsion@midiaresearch.com.

Additional note: we scaled down some of the numbers slightly to reflect some previous double counting of independent label revenue distributed by other independent labels.

About MIDiA Research

MIDiA Research is the global leading authority in music, the creator economy, and cross-entertainment. Our subscriptions, data tools, and strategy consulting bring clarity to complex industries by providing support and expertise. Our trusted data and powerful insights help make confident and impactful decisions. By leveraging multi-country consumer data, forecasts, market shares, and the insights from our creator panel, we empower clients to think differently, revealing unique solutions they did not even know existed.

With our deep understanding of both the business and culture of entertainment, we work with entertainment companies to navigate tough industry challenges. Driven by a passion for discovering new knowledge, insights, and solutions, our team nurtures creativity and innovation to consistently deliver dependable results.

The discussion around this post has not yet got started, be the first to add an opinion.