Why Snap Inc. Is Launching A Games Platform

Snapchat will announce a gaming platform for developers in the upcoming days, according to Cheddar. The hope is to boost engagement as well as revenue growth.

Snapchat is still trying to pave its path towards profitability. It has been struggling with engagement, having lost daily active users in both Q2 and Q3 2018 and remaining flat at 186 million in Q4 2018. A well-executed foray into gaming could help Snap Inc. significantly in terms of engagement as well as revenue.

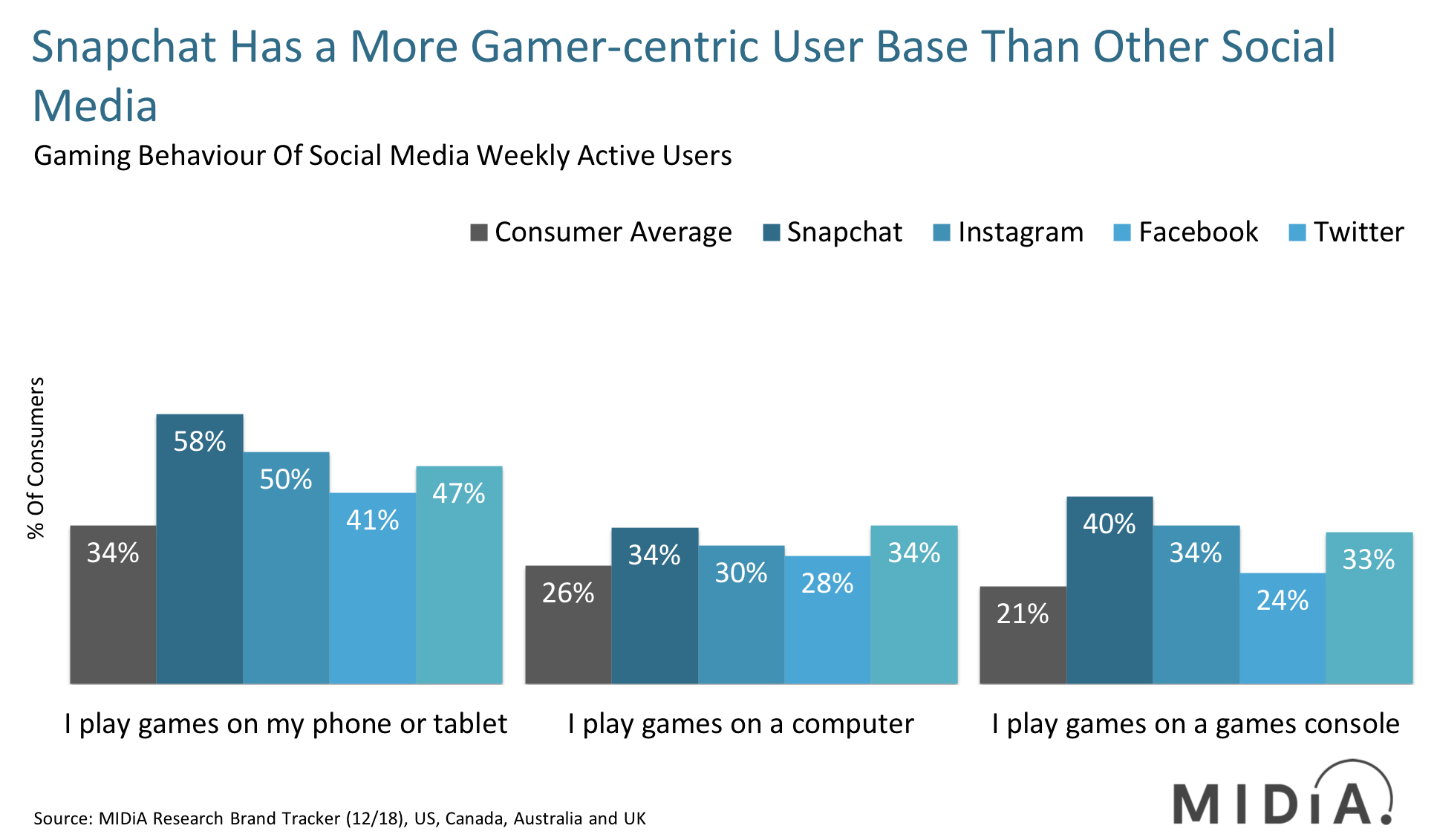

If Snapchat is to find an engagement booster across its user base, it is well positioned to do so with gaming. Snapchat’s weekly active users over-index for gaming on all platforms compared to rivals Instagram, Facebook and Twitter:

- Snapchat’s largest gaming opportunity is on mobile: More than half of Snapchat’s weekly active user (WAU) base play mobile games, with 47% playing every week. If Snap can sell games content to just a portion of this user base, it could have a significantly positive impact on its average revenue per user (ARPU). This is because in-game purchases and paid downloads open up an alternative revenue channel alongside advertising. Furthermore, establishing a games marketplace will also create more ad inventory for Snap to sell.

- PC and console over-index helps ad revenue: Though details of the platform are not known, it is fair to expect a marketplace built around a mobile developer platform. While Snap will likely remain a pure mobile gaming play, it will also reap the benefits of having lots of PC and console gamers in its user base. One, this will help attract increased marketing budgets from games companies to promote their titles. Two, it will attract marketing budgets from non-endemic brands which are looking to target gamers more effectively due to their heightened digital engagement and spending habits.

- Can Snapchat effectively compete for games developers: A key question to the success of Snap’s gaming efforts is whether it is able to entice developers in terms of both quality and quantity. From the technology point of view, this will depend on the platform’s ease of use and convenience for developers. From the commercial perspective, it will come down to the commission fee Snapchat is going to take from developers. If it comes in at the industry standard of 30%, there will be little motivation for developers to get on board. If it comes in at around 15% or lower to start with, this would be a much more serious consideration for the developer community.

- The Tencent Card: Questions remain around the importance of the role Tencent may or may not play in helping Snap’s gaming platform succeed. The social media and gaming behemoth of the east, which owns a stake in Snap Inc., has plenty of experience hosting games on social media platforms. It could also provide value in terms of potential catalogue partnerships, with Snap acting as one of Tencent’s distributors in the western hemisphere, if technology permits.

- Competition could intensify: Snap isn’t the first to provide gaming on a social media platform. Not only will Snap have to compete against already established companies like Facebook, but if successful, others are likely to follow suit. A hot candidate to enter gaming is TikTok, whose weekly active user base over-indexes in gaming even more than Snap’s user base. Furthermore, weekly active user bases of music services such as Spotify (56%), Apple Music (57%) and Deezer (78%) also have a similar or higher percentage of mobile gamers than Snapchat (58%), so we could see a whole new list of players moving into gaming to leverage its power in the attention economy.

Snap recognizes that in the peaking attention economy gaming has become an important space to own in order to maintain (and grow) engagement. While Snap’s gaming proposition is unlikely to draw new users to the social media platform, it absolutely has the potential to get more from existing Snap users, both in terms of time and money spent. If executed well, we expect engagement to grow along with ARPU and potentially daily active users, with the latter capped by the number of existing accounts as Snap’s gaming propositions are less likely to entice non-Snapchat users to create new accounts.

The discussion around this post has not yet got started, be the first to add an opinion.