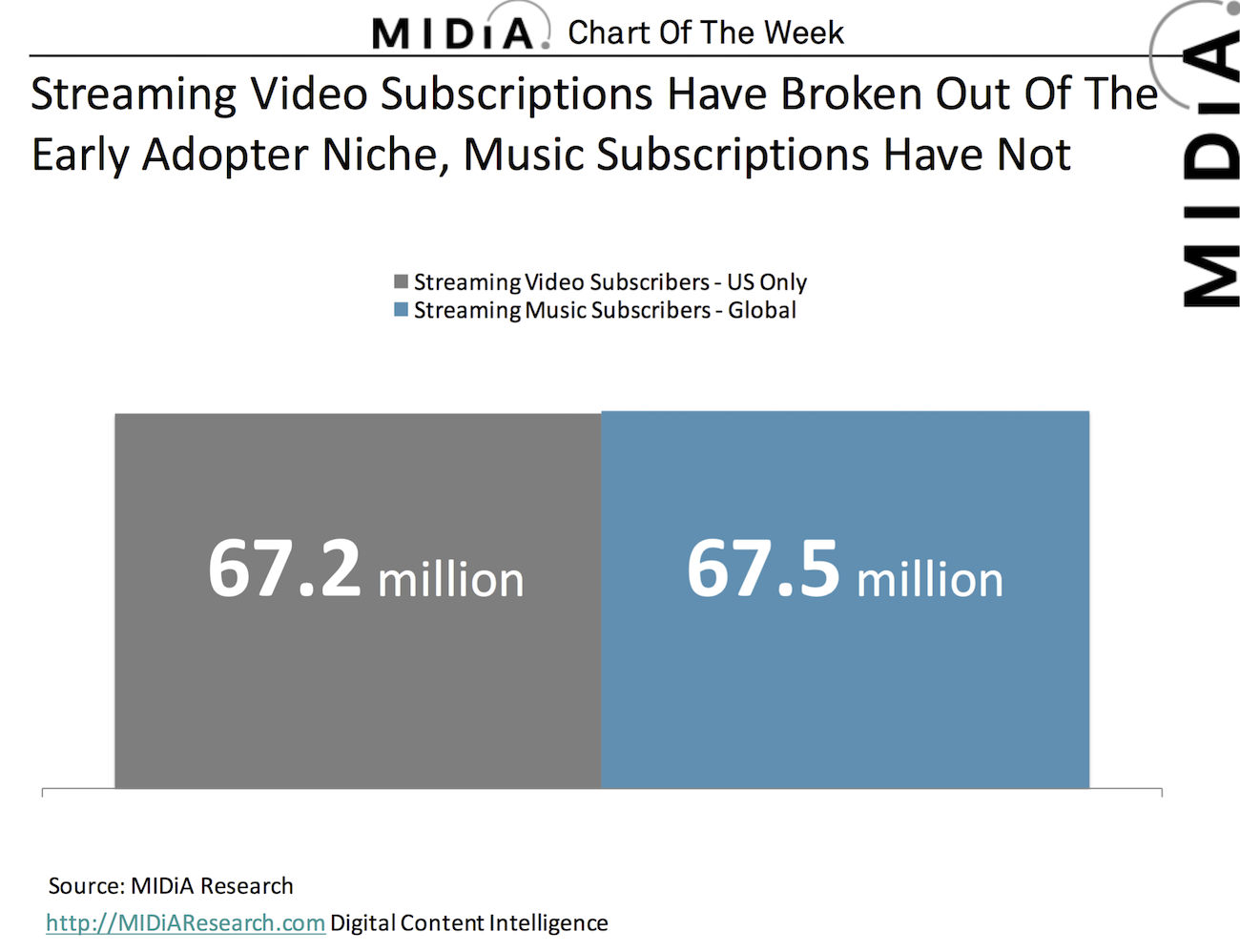

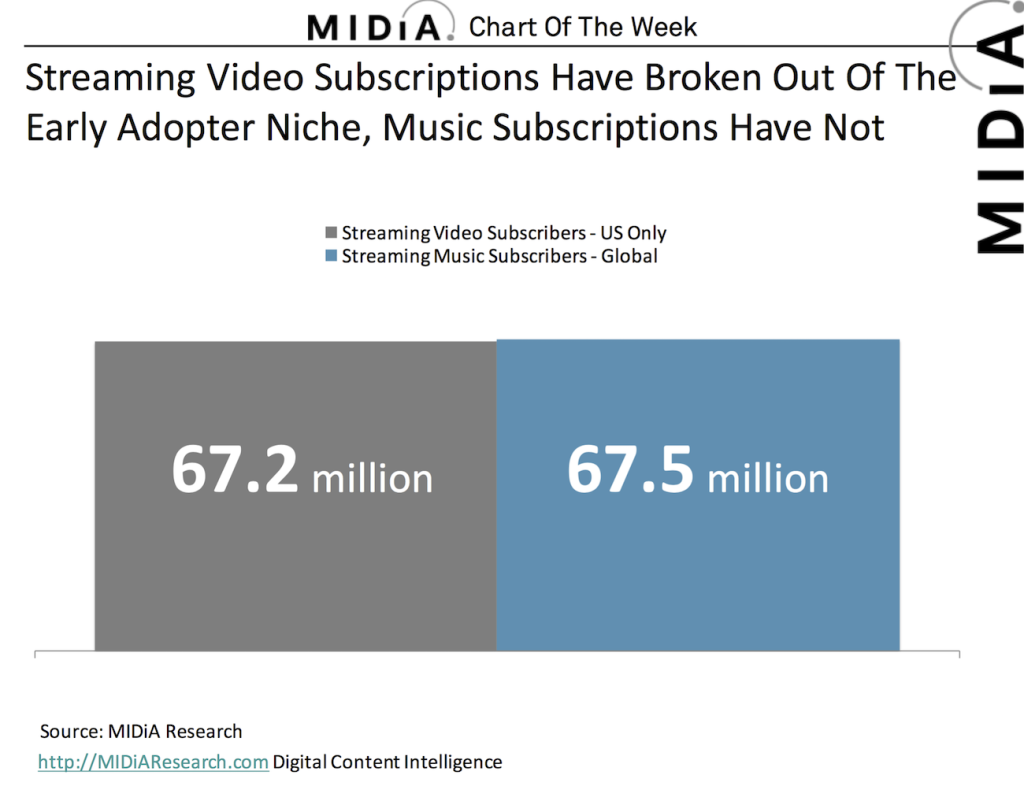

Chart Of The Week: Music Subscribers Vs Video Subscribers

2015 was a big year for streaming music but it was a bigger deal for streaming video, generating $16 billion in revenue compared to $4.5 billion for streaming music. (Both figures are retail values). The contrast between the two streaming markets is pronounced:

- Streaming Video: Exclusives are a standard part of video services

Streaming Music: Virtually all of the same 30 million songs are available everywhere

- Streaming Video: Rights are fragmented across a host of TV networks and studios

Streaming Music: 3 labels account for the majority of rights

- Streaming Video: Subscribers are just as likely to be male or female and have relatively even age distribution

Streaming Music: Subscribers are predominately male and under 45

- Streaming Video: Services compete on price, content proposition and functionality

Streaming Music: Services largely operate within the same price point and content

- Streaming Video: Video services are profitable (Netflix has a 32.9% US profit margin)

Streaming Music: Music services make huge losses

In short, video subscriptions are booming in a market that enjoys healthy competition and are consequently breaking through to mainstream audiences. This point is illustrated clearly by the fact that there are virtually as many streaming video subscriptions in the US (67.2 million) as there are music subscriptions globally (67.5 million).

2016 will be another big year for streaming music, relative to where it was in 2015, but it will be a massively under achieving one compared to how streaming video will perform. It is perhaps unfair to make direct comparisons, as paying for TV is a far more mainstream activity than music. Nonetheless, the fact streaming video has achieved so much in such short a period of time speaks volumes about how a competitive and open marketplace can prosper.

The discussion around this post has not yet got started, be the first to add an opinion.