Traditional Pay-TV Squeezes More Revenue Out of a Declining Asset

ESPN’s announcement last week about the latest Nielsen ratings showing that this season’s NFL coverage had seen viewing figures decline 9.7 from the 2016 season was startling enough. The follow up revelation that ad revenue had actually increased slightly by 2% over the same period, from $504 million in 2016 to $513 million last year, was a stark reminder of the pay-TV incumbent strategy to increase margins. In this way it compensates for declining revenues brought on by consumers switching to SVOD. Bear in mind though that this 2% increase was actually only 0.3% above US inflation at 2017 of 1.7%, so, in reality ESPN, Fox, NBC and CBS the TV networks with the current NFL broadcast rights only made a 0.3% incremental revenue gain in 2017.

Why is sports demand declining?

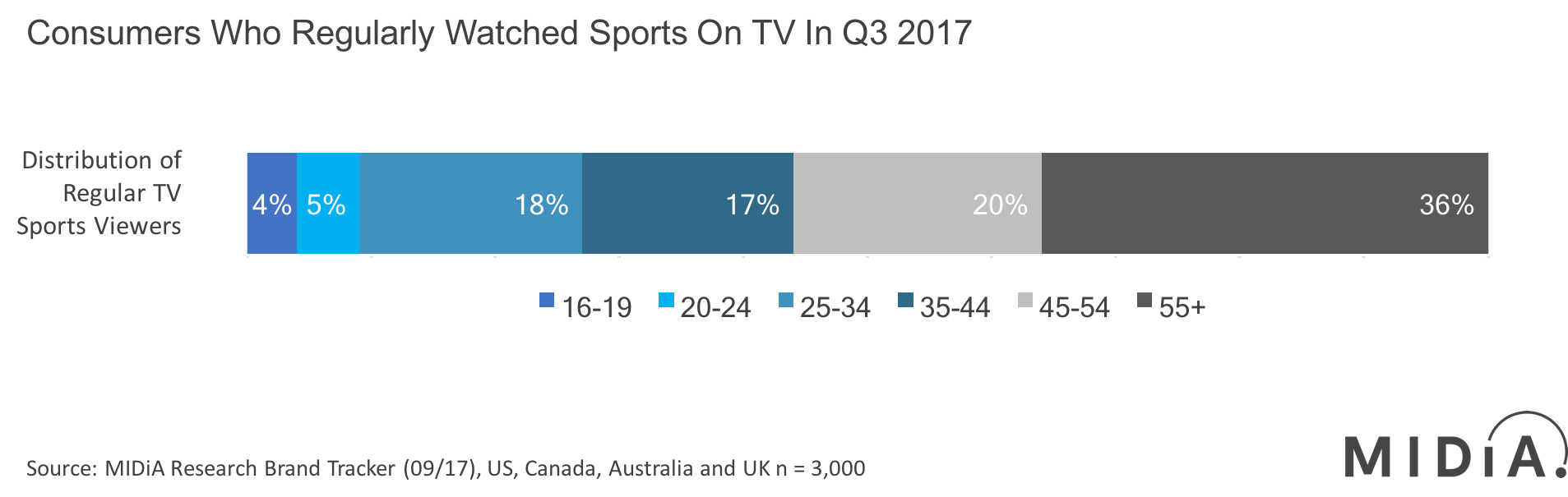

In the current peak attention economy, live sports simply has less relevance for consumers. In the US, UK, Canada, and Australia, only 9% of 16-24 year olds regularly watch sports on TV. If this statistic alone was not worrying enough for the pay-TV industry, more than a third of regular TV sports watchers are over the age of 55. Effectively, regular TV sports viewing is a niche activity among aging consumers.

Why does this matter?

As we’ve covered in our recent report on The Sports Rights Bubble, pay-TV has an increasingly unsustainable addiction to expensive sports rights. Cable, satellite and telcos have paid for and subsidised sports ever since ESPN demonstrated the revenue generation potential of live sports. This spawned a system of TV networks dependent upon pay-TV operators providing the cultural video centrepiece for 1990s and the first decade of the 2000s.

However, return on Investment (ROI) for the major domestic sports has now peaked, and traditional pay-TV is struggling with declining subscribers and stagnating revenues, while disruptive SVOD insurgents are accelerating cord-cutting with their affordable pricing and contract free subscriptions. Furthermore, SVOD providers are luring away mainstream consumers with the broadening of their content offerings to include live, and now with Thursday Night Football Digital rights going to Amazon, for example.

The NFL’s declining viewership are symptomatic of the changing nature of content consumption among consumers and the rapid realignment of future TV content models.

The discussion around this post has not yet got started, be the first to add an opinion.