Brazil climbs the global top 10: a new era for the music market

Photo: MIDiA Research

In recent years, Brazil’s music market has transformed, echoing the nation’s broader economic and cultural dynamics. After facing a severe economic crisis that began in 2017, Brazil is now experiencing a resurgence which has propelled it to the ninth largest global economy, according to the International Monetary Fund, overtaking nations like Canada, Spain, and Mexico.

The music industry mirrors this economic revitalisation, as detailed in MIDiA’s latest report: “Brazil music market | Ready for prime time”. Brazil's recorded music market grew 18.7% year-over-year to generate an impressive $641 million in trade revenues in 2023, significantly surpassing the global growth rate of 9.8%. Brazil is now climbing the ranks of the world’s top 10 music markets, highlighting the nation’s burgeoning cultural scene.

The streaming revolution

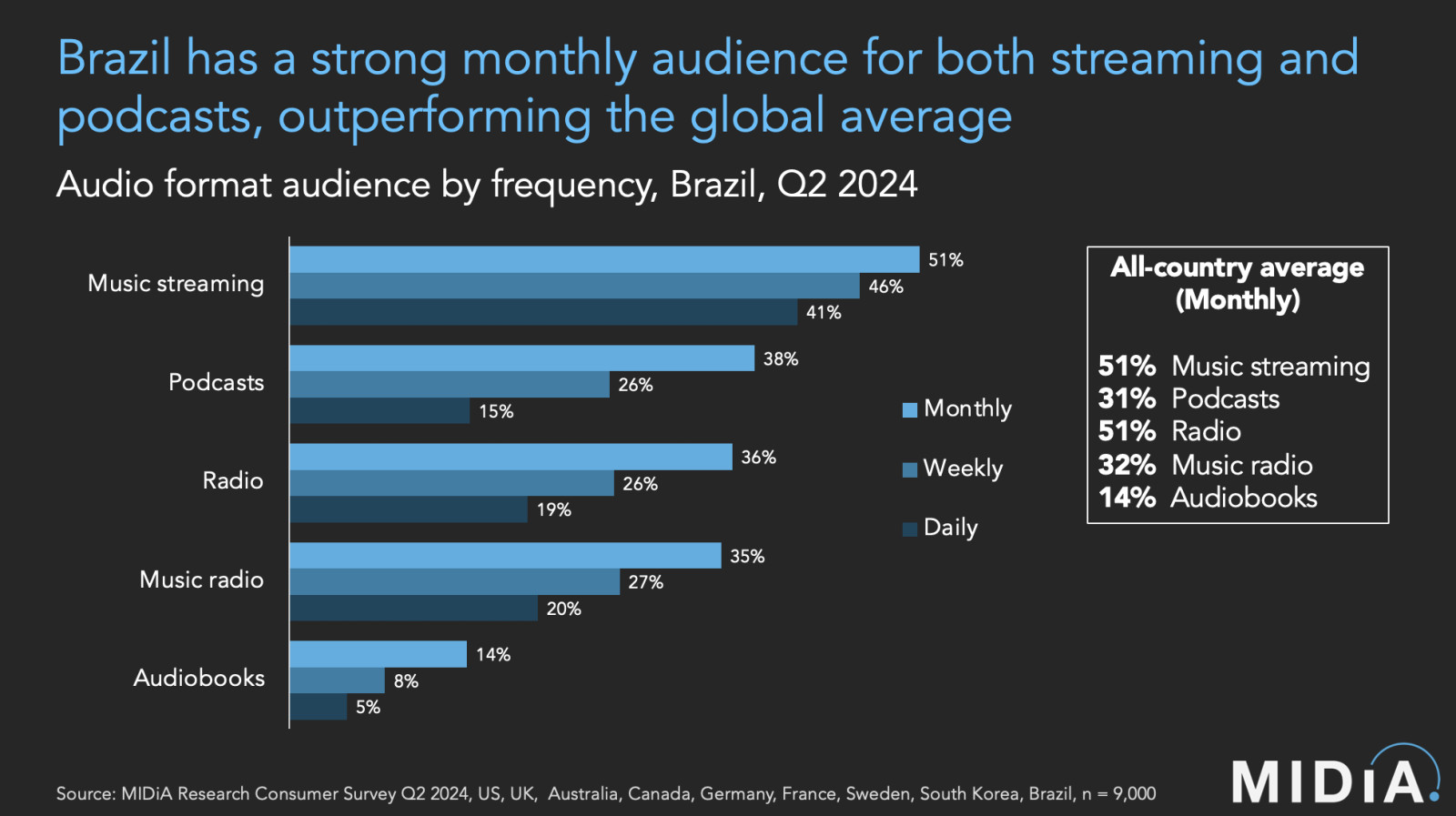

The vast majority — more than 80% — of Brazil’s recorded music revenue is driven by streaming. This positions Brazil as the seventh largest music streaming market globally by retail value as of 2023, jumping three places from 2022. The country boasts a young and internet-savvy population, which has accelerated the adoption of streaming services. According to MIDIA’s Q2 2024 consumer survey, just over half of Brazilians now engage with music streaming services monthly, a figure on par with the global average. This reflects a broader trend where the Global South leads new streaming user growth. In particular, the absence of a well-established downloads market helped create fertile ground for streaming's rapid growth in Brazil. Historically, platforms like iTunes focused primarily on English-speaking countries and, consequently, paid downloads did not develop in Latin America, clearing a path for the market to go straight from physical music to streaming.

Despite lower average revenue per user (ARPU), the sheer number of listeners in Brazil facilitates substantial growth in streaming revenues. Brazil's population stands at approximately 220.1 million according to the US Census Bureau. As of late 2023, Brazil has registered more than 30 million paid music streaming subscriptions, with Spotify leading significantly.

Featured Report

Q3 2024 music metrics Maturation effect

This report presents MIDiA consumer data for key music consumer behaviours and company financials for Q3 2024.Consumer data covered includes, streaming app usage, music behaviour and streaming activities....

Find out more…A bright — and competitive — future ahead

Despite facing challenges, including regional disparities and inconsistent infrastructure to support the music business, Brazil has a promising future. Annual recorded music revenue will surpass $1 billion by 2031 — a 74% increase from 2024. This will also enhance the global influence of Brazil's rich musical heritage, with the growing popularity of Brazilian funk in Europe and the US just one example. Brazil’s population is not only large in number but also deeply connected to its rich musical heritage. While English-speaking music has a strong presence, the overwhelming preference among Brazilian listeners is for Portuguese-language music. Artists such as Anitta and the rise of genres like Brazilian funk and rap have not only become domestic successes but have also begun to make waves on the global stage.

This is attracting attention from international industry players, with companies like Believe, ByteDance, Warner Music Group, and UnitedMasters establishing offices in Brazil and signing Brazilian artists. Deals such as Anitta's contract with Universal Music Latin and Sony Music Group’s acquisition of Som Livre in 2021 underscore the growing interest in Brazil's music talent.

Understanding the complexities of Brazilian consumers’ listening habits, their affinity for local music, and the diversification of music scenes is paramount for navigating this competitive environment successfully. Brazil's music industry is not only on the rise but is becoming a formidable player on the world stage, ensuring that its vibrant sounds resonate far beyond its borders.

If you liked what you read here, then check out the full report: Brazil music market | Ready for prime time. If you are not yet a MIDiA client, then drop us a line at businessdevelopment@midiaresearch.com

The discussion around this post has not yet got started, be the first to add an opinion.