Sweden Might Just Have Shown Us What the Future of Music Revenues Will Look Like

Earlier this week the IFPI released its Global Music Report – an essential tool for anyone with a serious interest in the global recorded music business. One interesting trend to emerge was the slowdown in Swedish streaming growth and its knock-on effect on overall recorded music revenues. Sweden has long been the leading indicator for where streaming is likely to head, providing a picture of just how vibrant a sophisticated streaming market can be. But now, with the market reaching saturation, it also gives us some clues as to what the long-term revenue outlook for the global music market could be.

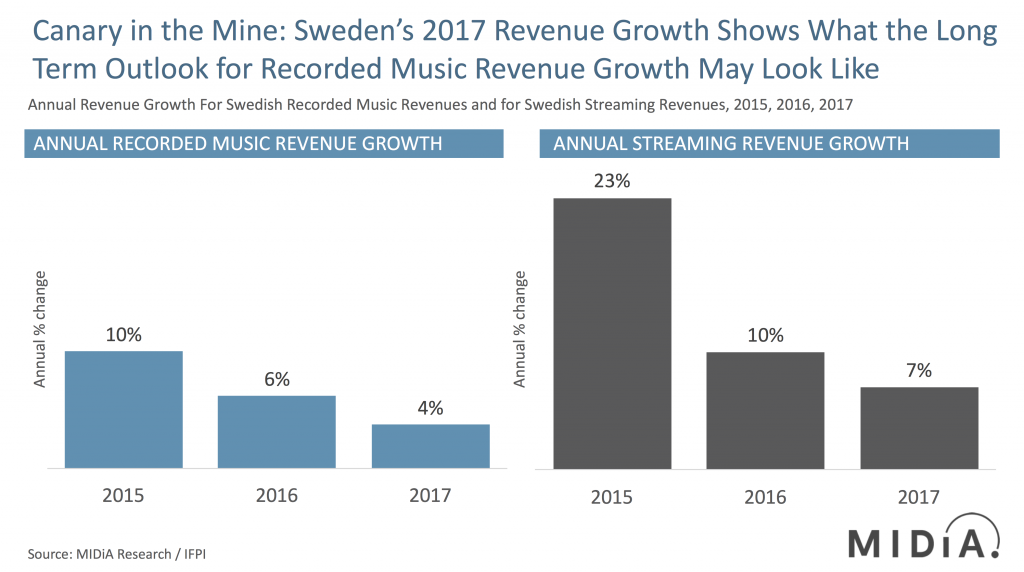

According to the IFPI, Swedish streaming revenues reached $141.3 million in 2017, up from $125.7 million in 2016, with subscriptions accounting for 96% of the total. That was an increase of just $9.3 million, or 7% year-on-year growth, down from 10% in 2016 and 23% in 2015. This is a typical trajectory for a market when it has progressed to the top end of the growth curve. With synchronisationand performance revenues collectively growing by just $1.5 million in 2017 and downloads and physical both continuing their long-term decline, streaming is not only the beating heart of Swedish music revenues, it is the only driver of growth. Consequently, overall Swedish recorded music revenues grew by just 4% in 2017, compared to 6% in 2016 and 10% in 2015. As streaming matures, total market growth slows.

So what can we extrapolate from Sweden onto the global market? Firstly, there are a number of unique market characteristics to be considered:

- Sweden is the home of Spotify, so adoption over indexes

- Incumbent telco Telia provided a lot of early stage growth for Spotify

- iTunes never really got going in Sweden, so the legacy download market was a much smaller part of the market than it is globally

- Physical music sales are further along in their decline (now just 10% of all revenues)

These factors considered imply that Sweden is an indicator of an optimum state streaming market; others may not get there or will not get there so quickly. This could mean that legacy formats decline more quickly in comparison, making total revenue growth slower. However, given that downloads are a bigger chunk of revenues in most markets, these factors should cancel each other out. Therefore, an annual growth of 4% in total music revenues is a decent benchmark for long-term revenue growth.

The question is, what happens to the remnants of declining legacy format revenue? Do those CD and download buyers disappear out of the market, or does some of their revenue switch over to ensure that growth continues further? The likelihood is that Apple will see much of its longer-term growth come from converting higher value iTunes customers into subscribers, but there is a clear case for expanding the market beyond 9.99. The current 10% price hike experiment Spotify is running in Norway is one route. But, a suite of higher tier products is a better solution, as are super-cheap low-end products (e.g. $0.25 a week for Today’s Top Hits) and, of course, boosting ad-supported revenue to steal audience from radio. That latter point is probably the best long-term option for pushing real continual recorded music industry growth.

There is a comment on this post, add your opinion.