Creator tools: The music industry’s new top of funnel

For most of 2020, MIDiA has been working on a major piece of work around the fast-growing creator tools space. The themes we had already started working on became rocket propelled with the onset of the pandemic, with an unprecedented volume of artists starting to engage with music production tools, services and hardware. Even before COVID-19, the creator tools space was set to transform the entire music business; now that future has become the present. This landmark report ‘Creator Tools – The Music Industry’s New Top of Funnel’ is immediately available to MIDiA Research clients here (more details of the report can be found at the bottom of this post).

Music production used to be a siloed segment of the music industry that revolved around studios, hardware and packaged software – at best a cost centre for labels. Now that is all changing. A new wave of creator tools companies are meeting the needs of a new generation of artists with innovative and intuitive music production solutions. Adding to an already vibrant marketplace, this new breed of production tools and services, often subscription-based, are reinventing the creative process and will reshape the long-term view of what a music company is.

This is set to be the most dramatic product strategy shift the music industry has experienced in decades catalysed by the COVID-19 pandemic. 68% of independent artists reported making more music and 36% doing more online collaborations during lockdowns.

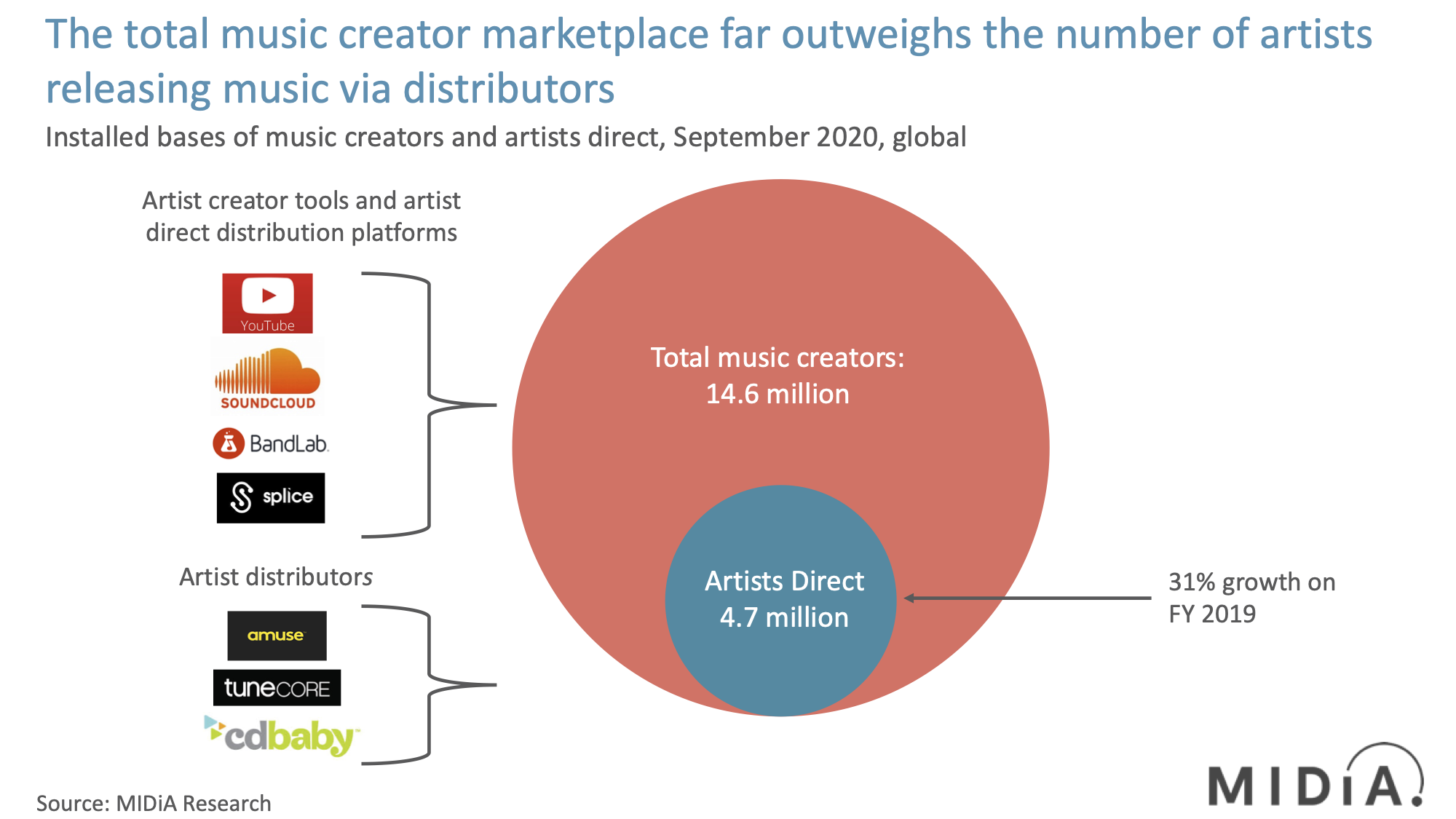

There are 14.6 million digital music creators globally, of which 4.7 million are self-releasing ‘artists direct’, up 31% from 3.6 million in 2019.

The emergence of a subscription economy

In the same year, music software, sounds and services generated $884 million, with plugins and VSTs the largest single segment at 43%. Building on this ‘COVID bounce’ total revenues will reach $1.86 billion by 2027. Though music software is the most widely-adopted creator tools category among independent artists, sounds and services will be the two largest drivers of future growth.

Subscriptions models will also be key, with new models, more self-sufficient tools and the rise of SAAS services making the market majority subscription by 2026, with subscription services reaching $870 million by 2027, up 477% from $151 million in 2019. The shift from software sales to SAAS models means these companies are collecting crucial creator data before they even get to the distribution or release stage, giving these companies the ability to identify the likely hits before they even get into streaming services. This is the music industry’s new top of funnel. Meanwhile at the other end of the funnel, Apple (Garage Band, Logic) and Spotify (SoundBetter, Soundtrap) are well placed to push up the funnel, with the foundations of what tomorrow’s record label will be. Sony Music’s move to invest in creation app Tully is the start of what will rapidly become a creator tools arms race. Expect Splice and LANDR to become sought after by both labels and streaming services.

Creative feedback loops

The new breed of creator tools is also fostering creative feedback loops between other creators and in some cases with audiences—a dynamic MIDiA expects to become a mainstay of the future production landscape as digitally-native Gen Z and younger millennials mature in their production capabilities. The creator tools that build around such creative feedback loops will be those that resonate most with the young generation who will be the creators and fans of tomorrow’s music business.

Snap’s acquisition of collaboration app Voisey illustrates how this is so much more than just a music tech play. We are on the cusp of a consumer revolution also. Just like TikTok made amateur video making a mainstream consumer activity as Instagram did photography, so this new generation of apps and games are aiming to do the same with music. Warner Music’s Tones and I making a soundpack available for fans to create music with inside Roblox’s Splash is an early indication of how music making is about to go mainstream.

Featured Report

Music creator survey Creation: Rise of the new breed

This report is the first of two analysing the results of MIDiA’s 2025 global music creator survey, n = 2,109. This report explores the creation side of the equation and is aimed primarily at creator tools and services companies. The second report focuses on the music creators’ careers and is aimed more at labels, distributor, publishers, CMOs, ...

Find out more…Just as samplers and DAWs transformed music making, so this new approach to production will change the future of how music is made and in turn, how it sounds. Music production product strategy is at a pivot point, where a new breed of user experience-led propositions will rise to prominence. The smart services that have already empowered their users to go from zero to 100 more quickly than ever before, will grow their offerings in line with their user base’s growing capabilities. The business of music has always shaped the culture of music, but perhaps never more so than how the creator tools revolution will reshape the future of what it means to be a fan, an artist and a music company.

If you are not yet a MIDiA client and would like to learn more about how to get access to the ‘Creator Tools – The Music Industry’s New Top of Funnel’ then email stephen@midiaresearch.com

Report details

Pages: 48

Figures: 15

Words: 7,500

Vendor profiles: 12

Products tracked: c.2,000

Excel includes:

Music Software, Sounds and Services Revenue

Creator Tools Value Chain

Software Tracker Summary

Software Tracker – Plugins

Software Tracker – VSTs

Software Tracker DAWs

Software Tracker - Rent-to-own

Software Tracker – Platforms

Software Tracker – DJ Tools

Creator Tools Company Directory

Methodology Statement

The discussion around this post has not yet got started, be the first to add an opinion.